- If BTC breaks by means of the $70,649 resistance, the bulls might goal $72,000.

- ETH momentum was bullish as consumers focused an increase to $3,669.

- SOL's upward pattern could also be invalidated, and ADA might face the identical destiny.

The weekend introduced a way of aid to the crypto market after individuals endured a principally adverse week. This break might not have been vital, but it surely offered a steadiness not often seen today.

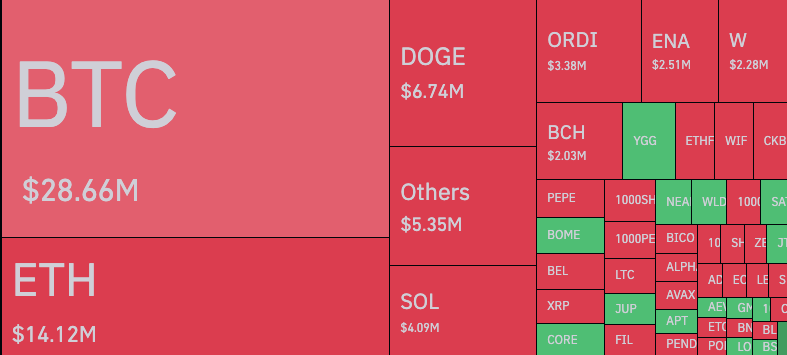

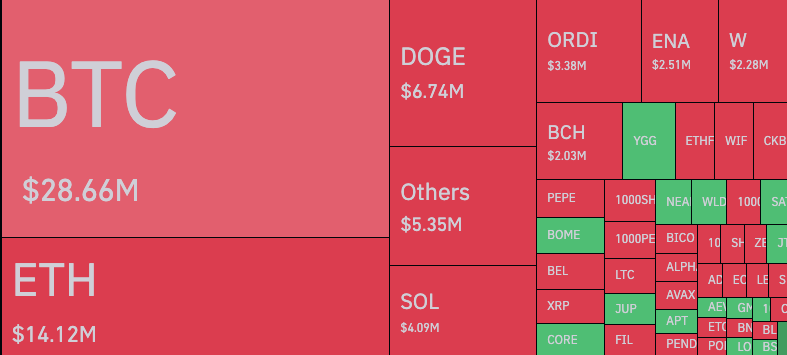

It was subsequently no shock that almost all of the $86.72 million 24-hour liquidation was brief positions.

On this article, Coin Version seems to be on the costs of Bitcoin (BTC), Ethereum (ETH), Solana (SOL), and Cardano (ADA) and the way they carry out within the brief time period.

BTC value evaluation

On April 6, bulls used the $67,344 help to forestall Bitcoin from falling. On account of this formation, the value of BTC as soon as once more rose above $69,000. The present pattern proven by the coin means that it could attempt to retest $70,000.

Nevertheless, overhead resistance existed at $70,649. If the bulls get away of this path, Bitcoin value might rise to $72,945. Alternatively, if rejected, the worth of the coin might drop to $65,592.

In the meantime, the 20 EMA (blue) and 50 EMA (yellow) settled under BTC however had been shut to one another. If this place holds for the subsequent few days, Bitcoin might swing sideways. Moreover, there’s a chance that the all-time excessive will not be reversed earlier than the halving.

ETH value evaluation

On the 4-hour chart, ETH was near $3,390, sharing an analogous construction with Bitcoin. In response to the Relative Power Index (RSI) indicator, consumers contributed to the rally as the worth approached 60.00.

If the shopping for momentum continues to rise, ETH value might attain the psychological space of $3,500. If ETH rises above this level, the value might rise to $3,669. Nevertheless, if the try fails, the worth of the altcoin might be $3,238.

SOL value evaluation

SOL's value fell under $170 on April fifth. Nevertheless, as of this writing, the token has returned to $180. Regardless of the rise, Chaikin Cash Stream (CMF) stays in adverse territory.

Sometimes, a distribution is indicated when the CMF is under zero. Subsequently, this pattern means that the upward momentum of SOL is unstable. If the CMF stays across the similar level, then the coin might fall.

Just like the CMF, the Superior Oscillator (AO) can also be adverse, suggesting downward momentum is constructing. Nevertheless, AO displayed a inexperienced histogram bar, indicating that the token might slowly transfer upwards. On this case, SOL might inch in the direction of $195.66. Nevertheless, if the paper is invalidated, the worth might fall to $168.03.

ADA value evaluation

In response to the 4-hour ADA/USD chart, the 9EMA (blue) and 20EMA (yellow) had been positioned across the similar space. These positions counsel consolidation, with ADA buying and selling round $0.58.

Nevertheless, merchants ought to be cautious. If the value of ADA falls under the short-term EMA, any potential restoration might be halted. Alternatively, if the 9-day EMA reverses the 20-day EMA, the value might develop in the direction of $0.62.

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any sort. Coin Version just isn’t chargeable for any losses incurred because of using the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.

Comments are closed.