- ADA stays under main EMA, short-term construction stays bearish regardless of non permanent rebound

- Futures open curiosity and spot outflows recommend weak conviction and cautious positioning

- Midnight’s Starstream provides privacy-focused zkEVM instruments and gives long-term help

Cardano (ADA) continues to commerce below strain attributable to technical weaknesses on shorter time frames, opposite to rising alerts from the event ecosystem. On the 4-hour chart, ADA stays in a short-term downtrend, reflecting cautious sentiment throughout the broader crypto market. Worth motion reveals that sellers are controlling the rebound whereas consumers are struggling to regain key technical ranges.

ADA’s technical construction suggests continued weaknesses

ADA is buying and selling round $0.36 after repeated failures to regain momentum after its excessive in mid-December. The 4-hour construction persistently reveals increased lows and decrease lows, confirming a short-term bearish development. Moreover, ADA stays under all main exponential transferring averages, reinforcing draw back strain.

The 50 EMA close to $0.374 and the 100 EMA close to $0.389 presently cap any restoration makes an attempt. Moreover, the 200 EMA close to $0.421 continues to outline a broader bearish construction. So long as ADA stays under the 50 EMA, sellers preserve management.

Fibonacci retracement ranges add additional resistance overhead. The 0.382 stage close to $0.399, the 0.5 stage close to $0.415, and the 0.618 stage close to $0.432 are consistent with the key EMAs. Due to this fact, if you happen to try to rise, you can be confronted with a stacked resistance zone.

On the draw back, fast help lies between $0.355 and $0.360. A deeper help zone is positioned close to $0.346, marking current lows. In consequence, a clear break under $0.346 might expose illiquid territory.

Futures and spot flows mirror cautious positioning

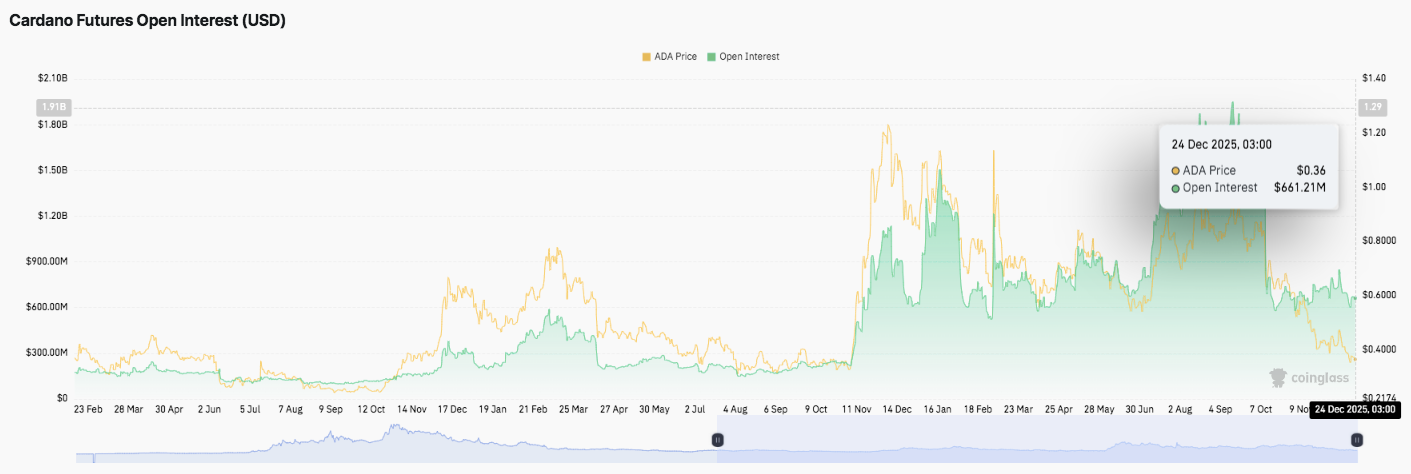

Derivatives information helps the bearish technical outlook. Cardano futures open curiosity reveals a transparent cycle of growth and contraction as the worth modifications. Open curiosity surged in late 2024 as ADA recovered, reflecting aggressive leverage entries. Nonetheless, that accumulation was reversed throughout a subsequent pullback.

