- Analysis analyst Tom Wang lately highlighted that the BRC-20 token accounts for 45% of Ordinal’s complete buying and selling quantity.

- The analyst’s publish got here after Ordinals’ quantity surpassed that of Solana-based NFTs.

- In associated information, each BTC and ETH have risen within the final 24 hours.

In a latest tweet, a analysis analyst named Tom Wan shared some insights on BRC-20 tokens and BTC Ordinals.based on director45% of Ordinal buying and selling quantity is from BRC-20 tokens, with Ordinal (ORDI) accounting for 22.1%.

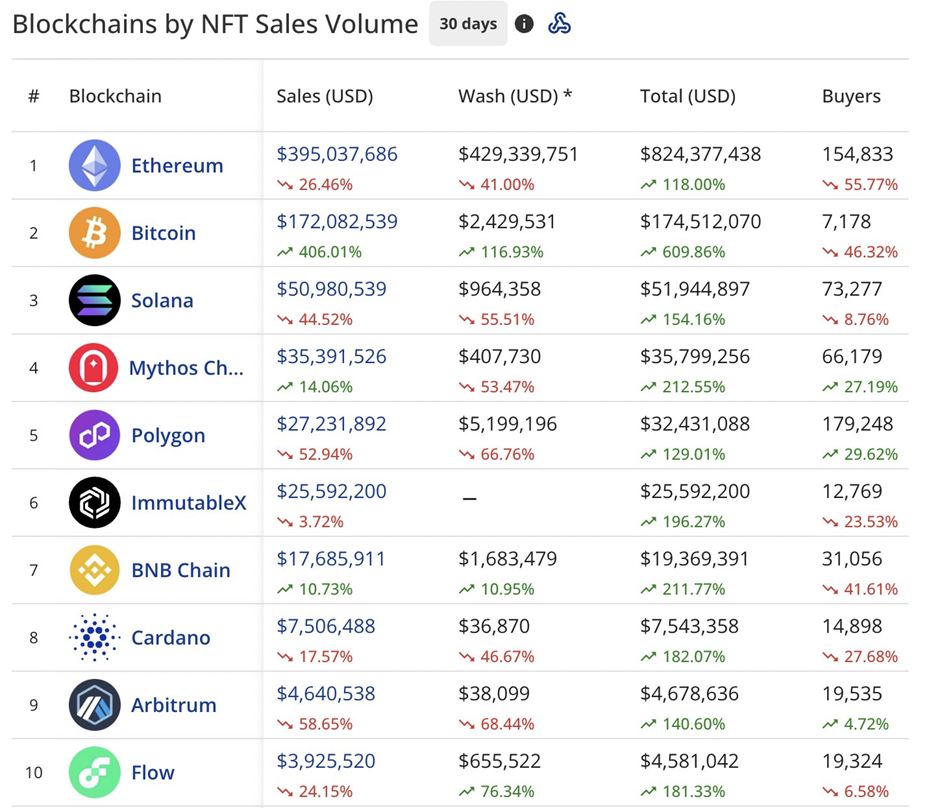

Because of this, analysts have raised a thought-provoking query as as to whether all ordinals needs to be thought-about NFT volumes, or restricted to ordinals inscribed in pictures. This follows information that Bitcoin (BTC) Ordinals has surpassed his Solana-based NFTS by quantity, making it his second-largest buying and selling quantity behind Ethereum-hosted NFTs.

Over the previous 30 days, BTC Ordinals complete buying and selling quantity reached $172,082,539, a rise of 406.01%. Throughout this era, ETH NFT buying and selling quantity fell by 26.46% to $395,037,686.

On the time of writing, CoinMarketCap has proven that each BTC and Ethereum (ETH) have skilled worth will increase within the final 24 hours. BTC has been buying and selling at $26,418.97 after registering a 0.52% rise in 24 hours. In the meantime, the value of ETH rose 1.39% on yesterday to $1,809.58.

The market chief was in a position to attain a every day excessive of $26,591.52 earlier than falling again. The 24-hour low was $26,121.83. Just like BTC, ETH has fallen from a every day excessive of $1,815.99 to a 24-hour low of $1,777.93.

Each cryptocurrencies noticed a drop in every day buying and selling quantity. On the time of writing, ETH had a buying and selling quantity of $5,414,599,653, down 22.47%. BTC buying and selling quantity fell by 20.71% to $12,676,643,115.

Disclaimer: As with all info shared on this pricing evaluation, views and opinions are shared in good religion. Readers ought to do their very own analysis and due diligence. Readers are strictly answerable for their very own actions. COIN EDITION AND ITS AFFILIATES SHALL NOT BE LIABLE FOR ANY DIRECT OR INDIRECT DAMAGES OR LOSSES.

Comments are closed.