The approval of the primary spot Bitcoin ETF by the U.S. Securities and Trade Fee (SEC) on January tenth marked a major milestone for the crypto market. Nevertheless, this milestone led to even better fluctuations in Bitcoin's value and on-chain exercise.

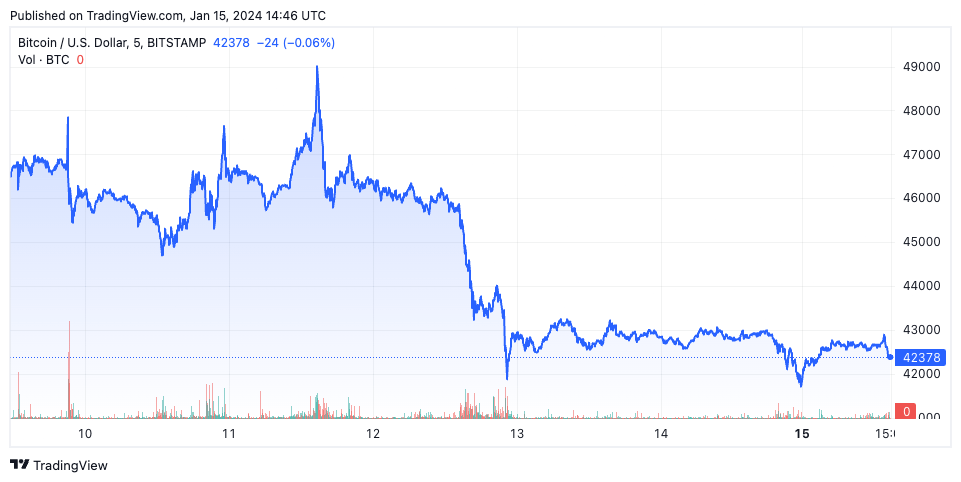

Initially, Bitcoin value reacted positively to the information of ETF approval, rising to $46,608 on January tenth. By January eleventh, the value had fallen to $46,393, with an much more notable drop occurring on January twelfth, when costs fell. As much as $42,897. This downward pattern continued for the following few days, and on January 14th the value reached $41,769.

