- ADA’s battle beneath key Fibonacci ranges highlights a persistent resistance zone out there.

- Open curiosity development of over $600 million displays continued hypothesis and confidence amongst merchants.

- Continued outflows from ADA exchanges counsel sturdy long-term accumulation and staking intent.

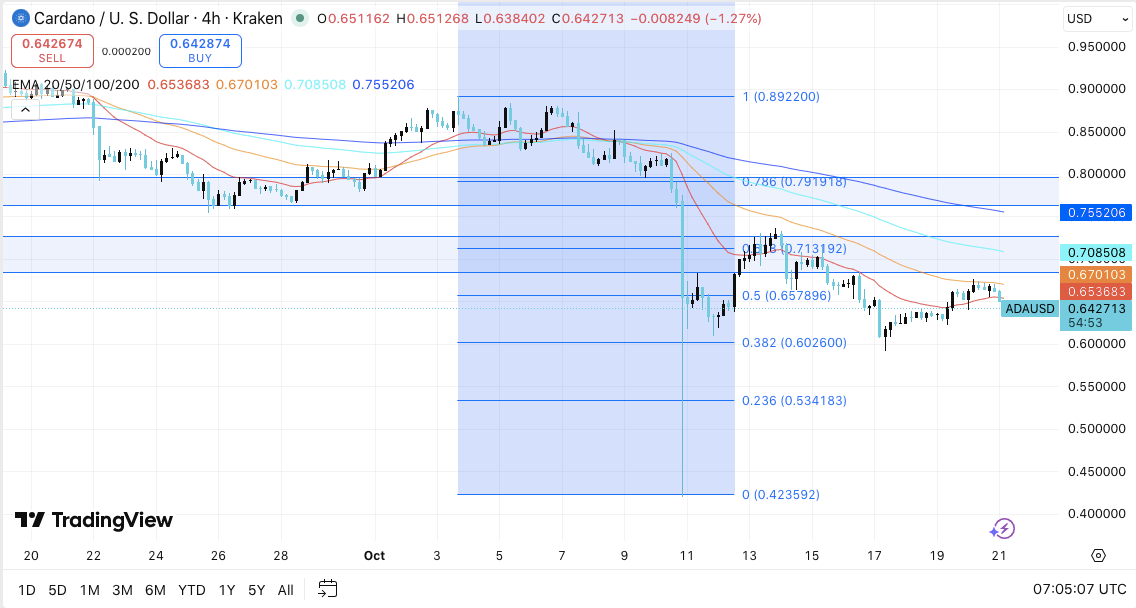

Cardano (ADA) stays below promoting stress after failing to interrupt above the 0.5 Fibonacci retracement stage close to $0.6579. The worth just lately fell to $0.6427, marking a modest decline of 1.27% from the earlier session. This transfer displays a decline in momentum after ADA had earlier rebounded from the $0.60 space. Because of this, merchants stay cautious as ADA struggles to construct sufficient power for a sustained breakout.

Main ranges counsel sustained resistance

The construction of ADA is technically nonetheless restricted between the foremost Fibonacci ranges. The 0.5 retracement stage at $0.6579 has emerged as a powerful rejection zone, whereas the following resistance lies on the 0.618 stage close to $0.7131.

If the bulls regain this zone, the 0.786 stage close to $0.7911 might be the following upside goal. Nonetheless, beneath the present vary, $0.6026 serves as instant help, adopted by deeper retracement ranges at $0.5341 and $0.4236.

Moreover, shifting averages strengthen this blended construction. The 20-day and 50-day EMAs are hovering round $0.65 and $0.67, indicating indecision within the brief time period.

Associated: Chainlink Worth Prediction: Are Fed Valuations and Oracle Energy Sufficient to Cease the Drop?

In the meantime, the 100-day EMA and 200-day EMA above $0.70 affirm that ADA is inside a medium-term downtrend. To realize a significant reversal, merchants are eyeing a detailed above $0.71, which coincides with each the 0.618 Fibonacci stage and the 100-EMA zone.

