- Cardano Value has $0.85 in assist, however resistance is between $0.87 and $0.88 in resistance, which makes the bull ready for a decisive breakout.

- By-product information trimmed open curiosity however confirmed a powerful lengthy bias amongst whales, indicating cautious confidence.

- Analysts evaluate the construction of the ADA to early 2021 and undertaking a possible cycle breakout to $1.00.

Cardano Value has been buying and selling regular, practically $0.86 after a pointy pullback from its $0.94 peak final week. Consumers defend the $0.85 assist zone, however the short-term outlook is whether or not the ADA can regain the $0.87-$0.88 resistance cluster marked by key shifting averages.

Cardano Value holds main assist

The four-hour chart reveals the ADA consolidated simply above the 200-EMA for $0.85. 20 and 50 Emmas are situated close to $0.88, creating speedy overhead stress.

Associated: XRP (XRP) Value Forecast for September seventeenth

The momentum indicator highlights the standoffs. Parabolic SAR exceeded the value, exhibiting bearish bias, and RSI was cooled to impartial territory. A break above $0.88 might invite a affluent purchaser, however dropping $0.85 exposes the ADA to $0.83 and $0.82.

By-product information suggests susceptible sentiment

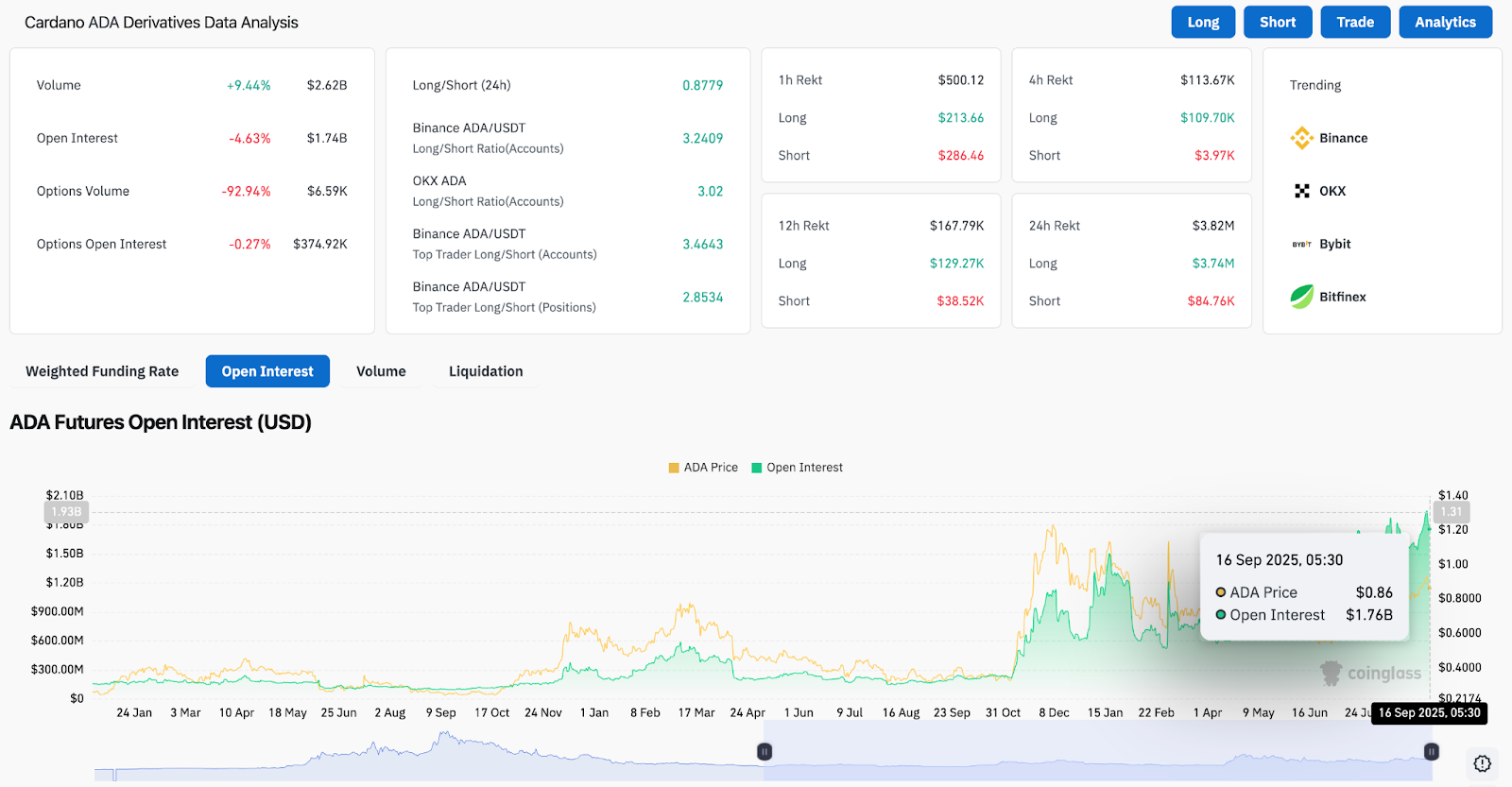

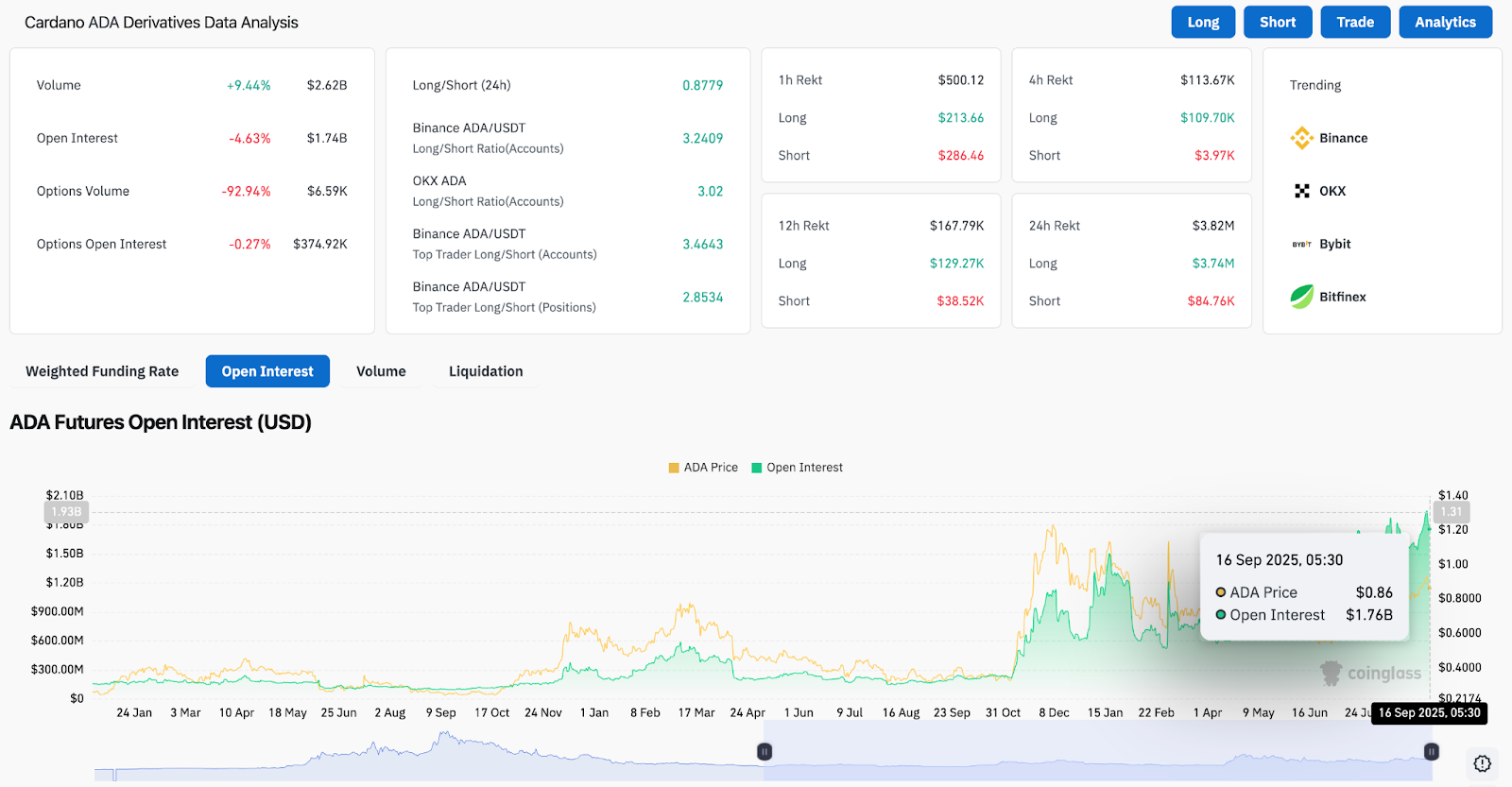

