- Cardano Worth traded for $0.81 immediately after shedding assist between $0.83 and $0.85, with $0.80 being $0.80 as a key protection.

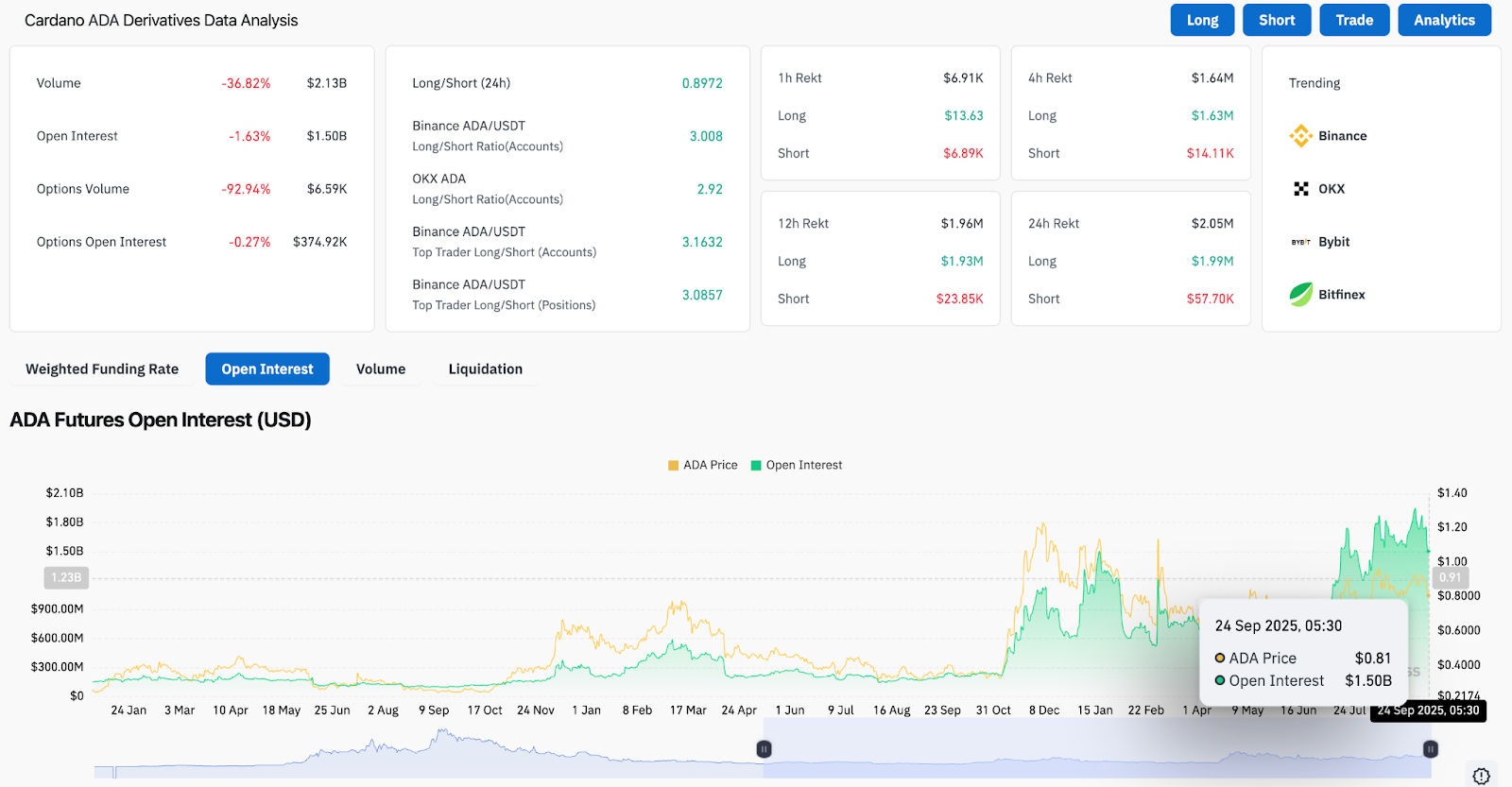

