- The ADA has consolidated practically $0.823 and holds help of $0.80 amid cautious dealer sentiment.

- A Break above $0.842 may goal $0.878 and $0.906, displaying bullish momentum going ahead.

- Institutional adoption and inclusion of ETFs can improve liquidity and result in short-term gatherings.

Cardano (ADA) continues to navigate the mixing interval with a transaction of practically $0.823. After a pullback from current highs, the ADA’s short-term outlook displays consideration amongst merchants ready to verify their subsequent main transfer.

Market knowledge reveals that cryptocurrencies have fallen into the tightening vary of $0.805 to $0.842.

Technical Construction and Key Ranges

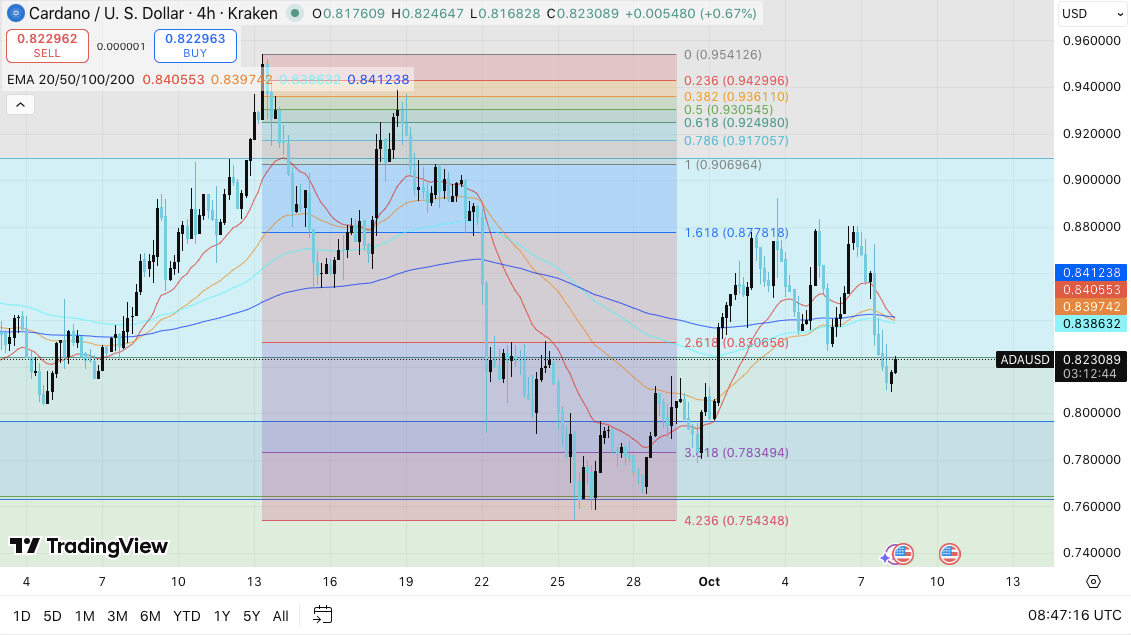

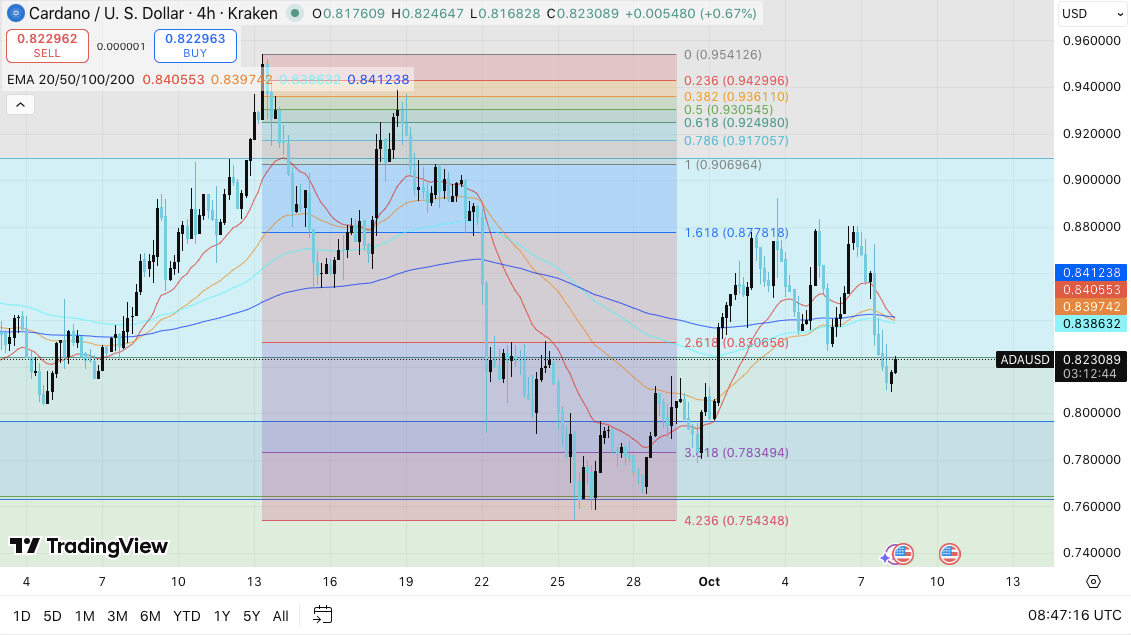

The four-hour chart reveals that ADA is beneath the 20, 50 and one hundredth interval exponential transferring averages (EMA) and refers to short-term bearish stress. Quick resistance is between $0.840 and $0.842, a zone that matches the EMA-100 and former rejection space. If the ADA violates this space, you’ll be able to proceed in the direction of the following Fibonacci targets $0.878 and $0.906.

On the draw back, the help zone between $0.805 and $0.810 remains to be essential, supported on the 2.618 Fibonacci degree. A sustained decline of lower than $0.783 may expose the ADA to a retest of practically $0.754 with a 4.236 growth. Nonetheless, consumers seem to defend the $0.80 vary, suggesting potential accumulation earlier than one other try rises.