On-chain and futures information reveals cautious positioning. Open Interes has lowered its 4.6% to $1.74 billion over the previous 24 hours. On the similar time, futures quantity has risen by nearly 9.5% to $2.62 billion, suggesting that merchants are spinning quite than popping out fully.

Associated: Bitcoin (BTC) Value Prediction for September seventeenth

Particularly, the Binance and OKX Lengthy/Quick ratios present robust lengthy biases, with prime merchants having the ratio above 3.0. This means belief between whales, such that broader open curiosity leaps downwards. When Open Curiosity stabilizes at over $1.7 billion, it could actually present a basis for up to date upside momentum.

Analysts spotlight the early bull cycle

Market commentators argue that Cardano’s newest construction displays early 2021 breakouts. Analyst Ali Chart posted, “Cardano’s bull run is in its early levels,” pointing to Fibonacci’s roadmap, projecting long-term advantages of over $3.00 if the cycle is repeated.

This story coincides with the historic accumulation levels that the ADA integrates earlier than the prolonged meeting. With Bitcoin stabilising practically $108,000 and Ethereum over $4,500, the broader market background helps the argument that the ADA will keep its bullish trajectory.

Technical outlook for Cardano costs

At present, key ranges are effectively outlined. The benefit is that clear breaks above $0.88 are focused at $0.90 and $0.93, and can be prolonged additional in direction of $0.96 if bullish flows return. The decisive transfer by $0.93 validates the cycle breakout paper and opens the trail to $1.00.

Associated: Linea (Linea) Value Forecast 2025, 2026, 2027, 2028–2030

On the draw back, dropping $0.85 will increase the chance of retracement to $0.83 and $0.82. A breakdown of below $0.82 unlocks latest rally and exposes the ADA to a assist zone of $0.78-$0.80.

Outlook: Will Cardano go up?

Cardano value motion is a crucial time. Quick-term methods recommend stress at resistance between $0.87-$0.88, however comparisons of chain circulation and cycles hold bullish narrative alive.

Analysts are cautiously optimistic. So long as the ADA is above $0.85, bias is leaning in direction of one other retest between $0.90-$0.93 within the close to future. A breakout above $0.93 checks an early stage bull circulating view, however dropping $0.82 might delay the rally and power a return to integration.

Disclaimer: The knowledge contained on this article is for data and academic functions solely. This text doesn’t represent any type of monetary recommendation or recommendation. Coin Version will not be accountable for any losses that come up because of your use of the content material, services or products talked about. We encourage readers to take warning earlier than taking any actions associated to the corporate.