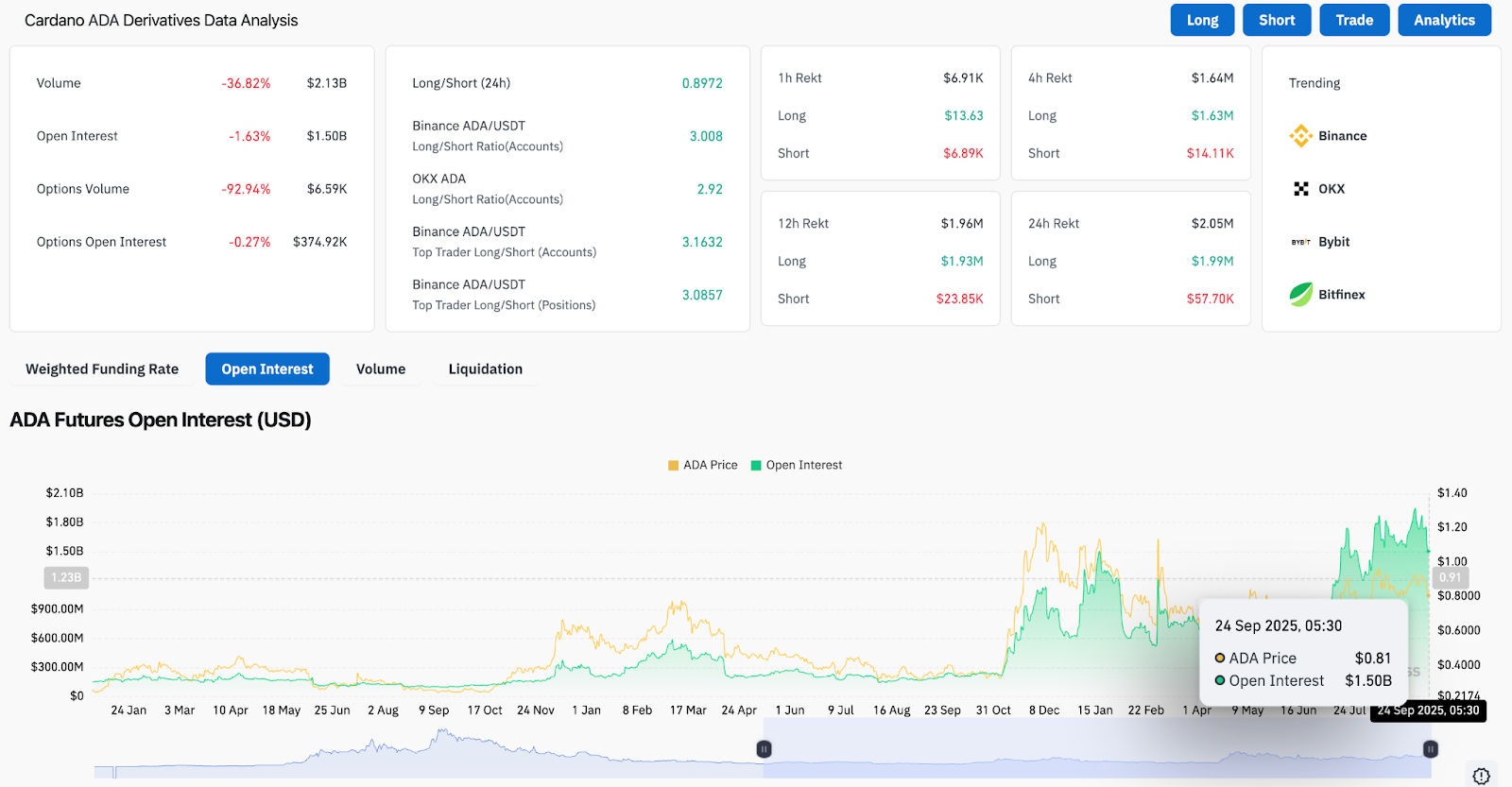

- By-product quantity fell 36% to $21.3 billion, with Futures liquidation leaning in the direction of a bullish place.

