- Rekt Capital tweeted that BTC closed under the $26,200 degree and did not regain help at $27,600.

- BTC surged 0.95% in 24 hours and is now at $26,082.69.

- The indicator highlights that BTC could expertise an upward pattern sooner or later.

A cryptocurrency analyst underneath the pseudonym “Rekt Capital” analyzed BTC’s efficiency this week and tweeted that Bitcoin closed under the $26,200 degree and did not regain $27,600 as help. Moreover, a cryptocurrency analyst mentioned that the “blue degree” ($26,638.3) might turn out to be a brand new resistance line for BTC sooner or later.

At present, BTC has skilled a 1.19% rise in 7 days and entered the inexperienced zone. Primarily based on CoinMarketCap, BTC worth is at $26,082.69 after a 0.95% surge in 24 hours. Regardless of BTC falling under the $26,200 degree, the cryptocurrency chief nonetheless has a buying and selling quantity of $11,583,591,020 on the time of writing.

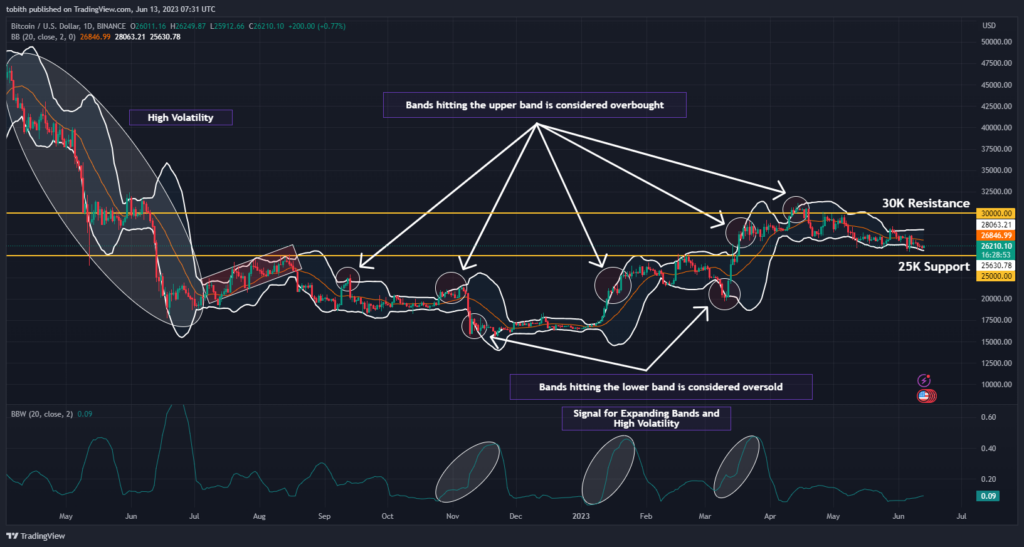

Trying on the BTC/USD 1-day chart, the candlestick is presently situated within the decrease half of the Bollinger Bands, suggesting the market is in a downtrend. Moreover, the hole between the higher and decrease bands stays slim, indicating low market volatility for BTC. Since BTC did not commerce above the $26,000 help degree, $25,000 may very well be seen because the help degree.

BTC volatility is more likely to stay low for a while because the Bollinger Bands Width (BBW) is shifting horizontally in comparison with earlier strikes. Furthermore, the BTC candlestick has returned contained in the Bollinger Bands after being compelled into oversold territory. Nevertheless, BTC’s retracement missed the chance to succeed in the higher half of the Bollinger Bands.

BTC’s present worth momentum is forming a descending triangle sample because it appears to be like to kind new lows. A descending triangle can create two potential entry factors: bullish and bearish. A bearish entry level might see BTC drop 3.81% earlier than reaching the help degree.

Alternatively, BTC must rise 15.52% to interrupt $30,000 on the new help degree. If BTC experiences related pattern energy throughout a reasonable downtrend, the crypto chief might attain $30,000 in 11 weeks.

Furthermore, the RSI worth is 43.70, nonetheless under the SMA, which may be thought of a bearish sign. Nevertheless, the hole between the RSIs is so slim that it’s potential for the RSI to interrupt above the SMA. This crossover will affirm the start of BTC’s uptrend. After the bullish crossover, the RSI could keep close to the robust pattern for a while and push the worth in direction of BTC’s goal of $30,000.

The RVGI bullish crossover additionally confirms that the RSI will get away of the SMA. One other potential sign for BTC’s uptrend comes from the formation of a reasonably bullish divergence noticed within the RSI. If the RSI varieties a better low, BTC might hold shifting increased, avoiding the $26,000 ranges.

Disclaimer: As with all info shared on this pricing evaluation, views and opinions are shared in good religion. Readers ought to do their very own analysis and due diligence. Any actions taken by readers are strictly at their very own threat and Coin Version and its associates shall not be answerable for any direct or oblique damages or losses.

Comments are closed.