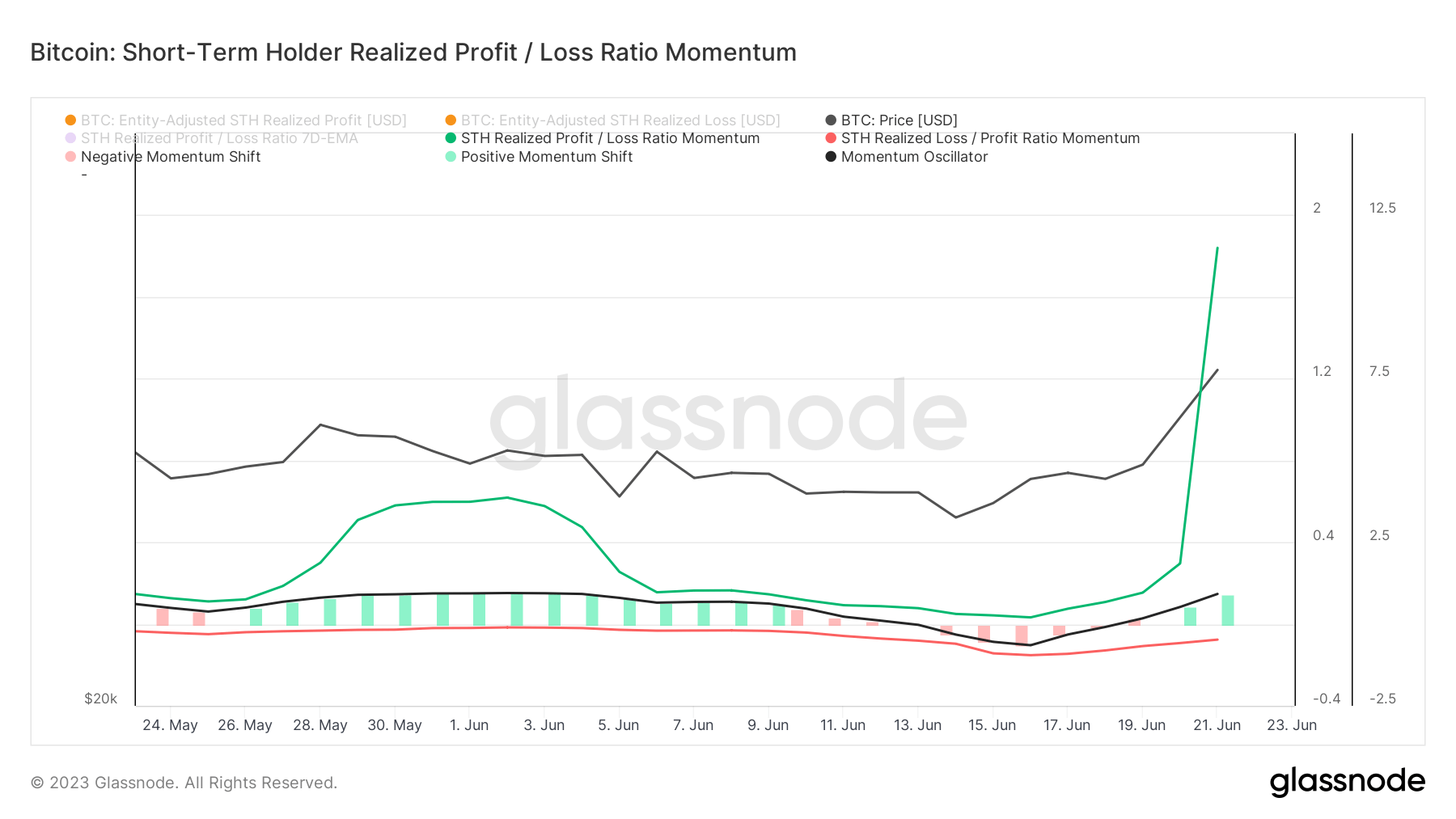

On June twenty first, bitcoin crossed the $30,000 mark for the primary time in two months, displaying indicators of renewed vigor within the cryptocurrency market.

The rally generated greater than $228.8 million in short-term liquidations inside 24 hours, of which Bitcoin accounted for $110.5 million. Bitcoin’s resurgence above the $30,000 threshold may sign an upcoming rally, which is mirrored in on-chain knowledge, particularly short-term holder conduct.

A brief-term holder (STH) is an investor who holds crypto property for lower than 155 days. Their conduct is delicate to latest worth actions, which makes them essential in market evaluation and a dependable indicator of market momentum.