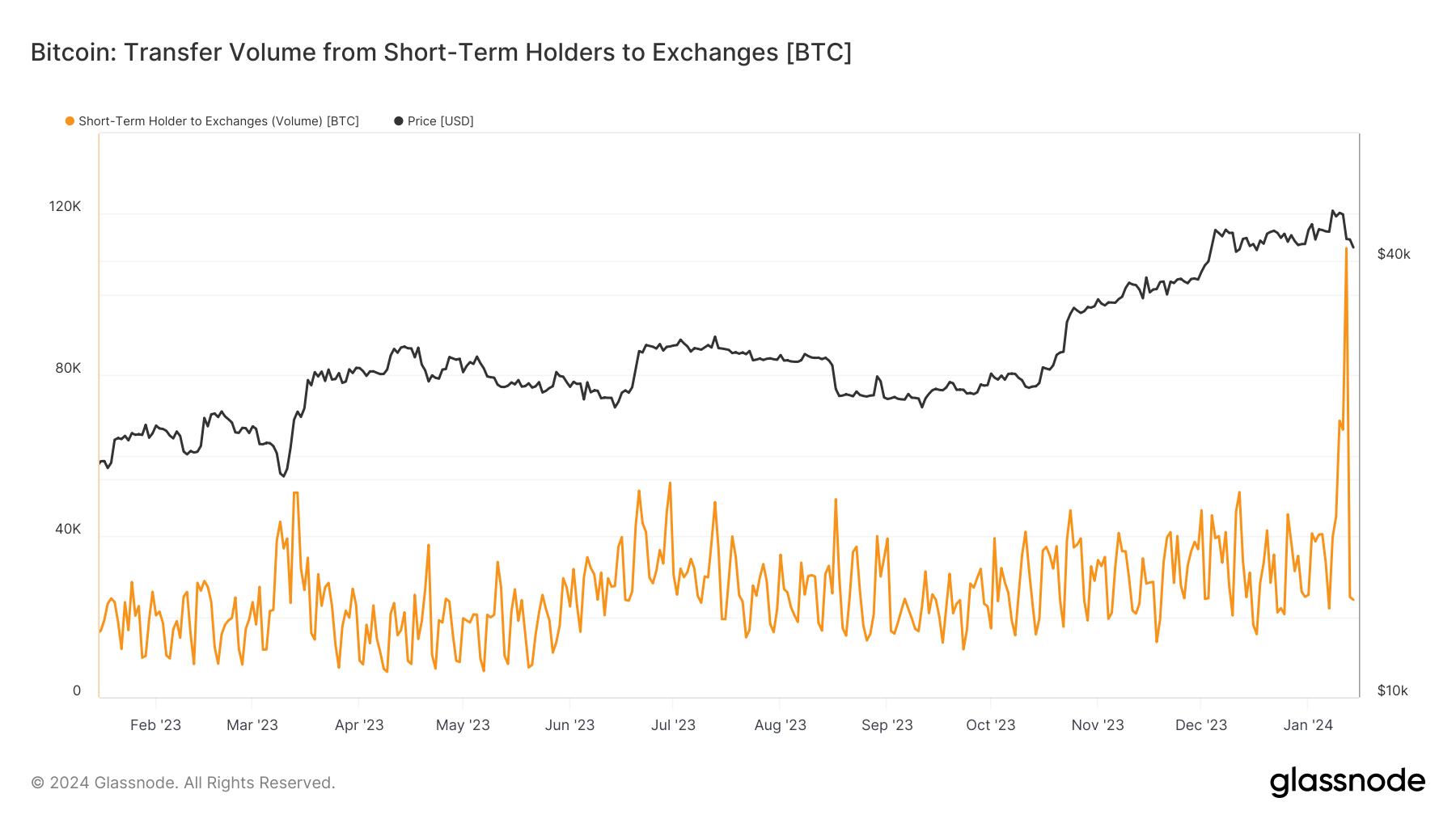

The exercise of short-term holders, particularly buying and selling with exchanges, reveals the place many of the volatility is coming from. A major enhance within the quantity of Bitcoin despatched to exchanges was noticed, significantly on January twelfth when short-term holders transferred 111,476 BTC to exchanges, the very best stage since Might nineteenth, 2021. . This spike signifies a major decline in Bitcoin. Addresses the place he has held BTC for lower than 155 days.