Future and market sentiment

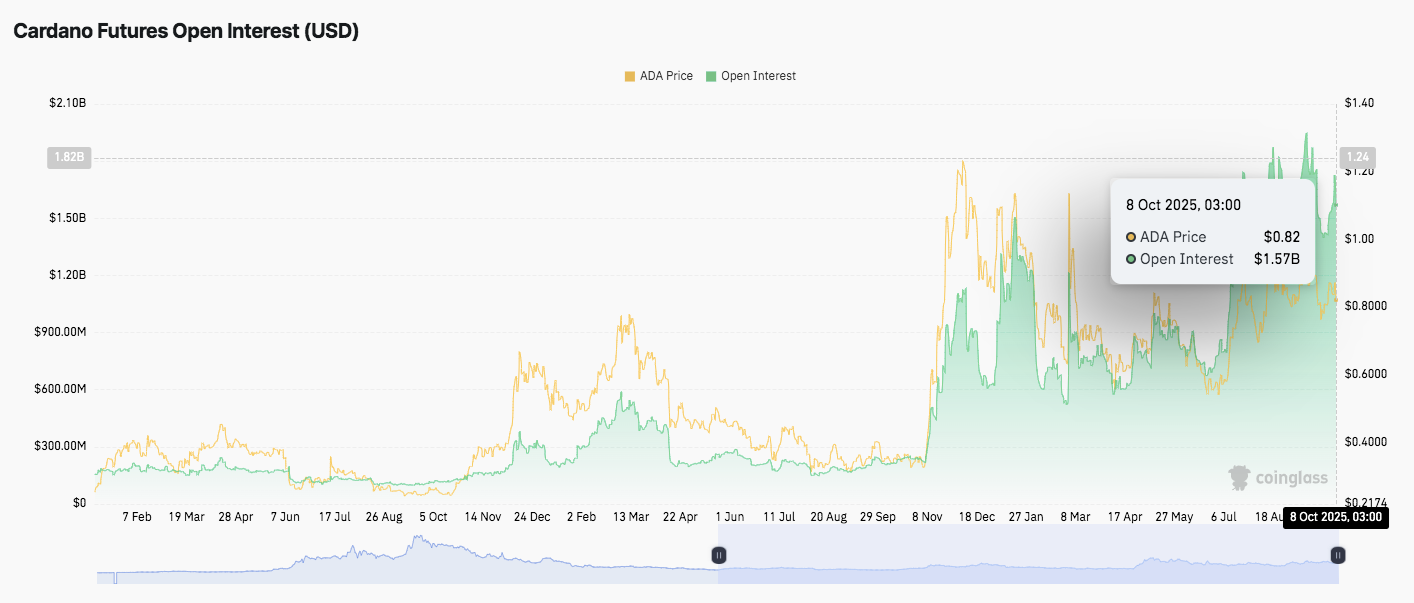

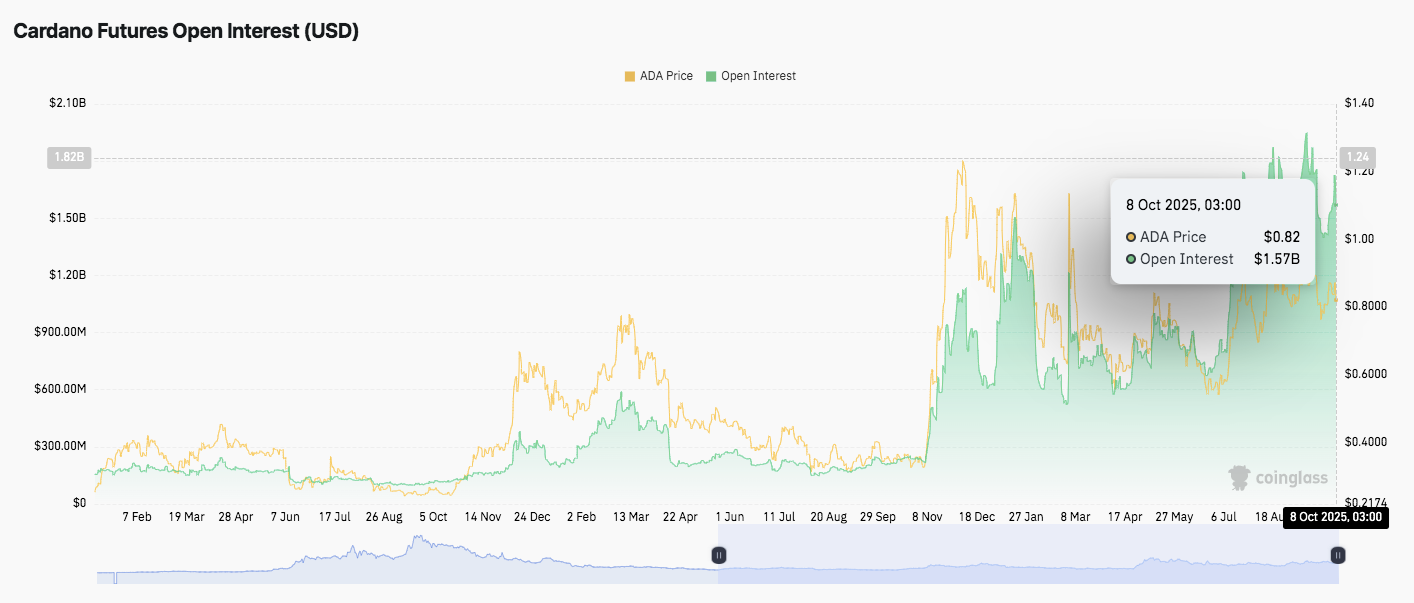

Futures market knowledge highlights rising hypothesis across the ADA. As of October eighth, open curiosity had skyrocketed to $1.57 billion, up considerably from $300 million in early 2024. Traditionally, ADA costs have intently correlated with open revenue ranges.

Associated: Ethereum Worth Forecast: Jackma’s ETH Reserve Report boosts market sentiment

The primary threshold was a $1.2 billion dependency with average help and $1.8 billion in resistance, leading to earlier liquidation. The sustained ranges above $1.5 billion may level to new bullish actions and elevated investor confidence.

