- Bitcoin was buying and selling round $101,550 on November fifth after falling 11.8% within the week, with the market in risk-off mode.

- Failure to shut this week above $108,000 will go away the door open for a deeper transfer in the direction of the $98,000 to $102,000 zone.

- Large BTC inflows to exchanges and liquidity strains because of the U.S. shutdown are limiting push shopping for throughout cryptocurrencies.

Bitcoin has prolonged its decline this week, buying and selling round $101,550 on November fifth, and merchants stay targeted on whether or not the market can defend six-digit territory. This transfer adopted a every day lack of 5.29% and a decline of 11.82% over the previous week, despite the fact that Bitcoin’s every day buying and selling quantity nonetheless reached billions of {dollars}.

The tone throughout the desk has turned to warning as sellers are sending extra Bitcoin again to exchanges whereas new spot demand is slowing as a consequence of macro uncertainty. This leaves Bitcoin susceptible to the following leg except consumers retreat.

Associated: Why are Bitcoin and crypto markets falling right now?

Bitcoin falls beneath weekly pattern, falling wanting $108,000

Analysts Recto Capital noticed that Bitcoin ended beneath its 21-week exponential shifting common (EMA) and became a brand new resistance degree. The asset has now remained beneath the $108,000 degree for 5 consecutive weeks.