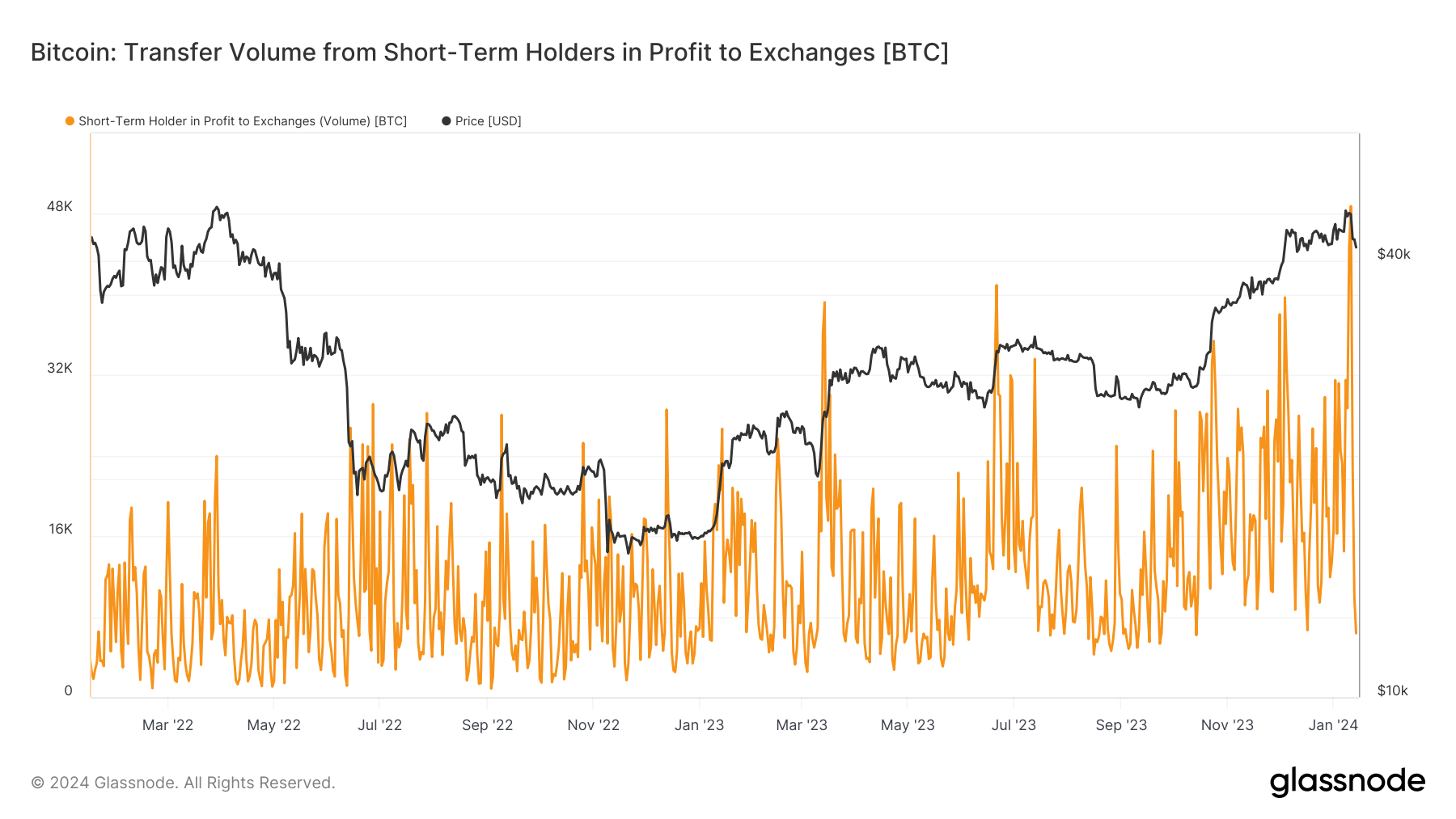

Additional evaluation of short-term holders' positions in P&L reveals the extent of profit-taking amidst volatility. On January eleventh, the quantity of Bitcoin held by short-term holders as income transferred to exchanges reached a peak.