Open curiosity indicators energetic hypothesis

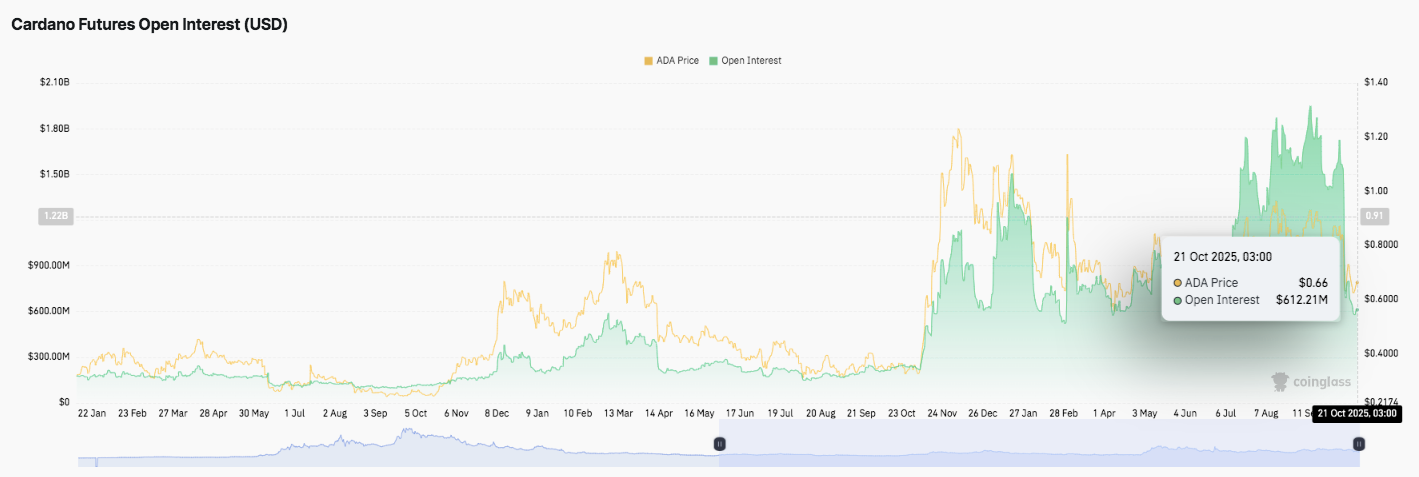

Though worth actions have calmed down, futures open curiosity has proven a outstanding restoration since mid-2024. ADA’s open curiosity has skyrocketed from lower than $300 million at first of the 12 months to greater than $600 million as of October 21, 2025. This enhance signifies elevated dealer participation and liquidity.

Moreover, spikes in open curiosity have traditionally coincided with rising costs, indicating leveraged lengthy positions entered throughout bullish intervals. Due to this fact, continued exercise above $600 million displays continued speculative confidence, though spot costs stay range-bound.

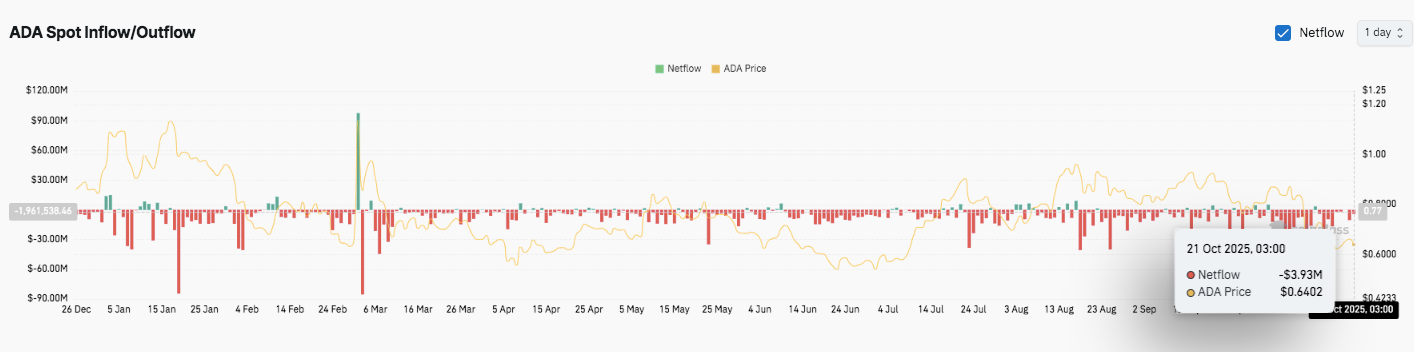

Forex outflows point out long-term accumulation

Trade circulate information reveals a distinct image. ADA has recorded constant outflows all through 2025, indicating short-term promoting stress and a decline in potential accumulation habits. On October twenty first, the ADA worth fell to $0.64, leading to a internet outflow of $3.93 million. This transfer means that holders are transferring their tokens from the change, presumably for long-term storage or staking.

Technical outlook for Cardano worth

Whereas ADA trades inside a tightening vary, key ranges stay nicely outlined.

- High stage: The instant hurdles are $0.6579 (0.5 filib) and $0.7131 (0.618 filib). A break above these may open targets in the direction of $0.7911 (0.786 Fib) and $0.84.

- Cheaper price stage: The primary main help is $0.6026 (0.382 Filib), adopted by $0.5341 and $0.4236. A drop beneath $0.60 may expose a deeper correction stage earlier than consumers reappear.

- Higher restrict of resistance: The 100-day EMA close to $0.7085 is roughly according to the 0.618 Fibonacci stage, forming an vital axis for medium-term bullish momentum.

Technical construction reveals ADA compressing inside a corrective vary, shifting averages are flattening, and momentum indicators are exhibiting indecision. A definitive breakout above $0.71 may set off a brand new impulse wave focusing on the $0.79 to $0.84 zone. Then again, if the worth fails to get well above $0.65 to $0.67, there’s a chance that there can be one other sell-off in the direction of $0.60.

Can Cardano regain its bullish power?

Cardano’s near-term route will depend upon whether or not consumers can defend the $0.60 area whereas absorbing profit-taking stress. Sustained open curiosity of over $600 million signifies excessive speculative participation and suggests merchants expect a directional transfer within the close to time period.

Associated: Bittensor Worth Prediction: TAO targets $500 as bullish momentum grows

A breakout of $0.71 and concurrent quantity enlargement may sign the start of a medium-term restoration for ADA. Nonetheless, constant foreign money outflows point out that traders want long-term holding methods over aggressive buying and selling. Due to this fact, ADA stays in a pivotal zone the place confidence and momentum will decide whether or not October ends with a bullish reversal or continues to maneuver inside a variety.

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any type. Coin Version just isn’t accountable for any losses incurred on account of using the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.