Whereas the same old volatility was absent from the derivatives market, the slight fluctuations seen over the previous few days managed to make clear refined market traits.

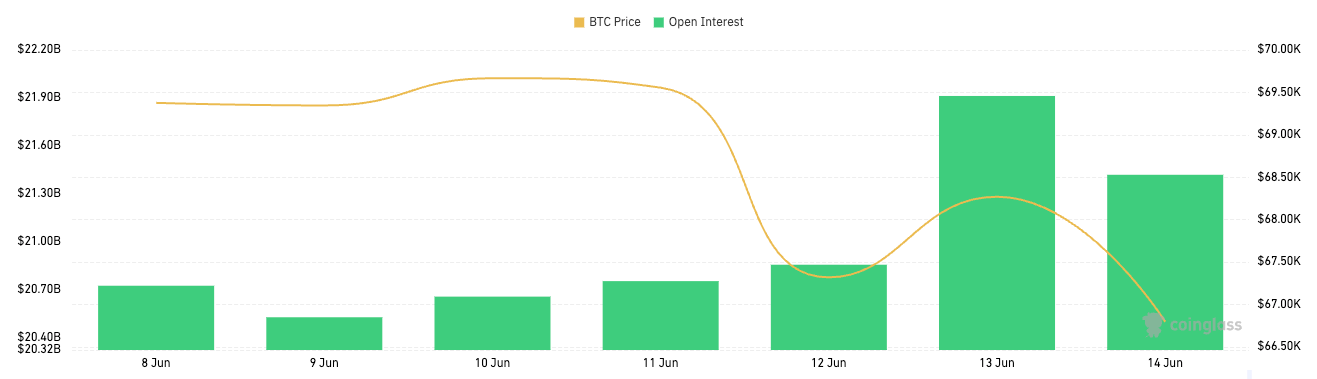

Between June 12 and June 14, open curiosity in Bitcoin choices elevated from $20.85 billion on June 12 to $21.91 billion on June 13, earlier than declining to $21.42 billion on June 14.

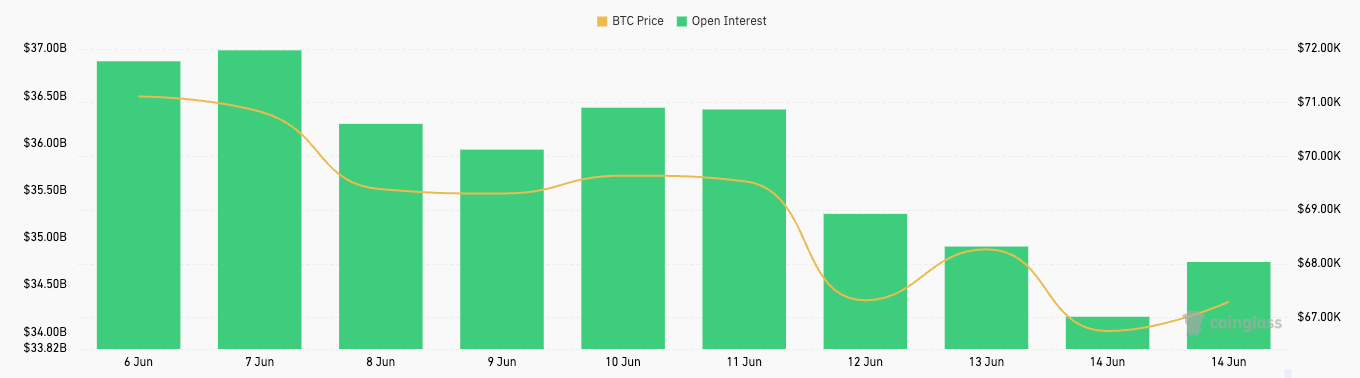

Bitcoin futures open curiosity additionally declined barely through the interval, falling from $35.25 billion on June 12 to $34.17 billion on June 14.

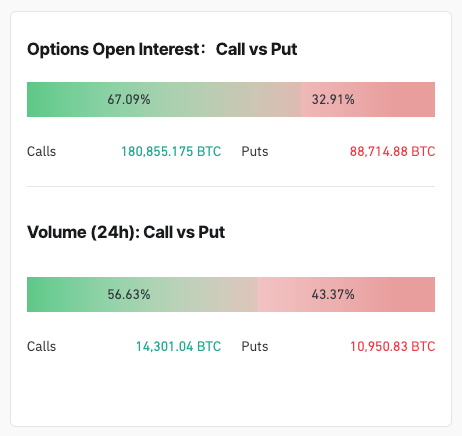

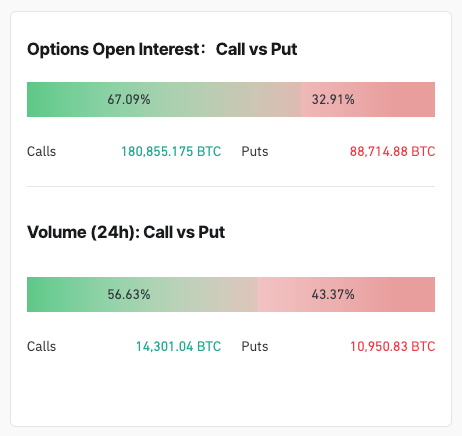

The preliminary enhance and subsequent lower in choices open curiosity, when analyzed together with value, suggests blended market sentiment. After a quick restoration on June 13, Bitcoin fell from $69,555 on June 11 to $66,780 on June 14. The outnumbering of name choices (67.17%) over put choices (32.83%) as of June 14 signifies an general bullish sentiment regardless of the value decline. 24-hour choices buying and selling quantity on June 14 was additionally tilted in the direction of calls (59.88%), supporting this bullish outlook even in a declining value atmosphere.