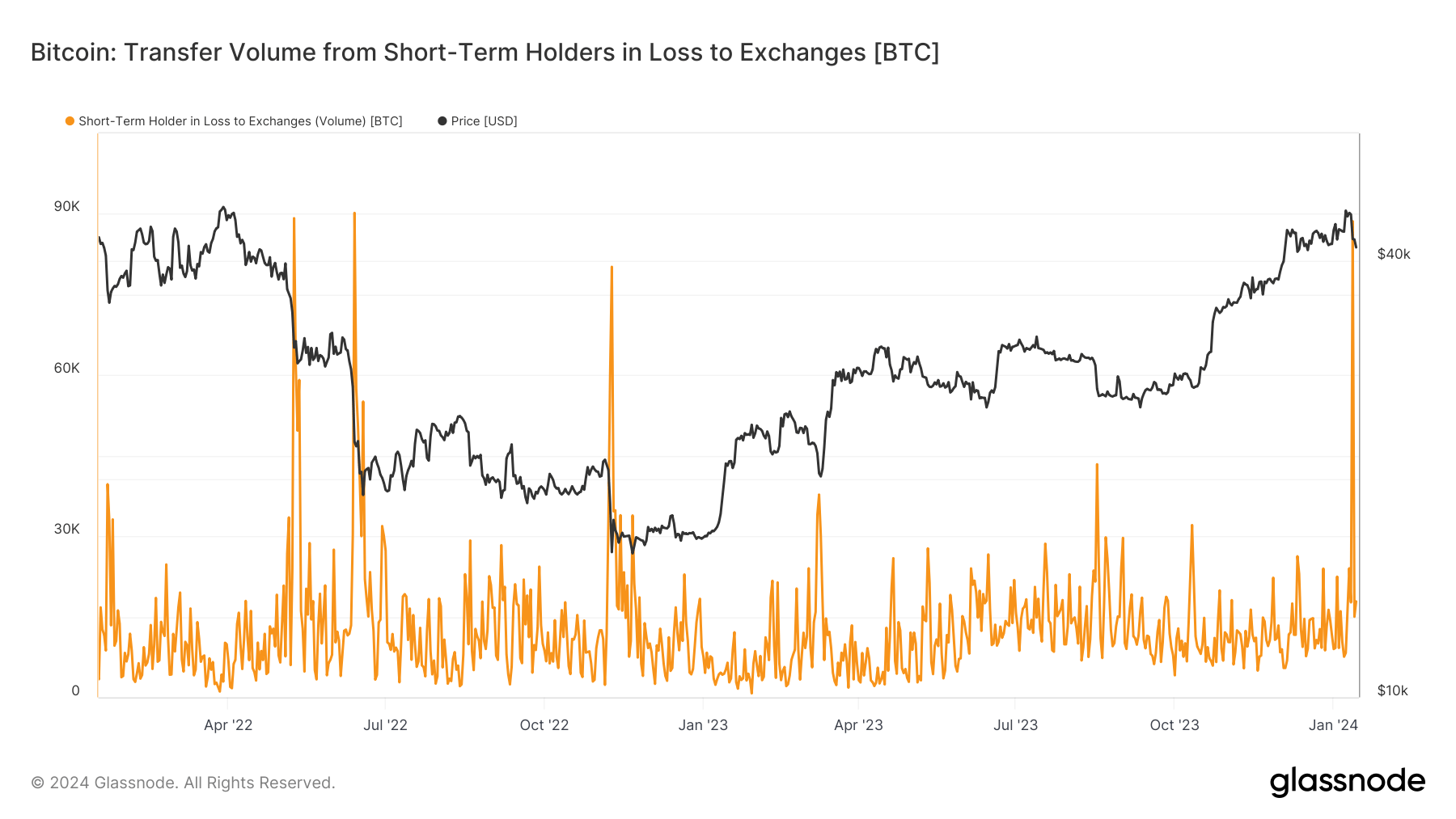

Conversely, the following day, losses on Bitcoin held by short-term holders had been transferred to exchanges, reaching a peak. These actions recommend that after costs began to fall, market sentiment shortly modified from taking income to slicing losses.

