- ADA is struggling beneath $0.4689 because the highs and lows affirm persistent promoting stress.

- Regardless of the continued decline in spot costs, futures open curiosity stays excessive at practically $751 million.

- Sign merchants scale back publicity as outflows prevail and gathered curiosity is weak.

Cardano continues to face regular downward stress as merchants look ahead to weakening momentum throughout key time frames. The market continues to push ADA towards new lows as volatility will increase and patrons are unable to regain important ranges. The present construction exhibits that the market is being pushed by warning, with merchants responding to every failed rebound by decreasing publicity.

Value falls as ADA struggles to keep up assist

ADA is buying and selling close to $0.4689 after rejecting a number of restoration makes an attempt on the midrange oscillator. The 20-SMA acts as stable dynamic resistance above the market. Moreover, decrease highs proceed to type throughout the 4-hour chart, confirming sustained promoting stress.

The decrease Bollinger Band is positioned close to $0.4537, forming the primary main assist zone. A break beneath this stage might result in additional draw back with a goal of $0.4220.

This zone coincides with the Fib 0.236 space the place the value response fashioned earlier this 12 months. Moreover, deeper weak point might expose a wider Fib 0.0 zone round $0.2754, which signifies an excessive draw back goal from the complete swing vary.

Associated: XRP value prediction: ETF hype fades as sellers steer value in the direction of channel assist

On the upside, ADA wants a clear transfer to $0.4720 to point early stabilization. The resistance zone at $0.4788-$0.5038 continues to restrict intraday features. Furthermore, the Fib 0.382 stage at $0.5127 stays a very powerful marker of pattern power. A detailed above this stage might change short-term sentiment.

Open curiosity rises regardless of low costs

Cardano futures open curiosity has proven stable motion all year long. Even when the spot chart pattern declines, merchants proceed to make the most of leverage.

In the course of the mid-year buying and selling swings, open curiosity exceeded $1.2 billion. That quantity now stands at practically $751 million, indicating continued participation. Subsequently, this sample signifies that regardless of the continued decline in spot costs, merchants expect extra volatility sooner or later.

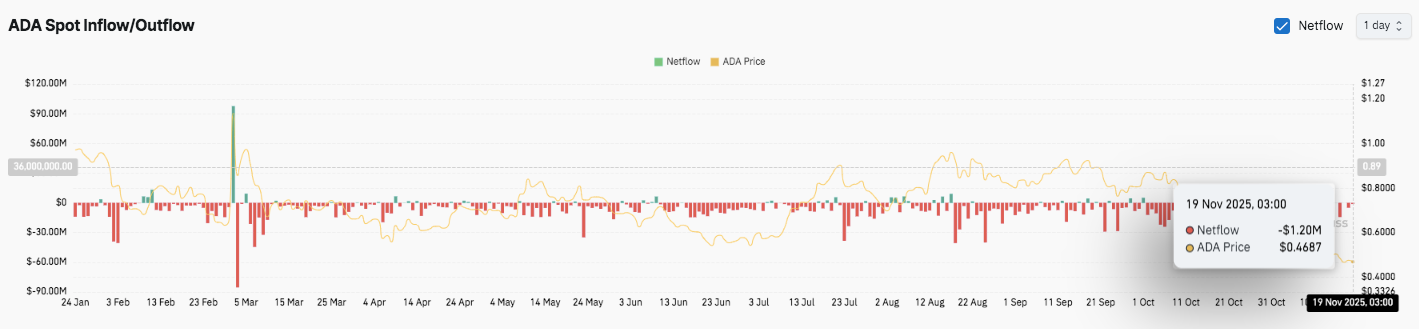

Outflows dominate as merchants scale back publicity

ADA influx and outflow information present a secure distribution. Outflows stay extra frequent and bigger than inflows. This pattern means that traders proceed to scale back threat even throughout volatility. By mid-November, ADA recorded new outflows of $1.2 million whereas the value hovered round $0.4687. Moreover, weak inflows spotlight the cooling urge for food for accumulation at present ranges.

Associated: Ethereum Value Prediction: ETH faces stress as outflows enhance and channel downtrend deepens

Technical outlook for Cardano value

Cardano’s key ranges stay clearly outlined because the market passes by way of the most recent downtrend. Though ADA continues to hover close to oversold territory, the general construction stays bearish so long as value stays beneath the short-term EMA resistance.

- High stage: The speedy hurdles are $0.4720, $0.4788, and $0.5038. If momentum strengthens, a breakout above these zones might prolong to $0.5127 and $0.5860.

- Cheaper price stage: $0.4537 stays near-term assist, adopted by $0.4220 as a key Fibonacci benchmark. A extra detailed breakdown reveals $0.2754 if the vendor retained management.

- Higher restrict of resistance: $0.5127 (Fib 0.382) stays a key stage for reversing medium-term bullish momentum.

The technical image exhibits ADA compressing between a descending shifting common resistance line and a tiered assist zone. The rejection of the center line of the Bollinger Bands signifies that purchaser makes an attempt are weakening, however the decrease band continues to draw assessments on every decline. This construction displays tight value motion the place a decisive break could cause elevated volatility in both path.

Will Cardano get well?

Cardano’s subsequent transfer will rely upon whether or not patrons can defend the $0.4537 assist through the upcoming trades. Holding this zone permits the value to problem the $0.4720-$0.5038 resistance band, which has restricted a number of restoration makes an attempt. A push by way of this cluster might give ADA room to retest $0.5127 and doubtlessly head towards $0.5860 if inflows strengthen and volatility picks up.

Nevertheless, a lack of $0.4537 would expose ADA to $0.4220, with patrons having beforehand constructed a robust base. Failure to carry $0.4220 might trigger the construction to break down, paving the way in which to the $0.27 space, which represents a full retracement goal from a broader swing.

Associated: PI Value Prediction: PI Value Stays Medium as Merchants Monitor Upcoming Unlocks

For now, the ADA stays a vitally vital space. Total sentiment stays weak as foreign money outflows dominate and derivatives positioning stays elevated. The circulate of technical confirmations and convictions will decide whether or not ADA stabilizes in the direction of a restoration or extends its downward trajectory.

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any variety. Coin Version isn’t answerable for any losses incurred on account of using the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.