- It is flagged between $86,549 and $88,244.

- MicroStrategy will buy 6,556 BTC price $555.8 million.

- $90,000 is taken into account a psychological and technical barrier.

Bitcoin has surged to just about $89,000, bringing it to an all-time excessive and setting the stage for a doubtlessly important breakout.

In response to Crypto analyst Michael van de Poppe, the flagship cryptocurrency is at present approaching a key resistance band between $86,549 and $88,244.

This stage has traditionally been tough to violate and sometimes results in short-term corrections.

Nevertheless, present market sentiment is mixed with macroeconomic clues like potential US-China offers, driving hypothesis about new rallys previous $90,000.

In a tweet posted earlier this month, Van des Poppe shared a expertise chart highlighting the Bitcoin rebound and its present place is near historic resistance ranges.

He advised that Bitcoin might first soak as much as retest help for $80,982.

If the present help isn’t retained, an additional discount to $76,604 is feasible, marking a retest of earlier help ranges that might now function a resistance.

Bitcoin earns 1.5% as whale accumulation will increase feelings

Bitcoin’s rise is supported by a powerful accumulation from institutional gamers, above $88,500.

Specifically, US-based firm holder MicroStrategy just lately acquired 6,556 BTC for a complete value of roughly $555.8 million.

The acquisition seems to have sparked elevated curiosity in Bitcoin as a hedge towards inflation and geopolitical threat, and has boosted confidence available in the market.

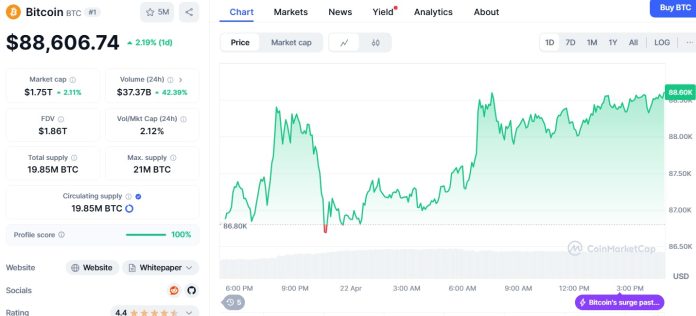

Bitcoin has elevated by 1.5% over the previous 24 hours, growing its revenue of 4.7% every week, in keeping with Coinmarketcap.

The surge has elevated its total crypto market capitalization by greater than $2.7 trillion.

Supply: CoinMarketCap

Van de Poppe famous that markets might stay bullish if Bitcoin merges with greater than $88,000 regardless of approaching over-acquisition territory.

A sustained rally above $90,000 might open up a transfer in the direction of new highs, however costs might drop in the event that they fail to keep up round $80,000 in help.

Analysts warn a pullback to $76,604 if help fails

Technical metrics recommend that Bitcoin’s RSI is approaching important ranges and short-term fixes might happen.

Nonetheless, many merchants are seeing resistance ranges of $90,000 as their subsequent main milestone.

If Bitcoin can help and help $90,000, it might mark a psychological and technical breakthrough.

Traditionally, such a sample has led to speedy worth discovery.

Nevertheless, if momentum fades, cryptocurrencies can maintain income and wrestle to revisit decrease help zones.

Van de Poppe outlined that the $76,604 revision stays inside wholesome limits and will function a springboard for future gatherings.

Value ranges have been beforehand necessary help and remained what you will watch within the quick time period.

Macro tendencies can help pushing bitcoin

By way of macroeconomics, Van des Poppe hinted on the potential affect of world occasions.

Specifically, indicators of de-escalation between the US and China can cut back market nervousness and encourage elevated threat urge for food for traders.

Geopolitical calm, mixed with institutional accumulation and beneficial regulation indicators, might set a stage the place Bitcoin will in the end break via its higher resistance.

Nevertheless, short-term volatility shouldn’t be dominated out, particularly as property are coated close to traditionally reactive zones.

As of April 14th, Bitcoin is simply over $88,606.

Now, all eyes are whether or not the world’s largest cryptocurrency can consolidate income via $90,000 in upcoming classes and surge.

Put up BTC approaches the resistance zone as analysts flag a possible pullback at $76,600.