Associated: PIPPIN Worth Prediction: Pippin outlook strengthens as whale place tilts…

At the moment, open curiosity is close to $660 million and ADA is buying and selling round $0.36. This mix means that leverage is constrained and speculative conviction is diminished. Moreover, merchants look like ready for a transparent set off earlier than rebuilding giant futures exposures.

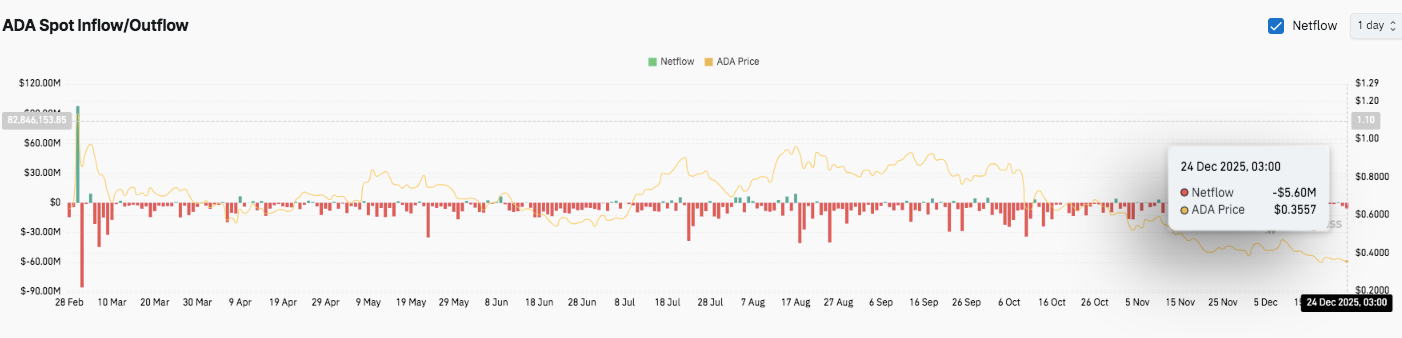

Spot move information can be bearish. Internet outflows dominated most classes, indicating continued sell-side strain. A short lived spike in inflows failed to achieve traction, indicating restricted shopping for curiosity. Importantly, current web outflows of practically $56 million coincide with continued worth declines.

Cardano builders spotlight Midnight and EVM compatibility

Nonetheless, community improvement gives a contrasting story. Cardano developer Guillemot just lately highlighted Starstream, a platform developed by the Midnight Basis. The system helps multi-chain deployment whereas enabling the execution of personal sensible contracts.

Starstream introduces the zkEVM framework, designed for privacy-sensitive purposes. Builders can deploy contracts throughout the chain and customise habits for every community. Moreover, the platform makes use of coroutines to simplify execution and scale back computational load.

Cardano Technical Outlook ($ADA)

Cardano worth motion stays technically constrained as ADA trades inside a well-defined bearish construction on the 4H chart. Costs stay under main transferring averages and volatility is subdued as merchants monitor key inflection factors.

- Prime stage: Speedy resistance lies between $0.373 and $0.380, with the higher certain of the EMA cluster rebounding. A clear breakout of this zone might begin a transfer in direction of $0.399 to $0.405. If the bullish momentum strengthens, an extension in direction of $0.421-$0.432 is feasible together with the 200 EMA and the 0.618 Fibonacci stage.

- Cheaper price stage: On the draw back, $0.355-$0.360 stays the primary space that consumers ought to defend. A lack of this zone will seemingly put strain on the worth in direction of the current lows of $0.346-$0.348. A decisive break there dangers exposing a deeper zone of liquidity under the present vary.

- Higher restrict of resistance: The $0.421-$0.432 space would be the key stage to reverse the bullish shift within the medium time period. Gatherings will stay modified till the ADA reclaims this space.

Technically, ADA seems to be compressed in a draw back vary characterised by falling highs and regular demand close to help. This construction usually happens when worth resolves directionally, earlier than volatility widens.

Will Cardano go up?

ADA’s near-term prospects depend upon consumers holding $0.355 and having the ability to get better $0.38 on follow-through. Sustained energy above $0.40 would point out stabilization and bettering momentum. Nonetheless, draw back threat stays if help will not be protected. For now, Cardano is buying and selling in a crucial zone, with technical confirmations and a move of convictions set to outline the subsequent transfer.

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any type. Coin Version will not be liable for any losses incurred because of using the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.