- ADA Neighborhood Sentiment is ranked seventh on this planet, offsetting stress as RSI alerts an extra stage of ranges.

Cardano Worth Right now is buying and selling practically $0.81 and extends the decline after falling beneath the assist zone of $0.83-$0.85. The failure uncovered the ADA to sustained stress, leading to fast resistance being shaped round $0.835 over 20 days of EMA. Merchants are taking a look at whether or not the $0.80 deal with will be held as the following essential protection.

Cardano costs break pattern assist

The four-hour chart exhibits that the ADA failed to take care of the upward channel, with the rejection being practically $0.92, confirming a change out there construction. The transfer has dragged the tokens below the EMAs of the 20, 50 and a centesimal intervals, reinforcing bearish bias.

Fibonacci’s retracement stage highlights $0.83 (23.6%) as misplaced pivots, however $0.78 seems as the following key liquidity pocket. The RSI measurement hovered close to 29, highlighting the inversion situation, however no inverted sign has been noticed. To flip the sentiment nearer in the direction of impartial, you want a pushback of over $0.835.

On-chain circulate highlights the weak spot of derivatives

Cardano Derivatives information reveals the background of the cooling market. Every day buying and selling quantity fell 36% to $2.13 billion, whereas open curiosity fell from 1.6% to $1.5 billion. Non-compulsory exercise collapses, quantity drops by 93%, indicating a scarcity of speculative urge for food.

Regardless of cautious positioning, the long-term ratio stays distorted in the direction of the Bulls, with the Binance account exhibiting a ratio above 3.0. This means that whereas wider participation is changing into much less frequent, devoted merchants proceed to wager on restoration. Nonetheless, futures liquidation is leaning closely in the direction of size, revealing the vulnerability of bullish beliefs.

Feelings are excessive regardless of value stress

https://twitter.com/minswapintern/standing/1970427934482800851

Neighborhood assist stays a distinguished counterweight to technical weaknesses. Based on Mintern Information, Cardano ranks globally at seventh in group sentiment, highlighting its resilient retail base. This optimism is as a result of the ADA has been practically 8% aside within the final 24 hours, referring to the distinction between feelings and value conduct.

Such positioning displays the ADA’s historic status for sturdy grassroots assist. It doesn’t assure a value restoration, however gives a story anchor that may appeal to opportunistic consumers throughout overselling.

Hoskinson’s daring remarks and regulatory enhance

Charles Hoskinson rekindled hypothesis this week by declaring that “Cardano will beat the web.” Though imprecise, the assertion coincides with constructive regulatory momentum. SEC approval of the Grayscale Digital Giant Cap Fund, together with the ADA, opens new channels for institutional publicity.

Traditionally, comparable approvals for Bitcoin and Ethereum have brought about a recent inflow from skilled buyers. Though it stays unsure whether or not ADA can replicate its trajectory, the mix of sturdy group sentiment and institutional pathways gives a supportive background.

Technical outlook for Cardano costs

Quick-term Cardano value forecasts for key assist and resistance:

- Upside Degree: $0.835, $0.872, and $0.90 if restoration momentum is constructed.

- Drawback ranges: $0.80, $0.78, $0.74 as essential defensive factors.

- Development Pivot: $0.92 as a breakout threshold to regain bullish development.

Outlook: Will Cardano go up?

Cardano faces a fragile stability between technical weak spot and bullish narratives. The lack of assist of $0.83 highlights bearish stress, however means that RSI ranges and powerful group assist might restrict the downsides.

If the ADA can defend the $0.80-$0.78 zone, a rebound to $0.872 continues to be cheap. The failure right here shifts the main focus to $0.74, placing deeper losses in danger. For now, the ADA trajectory is determined by whether or not sentiment-driven elasticity can offset the positioning of susceptible derivatives and restore reliability above $0.83.

Disclaimer: The data contained on this article is for info and academic functions solely. This text doesn’t represent any type of monetary recommendation or recommendation. Coin Version shouldn’t be answerable for any losses that come up because of your use of the content material, services or products talked about. We encourage readers to take warning earlier than taking any actions associated to the corporate.