- The Ada rebounds between $0.75-0.78, indicating robust resilience at technical help ranges.

- Futures opens a surge in curiosity in extra of $1.5 billion, reflecting a rise in dealer participation.

- The sustained web outflow signifies a decline in investor accumulation and gross sales strain.

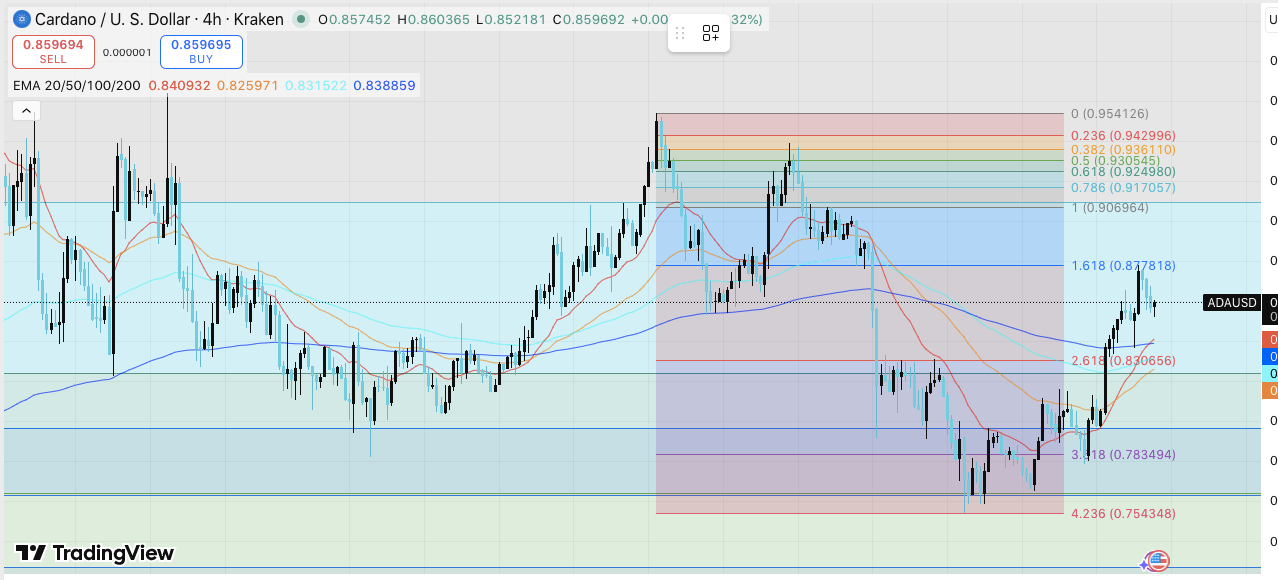

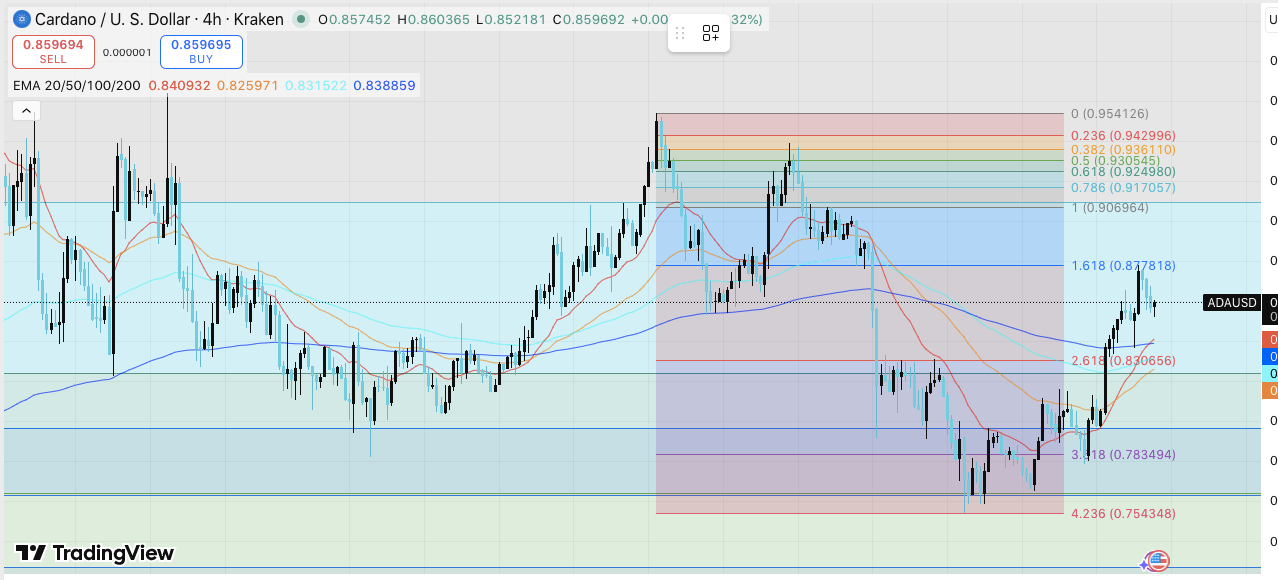

Cardano (ADA) entered the restoration part after a pointy pullback and traded round $0.86. Cryptocurrency has been resilient and has proven robust restoration from its help zone between $0.75 and $0.78.

Consumers not too long ago pushed the ADA for $0.878 in direction of a 1.618 Fibonacci enlargement. There, he confronted resistance and pulled again barely. This rebound displays a rising optimism amongst merchants and buyers who intently monitor key know-how ranges.

Vital ranges to see

On the draw back, the ADA will discover quick help, near $0.83. That is per the 20-EMA and a couple of.618 Fibonacci ranges. If this stage just isn’t maintained, the $0.78 zone comparable to the three.618 Fibonacci stage offers stronger help. A deeper pullback may check $0.75, with a 4.236 Fibonacci stage providing a possible flooring.

The reverse resistance stays clear. The $0.88 stage represents the primary hurdle already examined throughout latest bounces. The break above this level permits the door to open at $0.91, coinciding with a retracement of 0.786 Fibonacci, additional heading in direction of a swing peak of $0.95 from the earlier rally. EMAS within the 20-200 vary is converging, suggesting a possible bullish shift if ADA is maintained above $0.83.

Associated: Chain Hyperlink Worth Prediction: Hyperlink Eye $25 after robust restoration

The rising open curiosity displays market exercise

Cardano’s futures market exhibits elevated dealer participation. Open curiosity, which remained beneath $300 million firstly of the 12 months, exceeded $1.5 billion by October 3, 2025.

The rise coincided with ADA buying and selling at almost $0.87, indicating a rise in speculative exercise. In consequence, the fast development of open curiosity suggests stronger capital inflows into the derivatives market and elevated market engagement.

