- ADA maintains the $0.38 to $0.40 demand zone, however worth continues to be constrained under the falling EMA and the prevailing pattern line.

- Quick-term momentum is steady and the RSI and MACD are bettering, however follow-through stays restricted.

- Average spot inflows counsel early accumulation, however derivatives positioning reveals merchants stay cautious.

Cardano worth is buying and selling round $0.406 in the present day after rebounding barely from a key demand zone that has saved the worth down over the previous two weeks. The restoration got here after a pointy decline in November pushed ADA to its lowest ranges this 12 months, forcing sellers to sluggish momentum whereas consumers sought to stabilize costs close to long-term assist.

Greater timeframe construction nonetheless favors sellers

On the each day chart, Cardano stays locked under the sharp downtrend line that has managed worth actions since early 2024. All makes an attempt to maneuver larger since August have stalled under the draw back resistance, with sellers persevering with to regulate the general pattern.

Costs proceed to commerce under all main transferring averages. The 20-day EMA is close to $0.43 and the 50-day EMA is close to $0.49. The 100-day and 200-day EMAs are nonetheless far overhead at $0.58 and $0.65, confirming how upside room stays compressed absent structural adjustments.

The latest decline has pushed ADA straight into the excessive confluence demand band between $0.38 and $0.40. This zone coincides with earlier accumulations from mid-2023 and at present serves as a brief ground. Consumers have defended it up to now, however the rebound lacks follow-through.

Till ADA regains at the least the $0.43 to $0.45 space, the each day construction will stay corrective somewhat than constructive.

Quick-term momentum signifies early stabilization

Decrease timeframes counsel promoting stress is easing, however confidence stays low. On the 30-minute chart, ADA lately broke above the short-term downtrend line, marking its first technical enchancment since early November.

Associated: Shiba Inu Value Prediction: SHIB slides into channel each time Bounce sells

The RSI rose to the low $60s after spending a number of weeks in oversold territory, reflecting improved short-term momentum. The MACD additionally rose and the histogram bar turned optimistic. These alerts point out stabilization somewhat than a confirmed reversal.

Value motion stays tight round $0.40 to $0.41. This vary now serves as a short-term pivot. Above this, the restoration try will stay in place, however whether it is rejected, draw back dangers to the draw back demand band will rise once more.

