- Cardano Worth in the present day trades practically $0.798 and integrates the $0.83-$0.85 resistance, bolstered by EMA and Fibonacci ranges.

- The forecast market will allocate a 91% probability of US Cardano ETF approval by October twenty sixth, selling optimism.

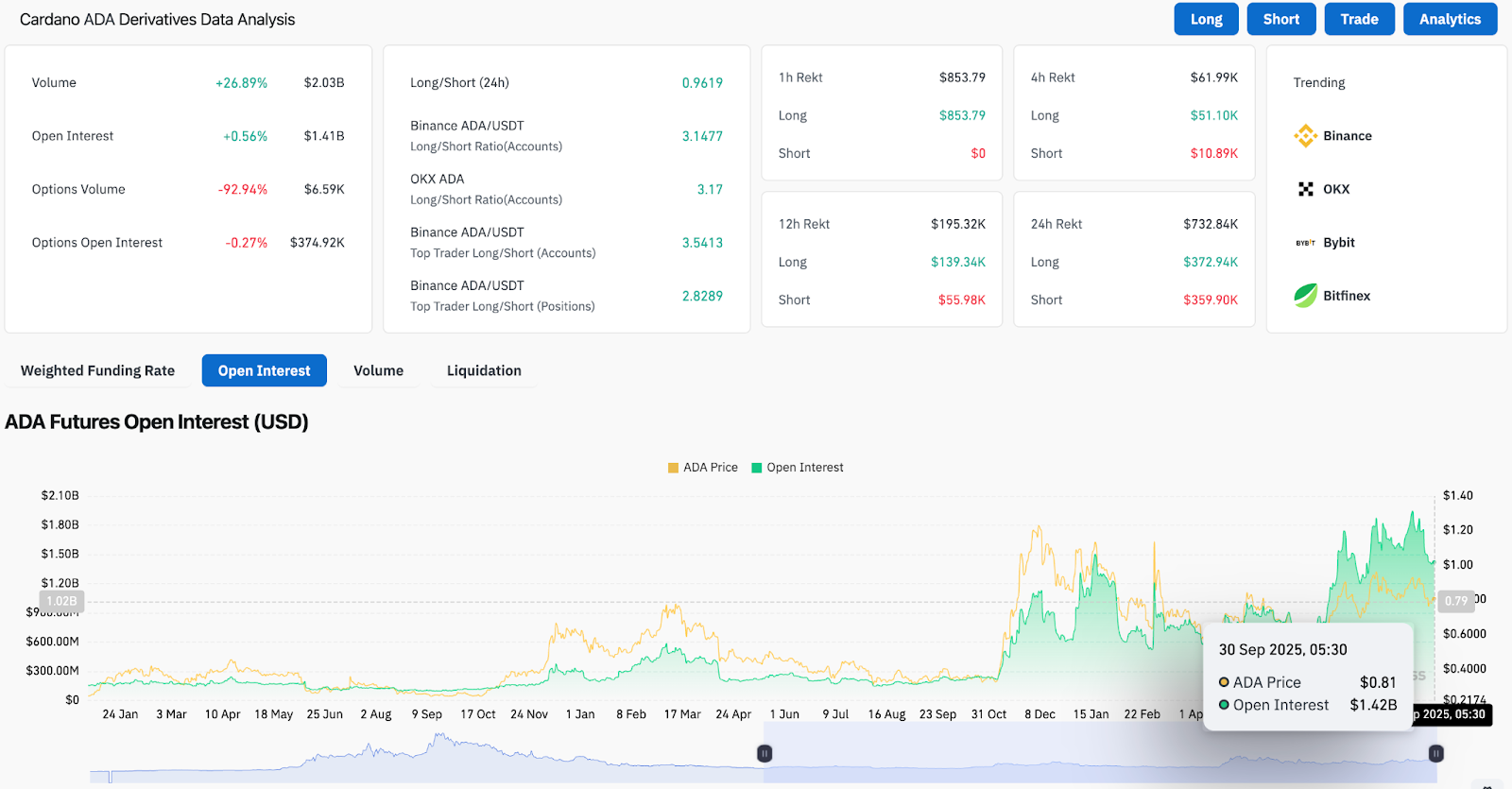

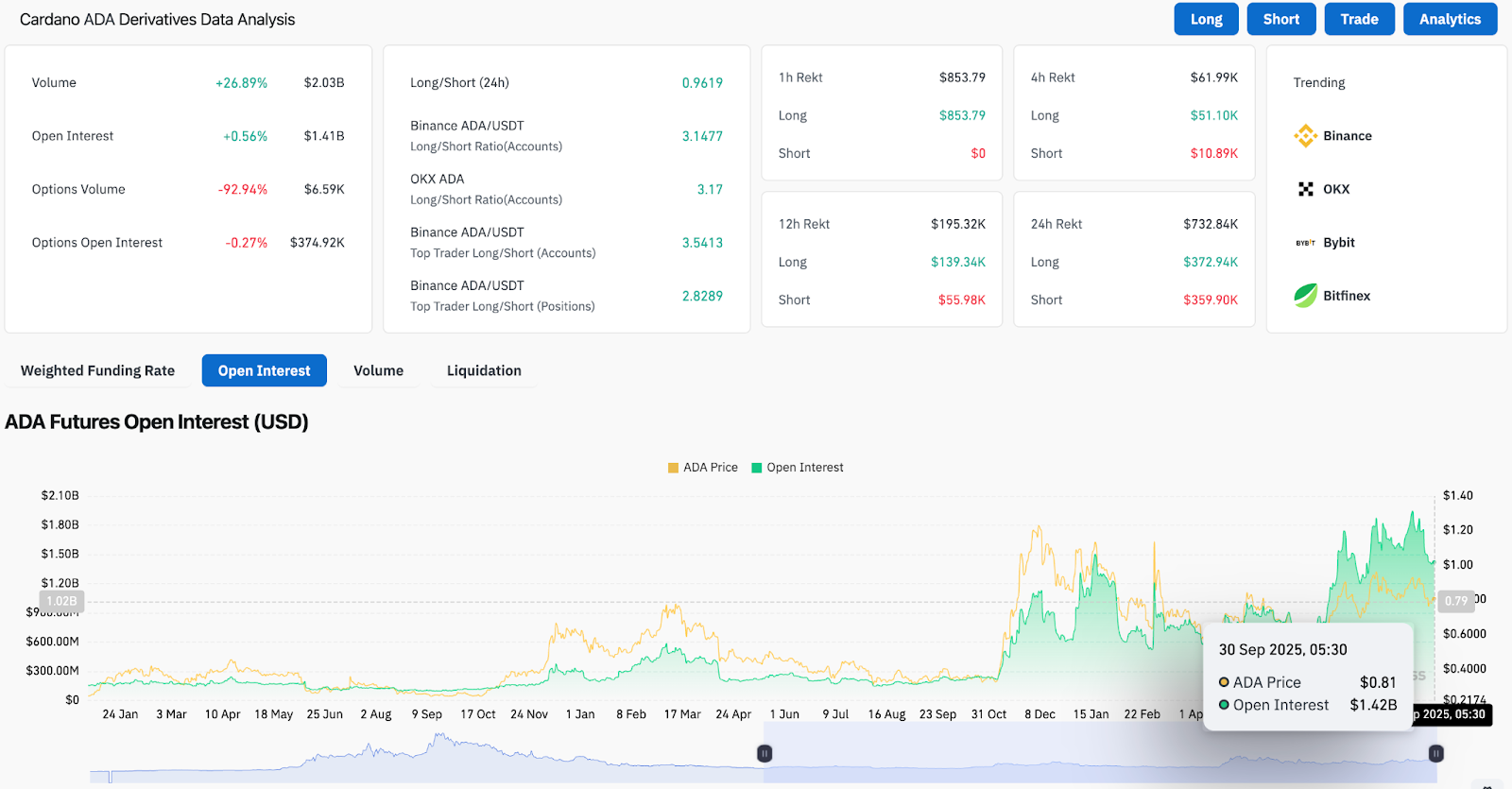

- Open Interes rises to a bullish, skewed $14.1 billion in lengthy/quick ratios, however watch out for exercise indicators for suppressed choices.

