- Chan's exhausting fork might see Cardano's worth beneath group management rise from $600 million to $10 billion.

- Cardano's exhausting fork represents a paradigm shift and is more likely to entice new builders and buyers to the ecosystem.

- ADA market tendencies point out cautious optimism with combined sentiment and a latest value improve of two.25%.

In response to a latest submit by Dan Gambardello on the X-Platform, Cardano's (ADA) Chan exhausting fork, scheduled for September 1, guarantees to be a shift in blockchain governance. The improve has the potential to redefine Cardano's place within the cryptocurrency trade. The important thing takeaway is that over $600 million of ADA (based mostly on immediately's costs) will probably be positioned solely beneath group management.

This determine might swell to $5 billion and even $10 billion as ADA’s worth rises, ushering in a brand new period of decentralization. Typically seen as a darkish horse within the cryptocurrency world, Cardano has persistently maintained its place among the many high 10 cryptocurrencies.

The Chang exhausting fork isn’t just a technical improve, it represents a change in governance for Cardano. This growth has the potential to draw extra builders, customers and buyers to the Cardano ecosystem, positioning it because the main community-driven blockchain.

Wanting past the influence of the exhausting fork, Cardano’s present market efficiency exhibits a constructive development. ADA value is $0.358232 with a 24-hour buying and selling quantity of $246,618,162, up 2.25% within the final 24 hours, with a market cap of $12.88 billion. The circulating provide is 35,960,643,044 ADA cash with a most provide of 45 billion ADA cash.

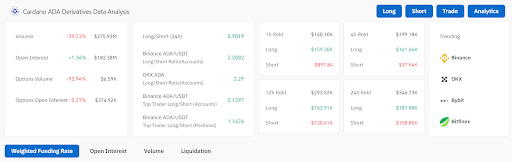

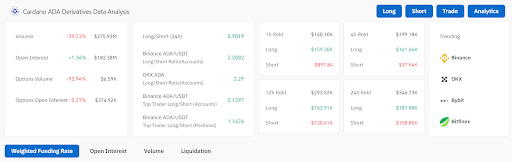

The derivatives market offered a combined image for Cardano, with buying and selling volumes declining 39.23% to $275.93 million, reflecting cautious buying and selling exercise, whereas open balances elevated barely 1.34% to $182.38 million, indicating extra positions are being held regardless of the drop in buying and selling exercise.

Choices buying and selling recorded a major drop of 92.94%, indicating a decline in speculative curiosity. Nevertheless, the lengthy/quick ratios on main exchanges resembling Binance and OKX point out a bullish development, with accounts and high merchants holding extra lengthy positions. That stated, the rising liquidation of longs throughout varied timeframes signifies cautious habits.

Disclaimer: The knowledge offered on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or counsel of any variety. Coin Version will not be accountable for any losses incurred on account of using the content material, merchandise, or companies talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.