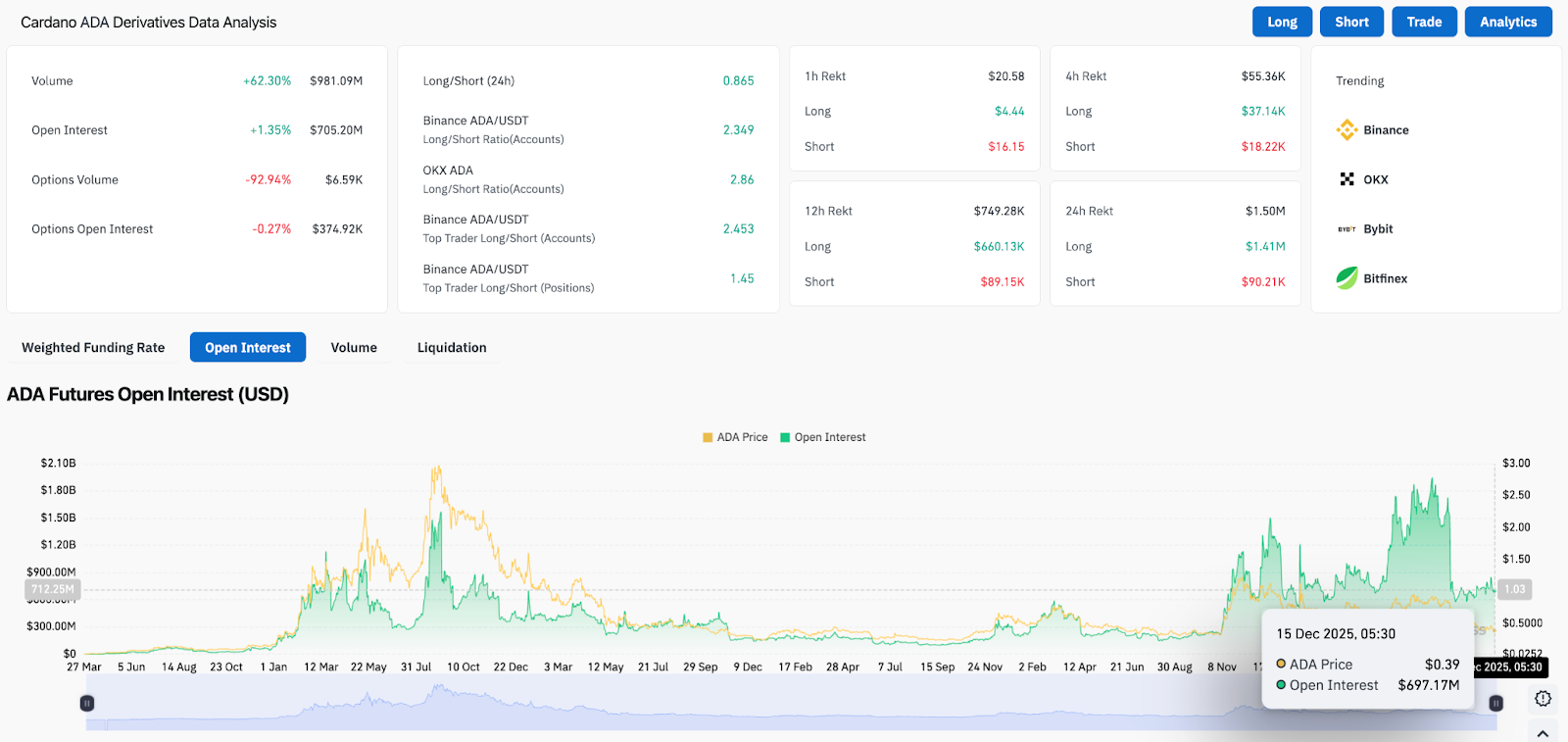

Derivatives stay cautious

Derivatives knowledge reveals merchants stay hesitant to chase the upside. Open curiosity elevated barely to roughly $705 million, however the enhance is modest in comparison with earlier cycles. This implies restricted new exploitation somewhat than lively restructuring.

The long-to-short ratio stays combined. Though account-based positions are lengthy skewed towards main exchanges, the position-based ratio is far more balanced. This distinction signifies a selective place somewhat than a widespread perception.

Liquidations have been comparatively subdued prior to now 24 hours. Lengthy liquidations barely outnumber shorts, however the whole continues to be small in comparison with the November flush. The shortage of compelled promoting helps the concept the decline has slowed, nevertheless it doesn’t assist new demand.

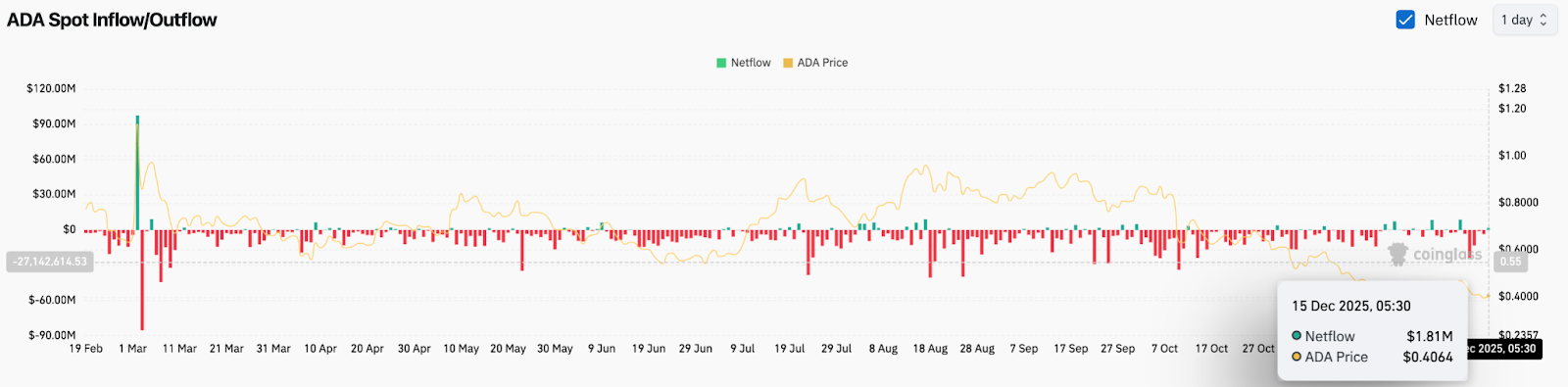

Spot flows counsel early accumulation

Spot movement knowledge provides an necessary layer of context. After weeks of outflows throughout the November selloff, internet inflows have been modest in latest buying and selling.

The newest studying, as of Dec. 15, was close to $1.8 million, suggesting some consumers are pulling again close to present ranges.

outlook. Will Cardano go up?

Cardano is aiming to stabilize after a protracted interval of decline, however the restoration stays fragile.

- Bullish case: A maintain above $0.40 and a return to $0.43 would open the door to a broader restoration in the direction of $0.49. A follow-through above this stage would mark a multi-month excessive on the each day chart.

- Bearish case: A lack of $0.38 would verify the continuation of the broader downtrend, with $0.33 rising as the following draw back goal.

Associated: Dogecoin Value Prediction: Downward Channel Strain Continues as Consumers Defend $0.137

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any variety. Coin Version will not be answerable for any losses incurred because of the usage of the content material, merchandise, or companies talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.