- Cardano is buying and selling round $0.495, clinging to the important thing assist at $0.49 after weeks of declines and weak development momentum.

- Whereas Coinglass information reveals inflows of $7.8 million, the broader outflow development continues as ADA stays below sturdy promoting stress.

- Resistance is between $0.50 and $0.56, however a lack of $0.47 might expose ADA to deeper draw back in direction of $0.44 and $0.40.

Cardano value is buying and selling round $0.495 immediately because the market appears to stabilize after weeks of decline. Sellers proceed to tug down constructions whereas ADA stays above one of the vital assist zones of 2025. Current ETF inclusion information has sparked curiosity, however costs haven’t but mirrored that catalyst as technical pressures stay dominant.

Inclusion in ETFs creates buzz however doesn’t change traits

Cardano has been formally added to 21Shares’ two new merchandise: FTSE Crypto 10 Index ETF TT0P and FTSE Crypto 10 ex-BTC Index ETF TXBC. This positions ADA alongside the business’s largest property and opens new prospects for institutional liquidity.

The index weighting fee is 0.71%. Whereas small in comparison with Bitcoin and Ethereum, it is a notable step for Cardano and alerts its rising recognition throughout a various basket of cryptocurrencies. Market members broadly anticipated the announcement to trigger volatility, however costs had been sluggish to react.

Spot flows are combined as sellers preserve stress

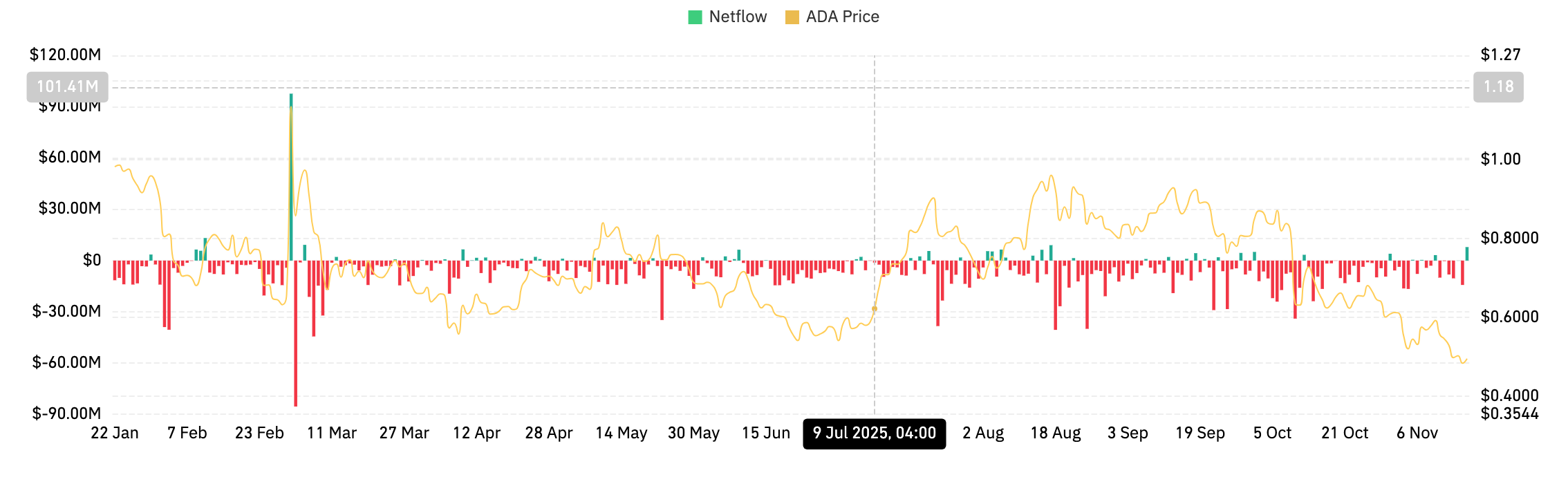

Coinglass information reveals a internet influx of $7.8 million in the newest transaction, which comes after continued losses all through the month. ADA noticed repeated spikes in outflows via October, confirming that merchants weren’t accumulating cash within the ETF regardless of experiences.

Associated: Ethereum Worth Prediction: ETH approaches key assist as derivatives exercise cools

The newest influx statistics alone aren’t sufficient to offset broader traits. Liquidity leaving the ecosystem additional accelerated the decline. Except capital inflows stabilize, sentiment will stay cautious whilst ETF assist makes headlines.

Spot flows stay one of many clearest indicators of market angle. ADA requires a number of classes of constructive prints earlier than the client regains a better stage of belief.

ADA falls beneath main EMA attributable to trendline rejection

The day by day chart reveals ADA trapped beneath the long-term downtrend line that has dictated each swing since its August peak. Sellers are defending the 20 EMA close to $0.56, and the value is at the moment buying and selling beneath the 20, 50, 100, and 200 EMAs, that are between $0.55 and $0.72.

This EMA formation strengthens the bears’ benefit. ADA tried a brief bounce to the decrease trendline, but it surely failed instantly. This rejection confirms that sellers stay lively in all approaches in direction of the $0.56 to $0.60 area.

The present $0.47 to $0.49 assist zone has been held a number of occasions this yr. If we analyze the breakdown clearly, the bottom value for July will probably be round $0.44, and after that, the deeper goal value will probably be round $0.40.

Associated: Bitcoin Worth Prediction: Massive Outflows Put BTC in Threat as Worth Nears $95,000

An RSI of 33 signifies an oversold state of affairs with no divergence of energy. The shortage of a bullish divergence signifies that momentum continues to be tilted to the draw back.

Intraday chart reveals early stabilization try

The 30-minute chart reveals small indicators of stabilization. ADA is buying and selling barely above VWAP, regaining its decrease volatility band for the primary time in two days. This means a pause in promoting stress somewhat than a strong change.

The directional motion index reveals that the unfold between +DI and -DI is narrowing. This compression displays a slowdown in bearish momentum, however the +DI has not convincingly exceeded the -DI. This retains the intraday outlook at a impartial to weak stage.

Quick-term resistance is close to $0.50. If ADA fails repeatedly earlier this week, the breakout goal might be $0.504 to $0.509. Except there’s a sturdy transfer above VWAP and this resistance band, intraday alerts will stay corrective.

Key ranges to concentrate on

resistance:

- $0.50: Preliminary intraday resistance and VWAP alignment

- $0.56: 20 EMA and development line interplay

- $0.63: 50 EMA Barrier

- $0.72: 200EMA main reversal zone

assist:

- $0.49: Immediate assist

- $0.47: Primary structural ground

- $0.44: July liquidity zone is decrease and deeper

- $0.40: Massive draw back goal if sellers achieve momentum

outlook. Will Cardano go up?

Cardano can solely get well if the value first regains $0.50 after which rises above $0.56 with sturdy inflows. A detailed above the 20 EMA could be the primary dependable sign that patrons are regaining management. To realize market confidence, ADA would wish to clear $0.63, which might readjust the development to the $0.72 space.

The bearish case stays lively whereas ADA is beneath the downtrend line. A detailed of the day beneath $0.47 opens the door to $0.44, and a failure right here would flip the decline right into a broader correction in direction of $0.40.

A transfer above $0.56 alerts an preliminary change in momentum. A lack of $0.47 confirms extra severe draw back threat.

Associated: Telecoin Worth Prediction: TEL Extends Quick-Time period Rise as Futures Buying and selling Surges

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any form. Coin Version will not be answerable for any losses incurred on account of the usage of the content material, merchandise, or companies talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.