Cardano Worth Immediately is buying and selling practically $0.798 and is about to get better after final week’s slide fell under the assist band of $0.81-$0.83. Patrons defend the $0.78 zone, however the market stays under the most important short-term transferring common.

The main focus will shift as to whether ADA can regain $0.83-$0.85, a resistance cluster bolstered by 50 days of EMA and Fibonacci confluence.

Cardano costs are battling resistance

On the four-hour chart, the ADA is consolidated between $0.78 and $0.83 after a pointy pullback that exceeds $0.95 from its September excessive. The value at the moment sits at $0.80 beneath the 20-day EMA, going through $0.82 and $0.83 for overlapping resistance from the 50- and 100-day EMA.

The 200-day EMA stays excessive at $0.84, forming a dense zone of resistance. Breakouts by means of this cluster clear the trail to journey to $0.87 (FIB 0.382) and the trail to journey to $0.90 (FIB 0.5). On the draw back, speedy assist is $0.78, with deeper liquidity pockets approaching $0.75 and $0.71.

The momentum indicator stays blended. The RSI is recovering from unsold territory, however has but to see bullish divergence. Parabolic SAR dots outweigh the worth and point out a whiskered bias.

Associated: Ethereum Worth Prediction: Analysts Watch $4,359 Ranges as Quick Aperture Threatening Bears

ETF Approval Odds Add tailwind

Market sentiment across the ADA brightened after the forecast market positioned a 91% probability of approval for the US Cardano Spot ETF by October twenty sixth.

Analysts argue that even a partial capital turnover from ETF merchandise to ADA can present significant liquidity enhancements. Nonetheless, approval timelines might not match the short-term technical breakouts completely, warning merchants to check hype in opposition to present chart pressures.

On-chain information exhibits cautious positioning

Differential stream signifies up to date exercise. Cardano Open Curiosity is $1.41 billion, a rise of 0.56% over the past 24 hours, however buying and selling quantity has elevated 26% to $2.03 billion. The lengthy/quick ratio of Binance is strongly bullishly distorted at 3.14, suggesting that leverage is tilted in direction of upside bets.

Nonetheless, optionally available exercise stays suppressed, down 92% in comparison with the earlier week. This lack of hedge might expose merchants to volatility shocks if the ADA is unable to regain resistance. Liquidation information has worn out $732,000 within the final 24 hours, highlighting how weak the restoration is, as Lengthy has absorbed a bigger share of the loss.

The inspiration strengthens the long run case

Past technical fluctuations, Cardano continues to construct belief as a resilient blockchain. Group information highlights that the community has been working for over eight years with out the unparalleled monitor document of many rivals.

This stability story provides institutional traders confidence as ETF hypothesis grows. It additionally helps circumstances the place Cardano’s analysis could also be much less speculative than its friends in the long term, particularly when wider adoption of distributed functions accelerates.

Technical outlook for Cardano costs

The important thing ranges of the ADA stay strictly outlined for October.

- Upside stage: $0.83–$0.85 (EMA cluster), $0.87 (FIB 0.382), $0.90 (FIB 0.5).

- Deficiency stage: Rapid assist of $0.78 adopted by $0.75 and $0.71.

- Development Help: $0.68 stays the final main defensive position.

Merchants are taking a look at whether or not ADA can shut day by day candles above $0.83. In any other case, you’ll be left with the chance of one other retest of $0.75 assist.

Outlook: Will Cardano go up?

The October Cardano value forecast will rely on whether or not consumers can regain resistance zones of $0.83-$0.85. Though engineers nonetheless name consideration, the rising open curiosity, sturdy lengthy/quick ratios, and looming ETF selections create potential catalysts for upward momentum.

If ETF optimism stays, the ADA might take a look at $0.90 and doubtlessly $0.93 in October. Conversely, if the worth loses $0.78, the vendor can regain management and revert the ADA to beneath $0.75.

For now, Cardano stays within the consolidated scope, and ETF hypothesis affords a strong narrative tail, however technical stage.

Disclaimer: The knowledge contained on this article is for info and academic functions solely. This text doesn’t represent any type of monetary recommendation or recommendation. Coin Version is just not answerable for any losses that come up because of your use of the content material, services or products talked about. We encourage readers to take warning earlier than taking any actions associated to the corporate.