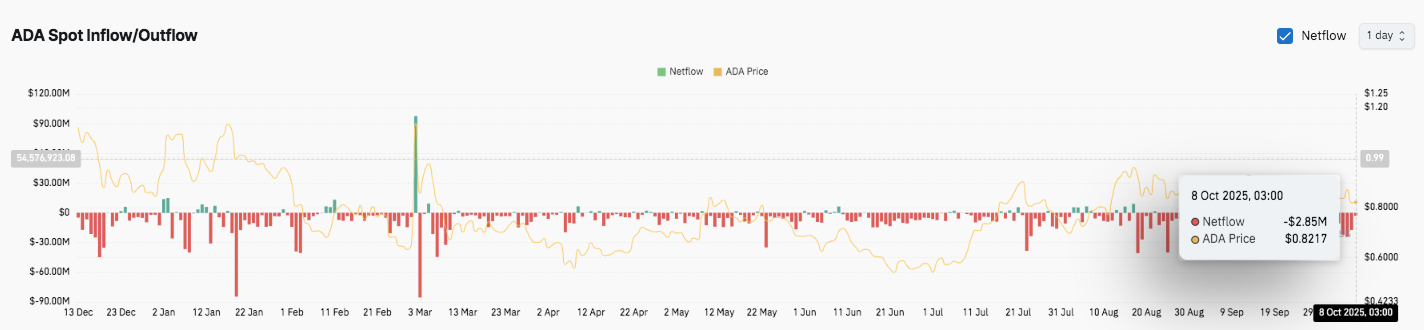

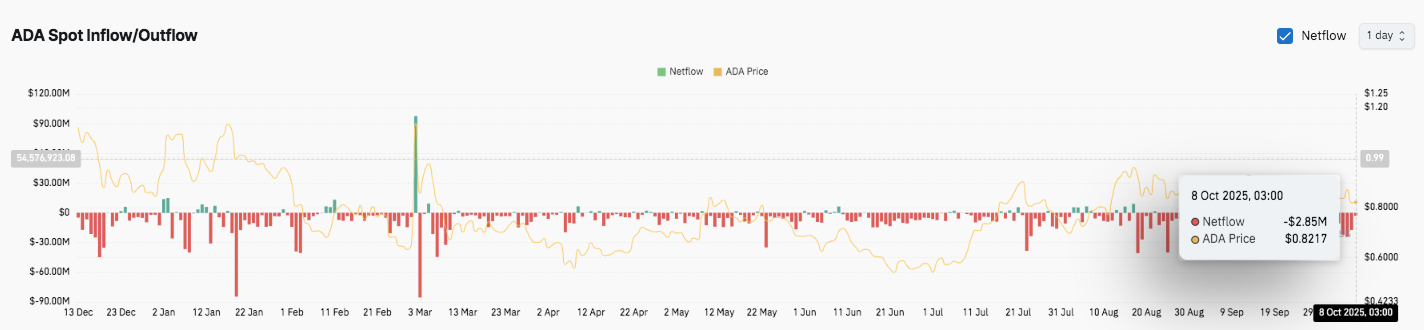

Spot inflows and outflows reinforce this blended feelings. All through 2025, the ADA has seen sustained spills, indicating it’s going to earn cash amongst short-term holders. October knowledge reveals a internet outflow of $2.85 million, reflecting cautious sentiment at practically $0.99 following the late August excessive.

Institutional progress and ecosystem growth

Regardless of technical integration, Cardano’s foundations proceed to be strengthened. The Hashdex’s resolution to incorporate ADA within the S&P Broad Crypto Index and so as to add ADA to the NASDAQ Crypto Index is rising the earnings of the establishment. These developments are anticipated to extend liquidity and visibility throughout conventional monetary markets.

The Cardano Basis’s 2025 roadmap additional highlights this momentum. The muse plans to allocate 220 million ADAs to new governance representatives and inject 2 million ADAs into the enterprise hub. Moreover, a $10 million real-world asset initiative and a 12% advertising and marketing price range has proven a dedication to long-term ecosystem growth.

Cardano (ADA) Worth Technical Outlook

Key ranges are effectively outlined as Kardano (ADA/USD) trades in a consolidated part of practically $0.823 heading into mid-October.

- Upside Degree: Quick resistance is between $0.840 and $0.842 and can work with 100-EMA and former rejection zones. A sustained breakout may pave the best way for $0.878 (1.618 FIB growth) and $0.906 (FIB 1.0 degree). If momentum is enhanced, the expanded targets are at $0.93 and $0.97, matching the earlier swing excessive.

- Drawback degree: Preliminary help is round $0.805-0.810, with demand zones starting from $0.78 to $0.80. Dropping this space may reveal a $0.754 space (FIB 4.236 degree) and act as a key disabling zone for bullish setups.

The technical scenario means that the ADA is compressed inside a slim vary, signaling accumulation of volatility earlier than the following directional motion. The relative power index (RSI) is impartial, indicating the stability between purchaser and vendor, whereas the amount sample reveals a typical gradual decline earlier than the breakout part.

Will Cardano rebound in October?

Cardano’s worth outlook for October will range primarily based on how consumers reply with a $0.80 help cluster. Holding this vary will set off short-term gatherings in the direction of $0.84 and $0.87, strengthening bullish confidence. Nonetheless, if you cannot keep it above $0.78, you’ll be able to see a way of leisure and drive the ADA in the direction of a deeper retracement zone.

Associated: Monero Worth Forecast: Bullseye $343 Market Curiosity Rebounds

Moreover, current inclusion of ADA within the S&P Broad Crypto Index Fund and Hashdex’s Nasdaq Crypto Index ETFs may improve liquidity and investor participation. If these institutional inflow coincides with improved on-chain exercise, the ADA may set a stage for restoration rally within the coming weeks.

Disclaimer: The knowledge contained on this article is for data and academic functions solely. This text doesn’t represent any form of monetary recommendation or recommendation. Coin Version will not be answerable for any losses that come up on account of your use of the content material, services or products talked about. We encourage readers to take warning earlier than taking any actions associated to the corporate.