Cardano (ADA) costs are buying and selling practically $0.91 after a brief pullback from $0.95 in peak. Tokens proceed to defend the $0.90 zone as help, with patrons specializing in the $0.96-$1.00 vary as their subsequent breakout goal. The transfer will permit the ADA to surpass Tron and regain its standing because the ninth largest cryptocurrency by market capitalization.

Cardano Worth retains rising channel help

On the each day charts, ADA has been buying and selling inside the upward channel since July, bounces from mid-channel help from practically $0.88 to retest the higher band. The 20- and 50-day EMAs for $0.86 and $0.83 are excessive and supply dynamic help for the construction.

Associated: Dogecoin (Doge) Worth Forecast for September sixteenth

The momentum stays constructive. A sequence of upper lows and structural fragment alerts spotlight up to date accumulation. The $0.75 200-day EMA sits as a long-term security internet, with the practically $1.05 channel ceiling rising as a vital zone of resistance.

Ada flips Tron in market rankings

On September thirteenth, Cardano formally surpassed Tron, changing into the ninth largest cryptocurrency by market capitalization. This improvement highlights the ADA’s return to the highest tier of digital property, strengthening traders’ belief as merchants search for relative energy in Altcoins.

Milestones sparked new social momentum as community-driven help usually results in participation in stronger markets. Analysts counsel that sustaining this rank can present a psychological increase to ADA holders and entice contemporary inflow.