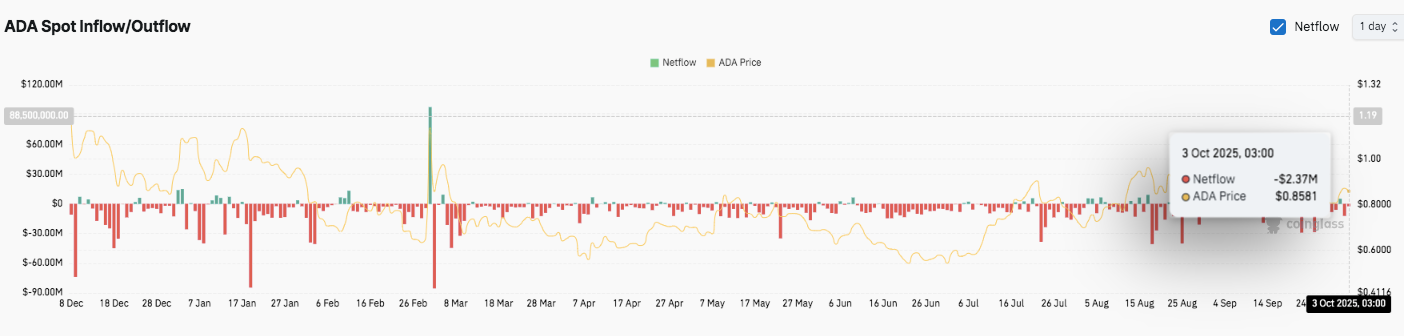

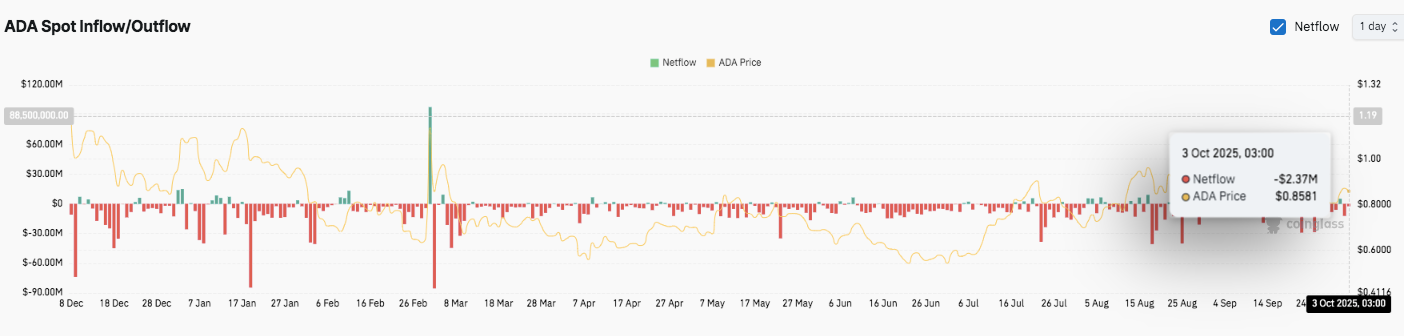

Change circulation sign accumulation

Spot inflows and outflows present additional perception. In latest months, sustained web outflows have been proven, indicating buyers are buying and selling ADAs. On October 3, the ADA recorded a web outflow of $2.37 million.

Such constant outflows typically point out accumulation and decrease gross sales strain. Moreover, they mirror the belief of buyers, as there are fewer cash obtainable to commerce instantly.

Cardano’s Technical Outlook (ADA/USD)

Key ranges are properly outlined as Cardano integrates key help for October.

Upside Stage: $0.88 (1.618 FIB enlargement) is the primary hurdle, adopted by $0.91 (0.786 retracement) and $0.95 (latest swing excessive). A sustained breakout above these ranges may prolong the rally to $1.02.

Drawback stage: $0.83 (2.618 FIB) matches 20-EMA because the closest help. Underneath that, $0.78 (3.618 FIB) serves as a stronger base, and $0.75 (4.236 FIB) serves as a deeper help if gross sales strain is elevated.

Ceiling of resistance: $0.95 stays a important stage for flipping the medium-term bullish momentum, marking the latest swing refusal.

Technical photographs counsel that the ADA is compressed throughout the restoration channel, signaling the EMA for a possible directional breakout. Momentum stays delicate to the $0.83 help that consumers proceed to guard their rebound construction.

Associated: XRP Worth Forecast: XRP Eyes $3.2 Breakout Revenue Surge as Spinoff

Will Cardano go up?

The forecast for the ADA worth for October is determined by whether or not the Bulls can keep it above $0.88. If the breakout is profitable, if the amount helps motion, you may open a path from $0.91 to $0.95, extending it to $1.02. Nevertheless, if you cannot maintain $0.83, the possibilities of retesting shall be $0.78 and $0.75.

For now, Cardano is sitting within the very far north. The rise in futures suggests accumulation opens curiosity and constant alternate outflows, however conspiracy should be confirmed by a important breakout. The October story exhibits an growing volatility, with the following leg of the ADA counting on the power of the customer on the important inflection stage.

Disclaimer: The knowledge contained on this article is for info and academic functions solely. This text doesn’t represent any sort of monetary recommendation or recommendation. Coin Version just isn’t responsible for any losses that come up because of your use of the content material, services or products talked about. We encourage readers to take warning earlier than taking any actions associated to the corporate.