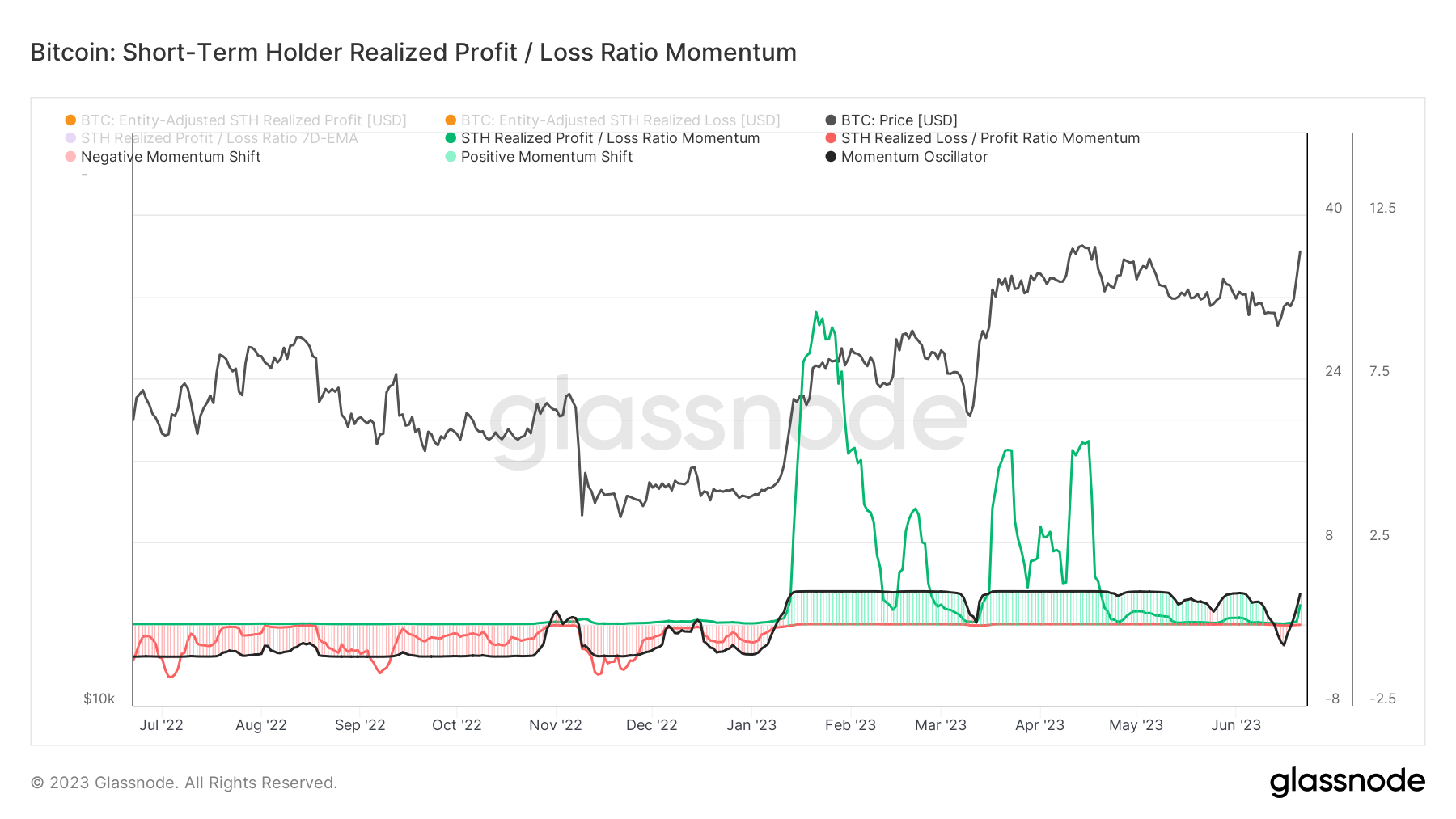

A currencyjournals evaluation primarily based on Glassnode knowledge confirmed a constructive change within the short-term holders realized revenue/loss (STH RPL) ratio, a key metric in understanding market dynamics.

