- ADA continues to make new highs, with a downtrend line rejecting any restoration makes an attempt since September.

- The $0.39-$0.40 help zone is weakening because the pullback fails to draw robust follow-through shopping for.

- Momentum and spot flows stay bearish, with draw back dangers remaining elevated except the pair recovers to $0.42-$0.43.

Cardano value is buying and selling round $0.392 at this time, stabilizing barely after reversing from the downtrend line that has capped its features since September. A brief-term pullback offers momentary aid, however the broader construction stays fragile as sellers proceed to dominate development management and spot flows are unable to show to help.

On the day by day chart, the downward construction stays intact.

On the day by day timeframe, Cardano stays locked in a sequence of clear lows. The downtrend line drawn from the September peak continues to defy all makes an attempt at restoration. The newest rejection occurred round $0.43, adopted by a fast return to the $0.39 space.

Worth remains to be under the supertrend monitoring round $0.34, and the parabolic SAR dot continues to print above value. Each indicators verify that the final development has not reversed. There was no sustained above-trend resistance at closing costs since October.

The broader motion since November resembles a downward development fairly than an accumulation. ADA briefly broke out of the wedge close to late December, however that breakthrough failed inside days. This failure turned the motion right into a continuation sample fairly than a reversal.

Sellers retain management of the upper timeframe construction except ADA trades under the downtrend line and regains the earlier breakdown degree.

Quick-term charts present ADA consolidating between $0.39 and $0.40, a zone that has been examined a number of instances over the previous week. Every dip into this space attracted reactive shopping for, however every rebound lower off the highs.

That motion is vital. Consumers are defending their help, however they aren’t pushing costs greater. This sample usually happens earlier than failure if strain persists.

Associated: Dogecoin Worth Prediction: DOGE Holds Floor Even As Market Enters Key Correction Section

If the day by day closing value is a clear closing value under $0.39, the present normal shall be invalidated and the following draw back room will seem round $0.36 to $0.35, an space in step with advance demand from late November. Beneath that, the construction opens in the direction of $0.32, the place patrons final intervened with confidence.

On the upside, near-term resistance lies between $0.41 and $0.42, adopted by a downtrend line close to $0.43. Upward makes an attempt stay corrective till the value closes above these ranges.

Momentum confirms weak purchaser dedication

On the 30-minute chart, the RSI stays subdued round 37-39, failing to regain the impartial 50 degree. This means sustained downward strain fairly than robust consolidation.

The MACD remains to be under the zero line and the histogram bars haven’t definitively flipped to optimistic. Every small bullish crossover disappeared inside hours, additional reinforcing the dearth of follow-through from patrons.

Momentum has not diverged in any significant manner. Monitoring costs are down. This settlement helps the view that markets are diversifying fairly than constructing bases.

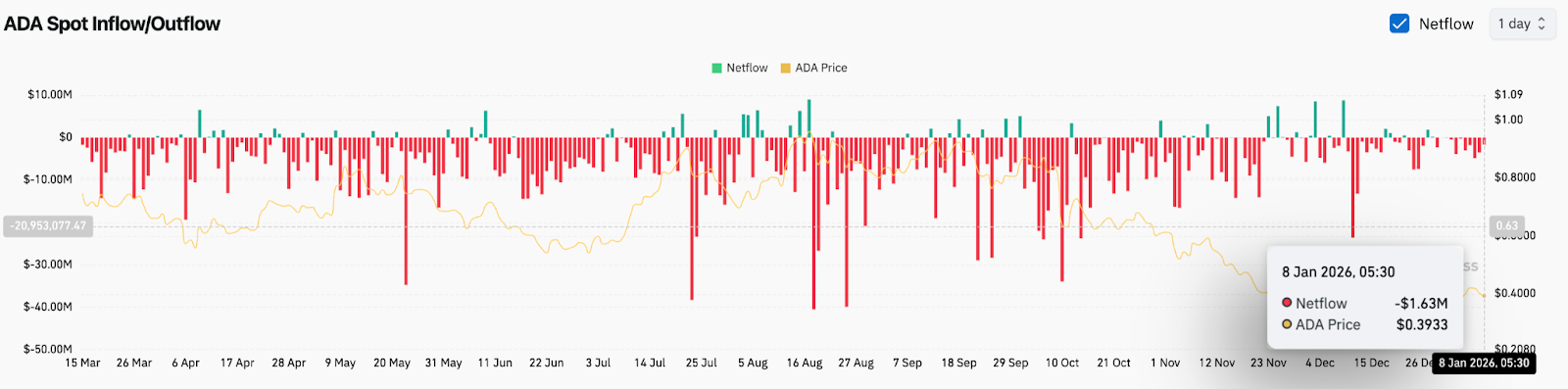

Spot flows proceed to favor sellers

Spot move knowledge additional strengthens the bearish image. On January 8, ADA recorded web spot outflows of roughly $1.6 million. Though not excessive, the consistency of destructive flows over latest periods is extra vital than measurement.

The continued web outflows throughout consolidation recommend that members are decreasing their bounce publicity fairly than accumulating it. This habits explains why the value was unable to regain resistance regardless of repeated exams.

Fundamentals can’t be transformed into value help

Earlier this month, Cardano founder Charles Hoskinson emphasised ecosystem improvement over value hypothesis, saying 2026 could possibly be the strongest 12 months within the community’s historical past. Though this remark strengthened long-term conviction, it had no measurable impression on value actions.

The market response was clear. ADA ignored this narrative and continued to fall. For brief-term merchants, optimism about improvement has not but translated into demand.

outlook. Will Cardano go up?

Cardano is at a crucial degree.

- Bullish Case: ADA holds $0.39, regains $0.42 and closes above the downtrend line close to $0.43 on growing quantity. If that occurs, the construction will change and a transfer in the direction of $0.46 to $0.48 will start.

- Bearish case: A day by day shut under $0.39 confirms a consolidation breakdown, with $0.36 attainable and additional draw back in the direction of $0.32 if the sell-off accelerates.

The development is down till the resistance is restored. Help has held up for now, however it’s waning. Shedding the $0.39 hand management will decisively return you to the vendor.

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any sort. Coin Version just isn’t liable for any losses incurred because of the usage of the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.