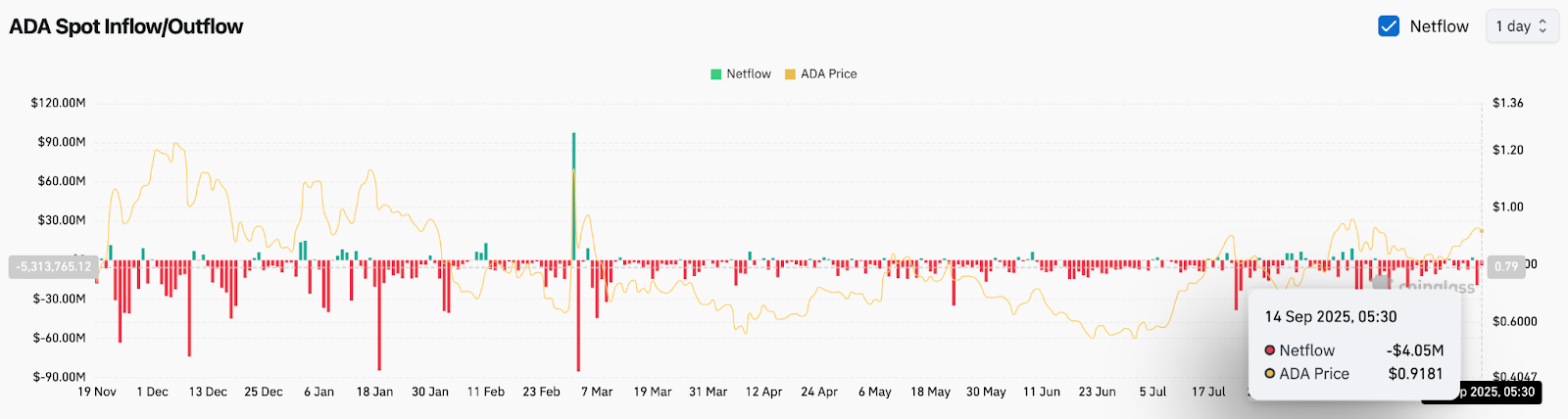

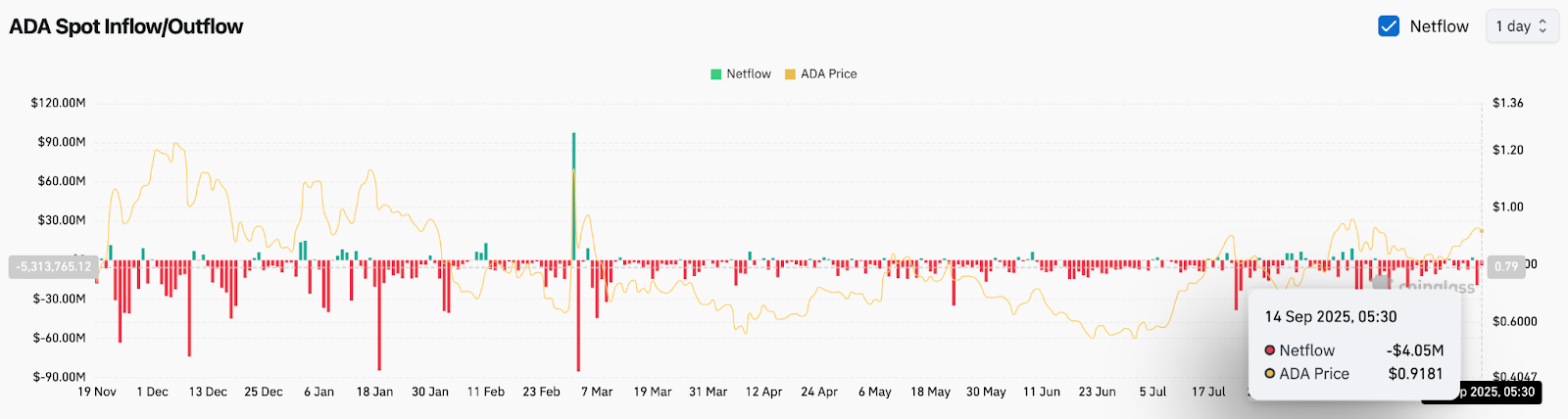

On-chain information exhibits blended circulation

Alternate circulation information emphasizes cautious positioning. On September 14th, the ADA recorded a internet outflow of $4.05 million, extending the sequence of blended flows noticed throughout September. Internet efflux normally suggests accumulation, however the scale of those actions stays modest in comparison with earlier cycles.

Associated: Solana (SOL) value forecast for September sixteenth

This sample displays a market that’s nonetheless testing beliefs. Lively addresses and spot demand are under peak ranges, however constant internet outflows point out that long-term holders proceed to withdraw provide from exchanges. A sustained accumulation might strengthen ADA bases that exceed $0.90.

Fibonacci ranges and parabolic SAR outline resistance

The 4-hour chart exhibits ADA respecting Fibonacci’s retracement zone. The value was pulled again after a brief faucet of a 0.618 retracement for $0.928, however the parabolic SAR stays under the spot stage, supporting bullish momentum.

Fast resistance seems between $0.95-0.96 and matches the 0.786 retracement zone. A profitable breakout on high of this cluster will end in a cross of $1.00-$1.02. On the draw back, if the vendor regains momentum, $0.90 is the principle short-term flooring, with deeper threat in the direction of $0.87.

Technical outlook for ADA pricing

The important thing ranges are effectively outlined. The benefit is that the ADA should clear $0.95 and verify for breakouts of $1.00 and $1.05. Motion past this zone coincides with the broader channel trajectory and may be prolonged to $1.10.

Associated: Ethereum (ETH) value forecast for September sixteenth

On the draw back, shedding $0.90 adjustments short-term sentiment, revealing $0.87 and probably $0.83. With out these ranges, the worth might return to $0.75, a long-term EMA cluster.

Outlook: Will Cardano go up?

Cardano’s value motion suggests bullish bias so long as $0.90 is held firmly. The mixture of rising channels, improved EMA construction, and psychological momentum by way of tron inversion help bullish circumstances.

Nevertheless, on-chain circulation stays medium, indicating that merchants usually are not absolutely dedicated but. To make sure ADA is resolutely increasing its income, it might want to bolster its inflows together with breakouts above $0.95.

Analysts are cautiously optimistic. If the ADA holds the channel and breaks after $0.96, the street to $1.00 and past seems to be more and more viable.

Disclaimer: The knowledge contained on this article is for info and academic functions solely. This text doesn’t represent any form of monetary recommendation or recommendation. Coin Version is just not answerable for any losses that come up because of your use of the content material, services or products talked about. We encourage readers to take warning earlier than taking any actions associated to the corporate.