Analysts observe $98,000 to $102,000 as most reversal zone for ache

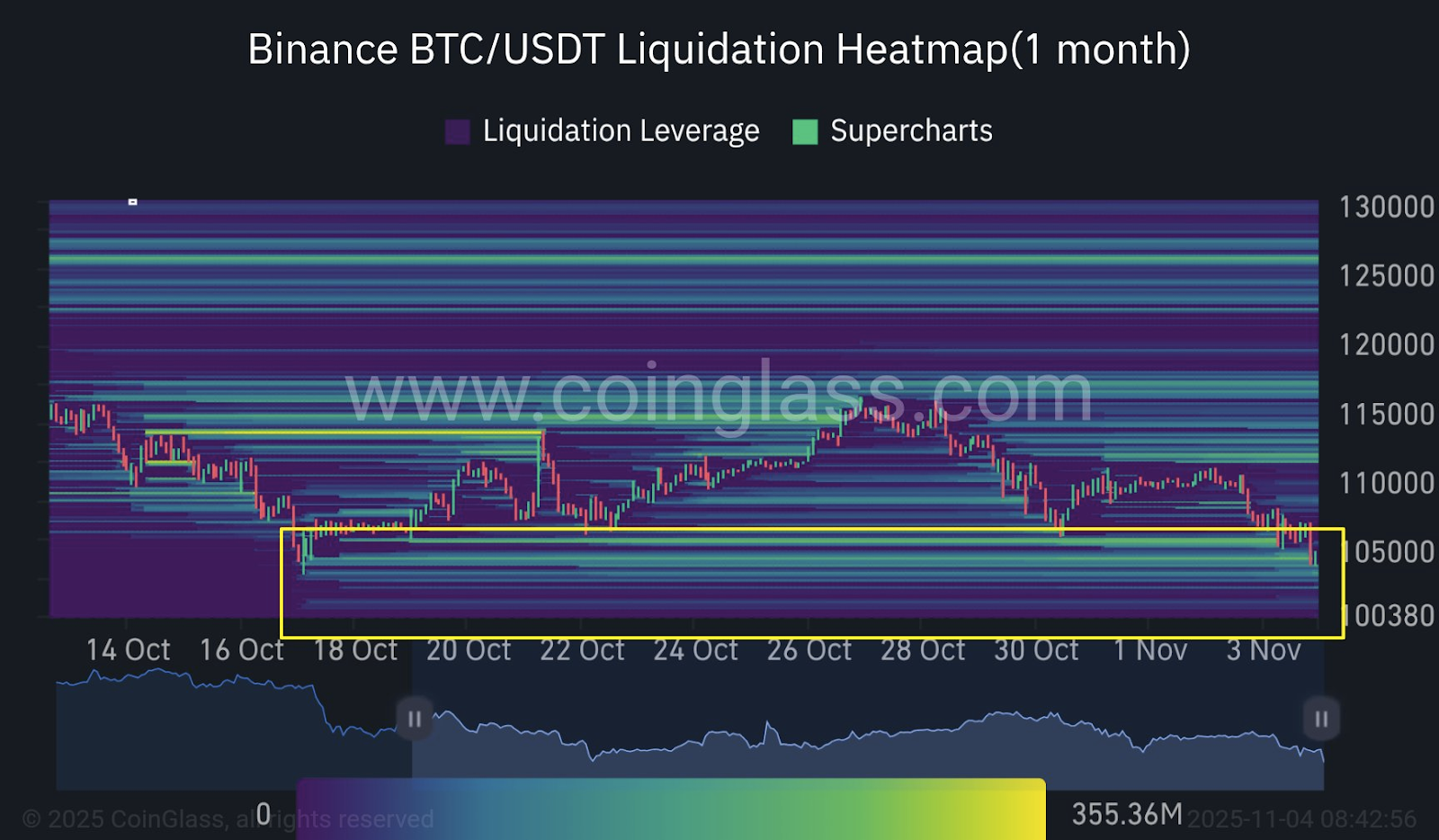

Charting service StockMoney Lizards stated that Bitcoin is approaching a so-called reversal zone. Whereas promote orders are concentrated within the international change order e-book, sentiment is trending bearish. The researchers famous that in previous cycles, comparable patterns of promoting at help have been adopted by sharp candlesticks in the wrong way as sellers have been exhausted. The group pointed to pockets between $98,000 and $102,000 as an space the place compelled promoting and capitulation may set off a rebound. Which means even when the bigger pattern remains to be below strain, merchants watching that band may even see a short-term bounce.

FX inflows point out that is the heaviest sell-side wave of the cycle

On-chain analysis platform CheckOnChain reported that Bitcoin’s value is “heading decrease” as traders develop nervous about reaching the cycle excessive of $126,000. Information exhibits that billions of {dollars} of BTC are returned to exchanges daily. Nonetheless, costs stay broadly above the $100,000 mark, which analysts say is stunning given the size of provide that has returned to the market.

The report means that sell-side strain this cycle is at an all-time excessive. The continued sell-off seems to be pushed by profit-taking and liquidity shifts quite than panic. Nonetheless, market contributors are watching carefully for indicators of stabilization as liquidity inflows search to soak up this wave of provide.

Macroeconomic components improve burden

In keeping with CryptoQuant, the latest US authorities shutdown has disrupted liquidity flows and amplified strain throughout digital property. Whereas short-term reduction is predicted as soon as the state of affairs is resolved, analysts warn that it could take longer for confidence and capital to get better.

Subsequently, Bitcoin’s capability to reclaim the $108,000 resistance stays essential in figuring out whether or not the present decline stabilizes or deepens right into a broader correction.

Bitcoin value right now – evaluation

- degree: Speedy resistance lies at $108,000, and the highest of the broader vary stays at $125,000. On the draw back, analysts are monitoring $102,000 and a spherical variety of $100,000, with a deeper zone at $98,000. A weekly shut beneath $100,000 will weaken the bullish construction and invite additional vary buying and selling.

- Momentum: On the weekly chart, momentum has declined after repeated failures at $108,000, suggesting to merchants that the breakout has not but taken maintain. Till momentum is regained, any pullback to the resistance is more likely to be bought.

- Liquidity and movement: Liquidity stays skinny as spot consumers should not absorbing further provide from exchanges. Which means if there’s one other wave of promoting, volatility may escalate quickly.

Associated: Bitcoin Value Prediction: Foreign exchange outflows attain $162 million as BTC loses trendline help

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any variety. Coin Version shouldn’t be accountable for any losses incurred because of using the content material, merchandise, or providers talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.