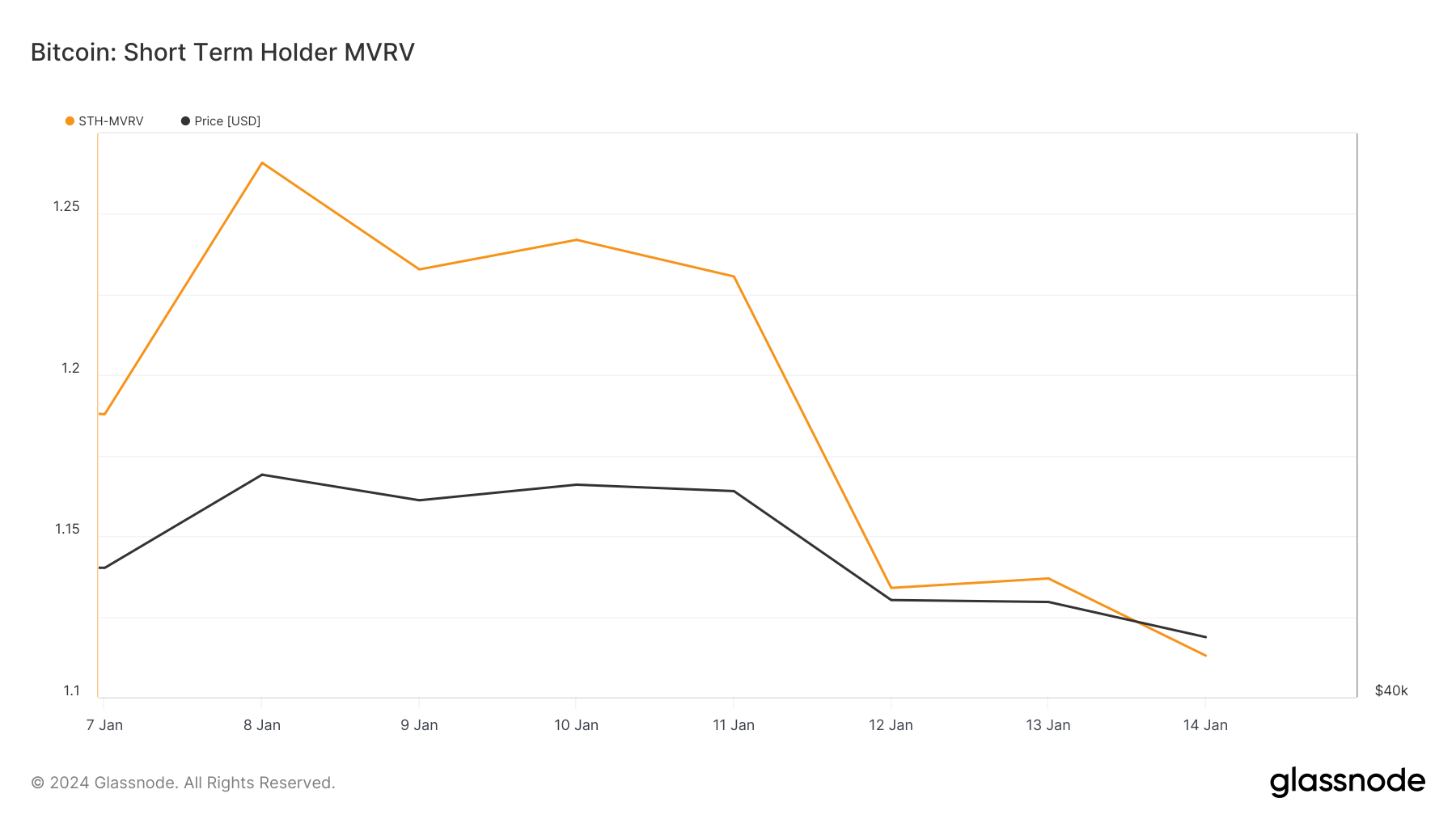

The Market Worth to Realized Worth (MVRV) ratio helps you perceive the profitability of those short-term holdings. MVRV compares the market worth (the final value BTC moved at) and the realized worth (the final time BTC was bought).

Usually, a excessive MVRV ratio means that holders are making a revenue and are inclined to promote, whereas a low MVRV ratio signifies minimal good points or losses. Throughout this era, the MVRV ratio has been on the decline, reflecting the declining profitability of short-term holdings, which can contribute to the promoting stress noticed available in the market.