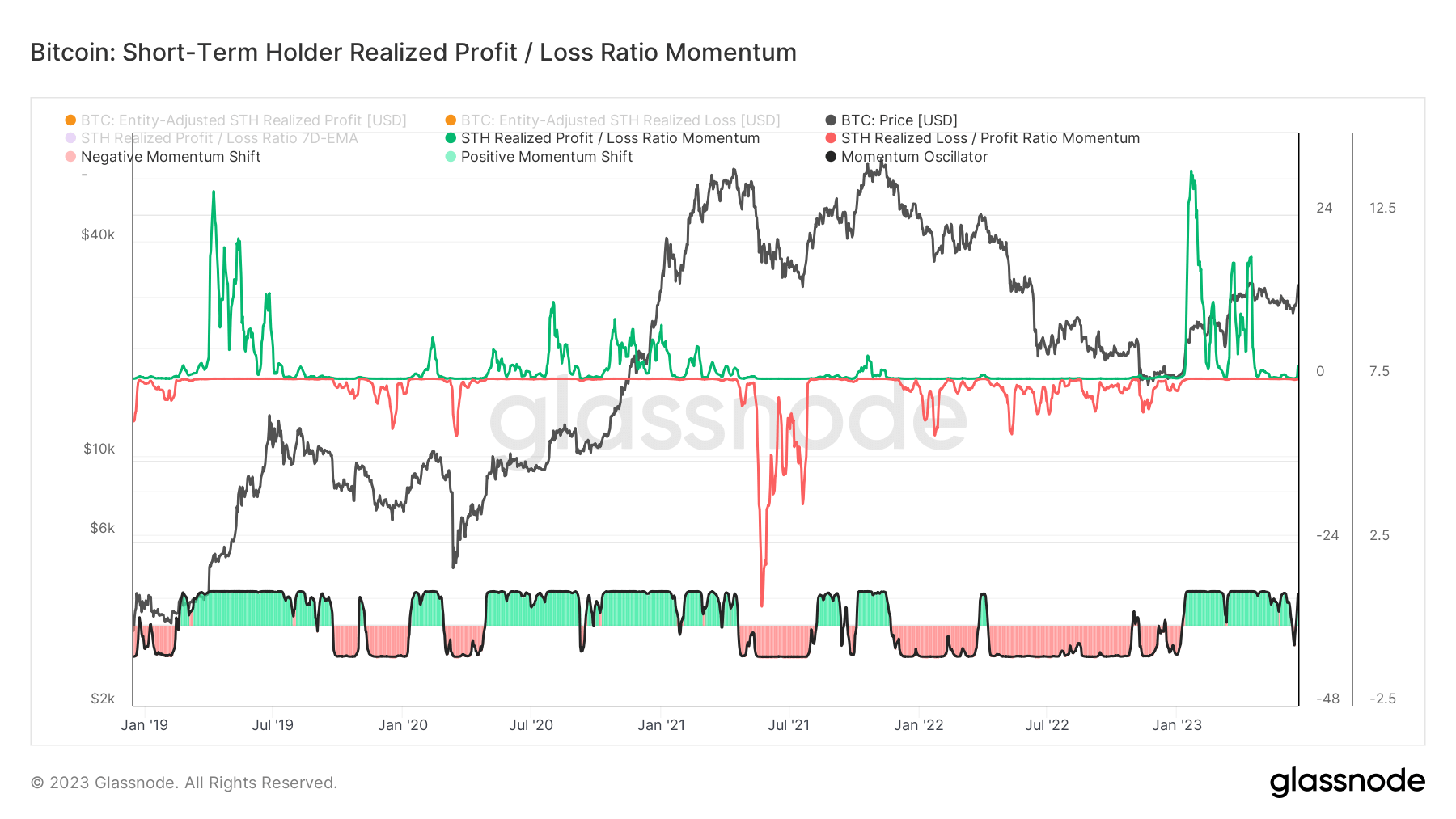

The STH RPL ratio, together with its one-year shifting common, might help establish development inflection factors by capturing intervals when the PnL ratio is accelerating in both course.

The revenue/loss ratio is calculated by dividing the worth of cash bought at a revenue by the worth of cash bought at a loss. On this case, inside the short-term holding interval of 155 days. This indicator displays how the STH is responding to latest worth actions and offers a sign of present market sentiment amongst new traders.

STH is often lively all through the market cycle and is statistically essentially the most attentive to market volatility. Homeowners of lately traded or acquired cash could have some extent of recency bias with respect to their coin’s price standards. Subsequently, a worth rise or fall under that stage is extra more likely to elicit a response.

Internet value transfers usually happen in excessive native market situations as traders take earnings close to highs and capitulate close to lows. This capital turnover often results in a rise within the share of wealth held by STHs, making them the dominant inhabitants noticed after these occasions. Monitoring modifications in STH momentum realizing revenue and loss may point out that the macro market development is at an inflection level.

Throughout market upswings, realized beneficial properties speed up as STH, which lately acquired the coin, beneficial properties. Conversely, realized losses speed up throughout market corrections, inflicting lately acquired STH to lose cash and trigger panic.

Traditionally, a pointy rise in STH P&L momentum has marked the start of a bull market, and a pointy decline in momentum has marked the start of a bear market. The latest constructive change within the STH RPL ratio, coupled with Bitcoin’s surge above $30,000, may point out a brand new part of bullish momentum out there.

A publish first appeared on currencyjournals that short-term Bitcoin holders are displaying constructive momentum out there as BTC surpasses $30,000.

Comments are closed.