These refined adjustments in OI are the results of a mixture of a number of components affecting the broader cryptocurrency market. The Bitcoin ETF has seen a mixture of inflows and outflows over the previous few days. The $100 million influx as a result of Bitcoin ETF restoration and the sudden $226 million outflow as a result of Ethereum ETF information present how arduous the market has been hit. This outflow could have contributed to a decline in demand for Bitcoin futures, as evidenced by the decline in futures open curiosity.

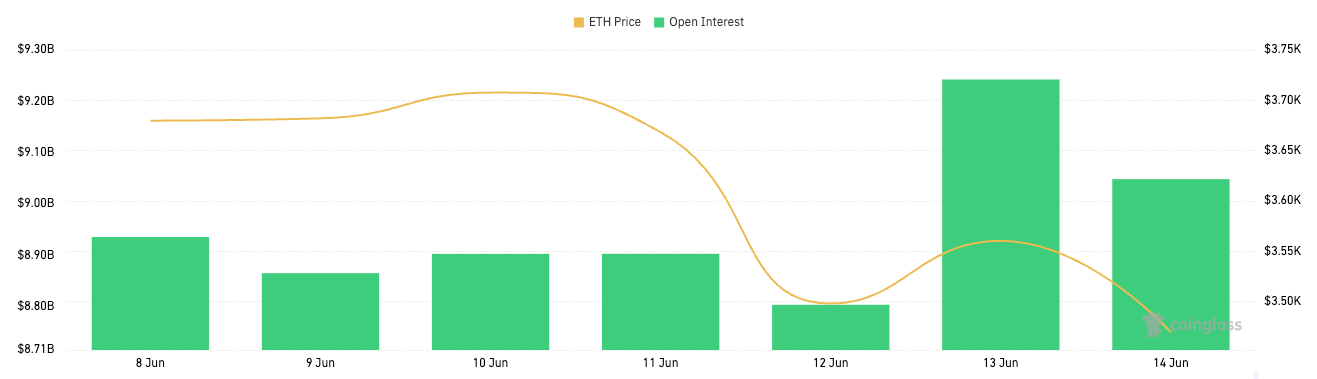

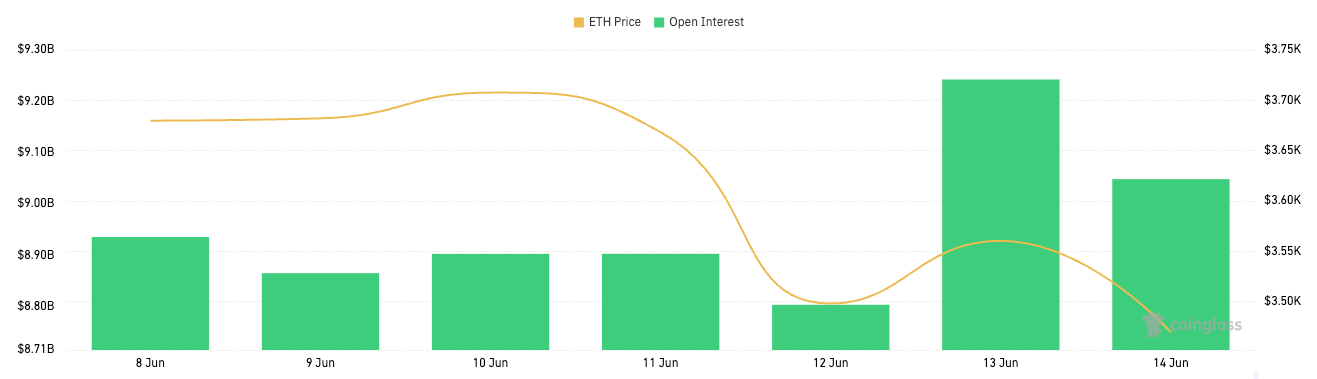

SEC Chairman Gary Gensler's assertion that an Ethereum ETF might be accredited this summer season seems to have shifted investor consideration and capital to Ethereum, influencing the Bitcoin derivatives market. This shift is clear within the Ethereum futures and choices markets, and the rise in open curiosity in current days displays this alteration in sentiment.

MicroStrategy's issuance of convertible notes to purchase extra BTC additionally influenced investor sentiment. Michael Saylor's newest transfer reveals the corporate's unwavering confidence in Bitcoin, which might definitely affect buyers collaborating within the derivatives market. This impression is clear within the dominance of name choices and the flexibility to keep up and enhance bullish positions regardless of sideways costs.

ETF outflows have a direct impression on the Bitcoin futures and choices markets. Bitcoin ETF outflows result in decreased liquidity and demand within the futures market, resulting in a lower in open curiosity. This relationship is clear within the information, the place we see a lower in futures open curiosity after vital ETF outflows. The connection between ETF outflows and futures open curiosity reveals how necessary institutional participation and sentiment are in transferring the market.

Bitcoin's sideways motion and lack of main fluctuations throughout this era had a suppressing impact on open curiosity. When costs are comparatively steady, merchants have fewer alternatives to revenue, which reduces buying and selling exercise and reduces futures open curiosity. Bitcoin's value vary from June 10 to June 14 was steady, albeit with minor fluctuations, suggesting a interval of market consolidation, resulting in a lower in futures open curiosity.