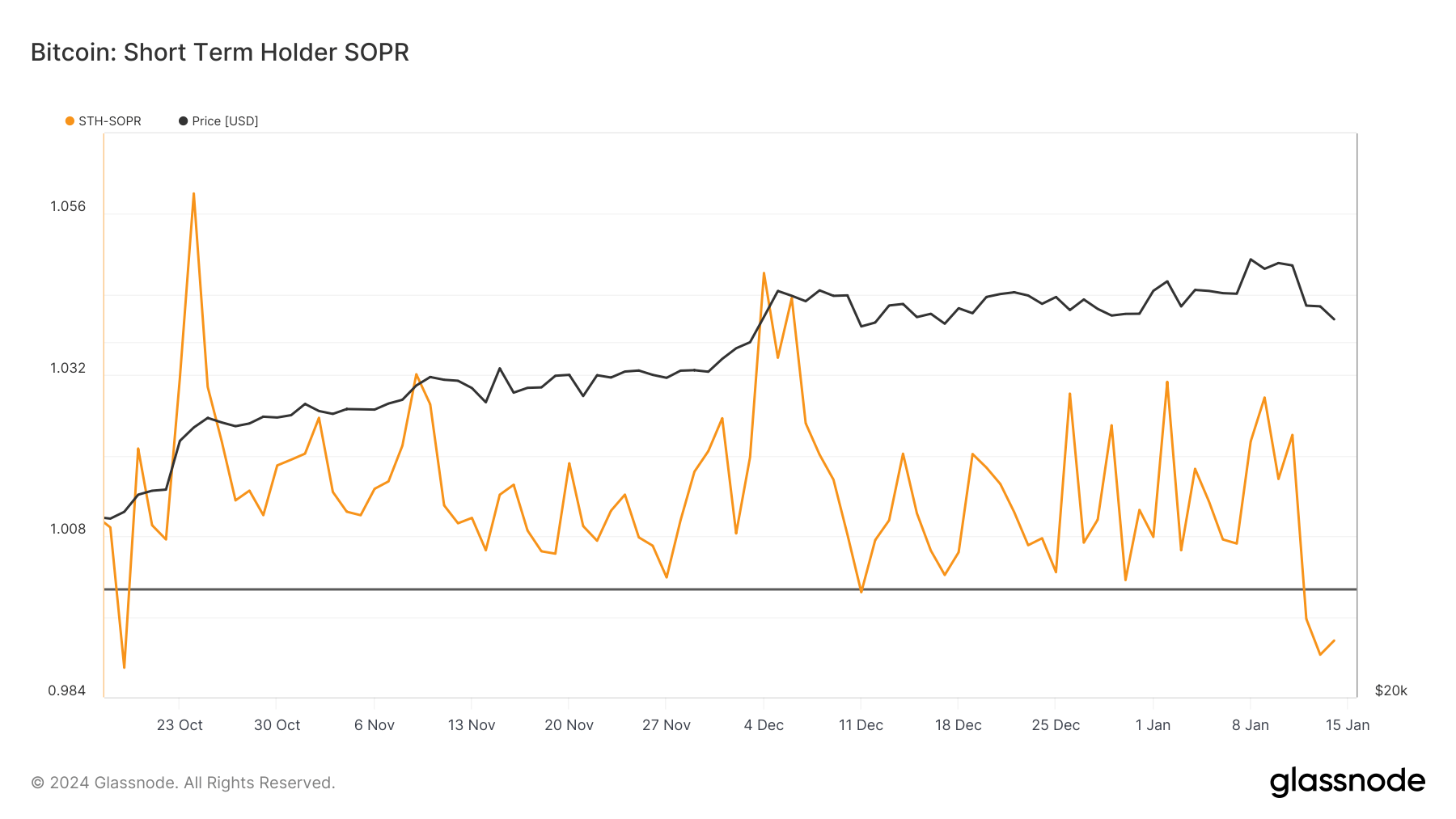

One other necessary on-chain metric is the used output return ratio (SOPR), which evaluates the revenue margin of used output. If the SOPR is larger than 1, it means the coin is promoting at a revenue. In distinction, a SOPR lower than 1 signifies that the coin is promoting at a loss.

Notably, the SOPR for short-term holders fell under 1 on January twelfth and thirteenth. That is necessary as a result of holders are more likely to promote their Bitcoin at a loss as the value falls, indicating a change in market sentiment.

Brief-term knowledge on the approval of the primary Bitcoin ETF by the SEC reveals that the Bitcoin market is very delicate to regulatory developments. Preliminary optimistic expectations for approval shortly became panic, marked by heavy promoting by short-term holders.

This motion is especially mirrored within the great amount of Bitcoin transferring to exchanges on January twelfth and the decline within the MVRV ratio. SOPR falling under 1 reveals how shortly and aggressively short-term holders are reacting to market volatility.

The put up Brief-Time period Holders Drive Bitcoin Volatility After ETFs appeared first on currencyjournals.