- ADA is buying and selling inside a slim vary of $0.62 to $0.69, indicating cautious market sentiment.

- Futures open curiosity decreased to $736 million, reflecting decreased demand for leveraged bets.

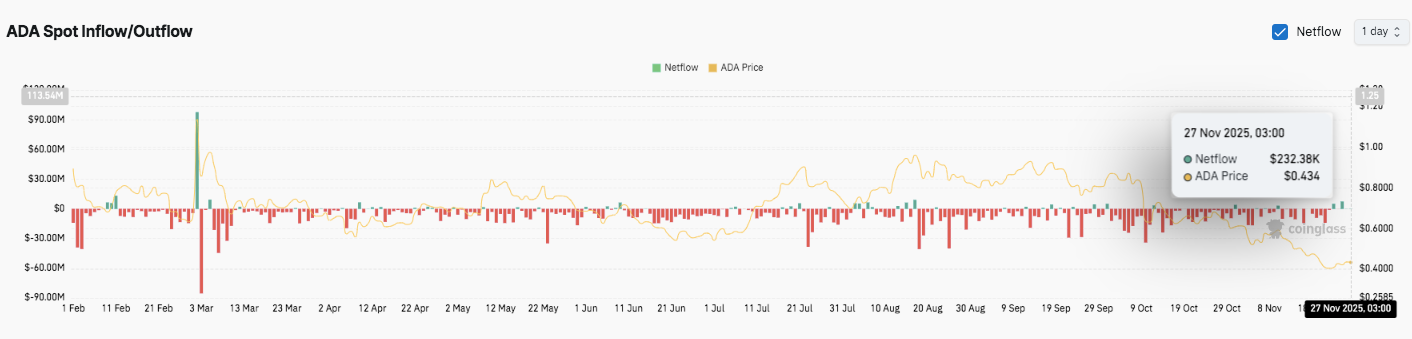

- Spot flows are exhibiting constant outflows, confirming a defensive buying and selling atmosphere for ADA.

Cardano continued to commerce in a slim vary this week because the market confirmed indicators of slowing down after months of regular decline. The token has plummeted from the $0.77 area in early October to succeed in the $0.42 zone, a stage per an ideal Fibonacci retracement.

ADA then started to alter course and created an built-in construction that now dictates its near-term prospects. This stabilization part comes as futures buying and selling exercise declines and spot flows stay unfavourable, indicating a cautious buying and selling atmosphere. The market stays delicate to every fluctuation as merchants are reluctant to construct aggressive positions.

Value stays above key helps as momentum weakens

ADA spent a number of weeks inside a slim vary between $0.62 and $0.69. This zone sees a gentle provide because it fades out close to the higher restrict every time it makes an attempt to maneuver greater.

The token repeatedly interacts with the EMA-9 and the midrange of the volatility band. These exchanges exhibit hesitancy amongst merchants as neither facet has gained management. Subsequently, an in depth above $0.6930 stays necessary as it could mark the primary significant change in momentum.

Associated: Ethereum worth prediction: ETH tries to recuperate as market prepares for Fusaka improve

Help stays nicely outlined at $0.62, with deeper assist close to $0.52 and $0.4219. These ranges attracted consumers throughout earlier declines. Nonetheless, a lack of the $0.62 zone may expose the decrease assist once more. Moreover, a transfer in the direction of $0.77 is unlikely till consumers reclaim the $0.65-$0.69 space on sustained quantity.

Futures markets present much less hypothesis

ADA futures open curiosity continues to say no from its earlier peak of over $1.9 billion. Merchants steadily decreased their publicity all year long, with open curiosity reaching $736 million by November 27. This decline suggests much less urge for food for leveraged positions as worth traits weaken.

Consequently, the market seems to have grow to be extra defensive than at the start of the 12 months. Compression in open curiosity additionally signifies restricted enthusiasm for high-risk bets, which regularly precedes conditions the place costs are range-bound.

Spot movement strengthens defensive bias

Spot influx and outflow information exhibits constant web outflows throughout most periods. Outflows intensified as ADA approached the $0.40 space, indicating that traders decreased their holdings during times of volatility. On November twenty seventh, there was a brief influx spike of $232,380.

Associated: Merlin Chain Value Prediction: MERL strengthens on inflows and rising rates of interest

However the broader pattern remained unchanged. Furthermore, accumulation stays restricted as consumers solely react throughout short-term stabilization phases.

Technical outlook for Cardano (ADA) worth

Key ranges stay well-defined as Cardano trades inside a broad consolidation vary following a pointy decline since early October.

The upside stage contains speedy hurdles at USD 0.6550, USD 0.6700, and USD 0.6930. A break above these zones may pave the best way to $0.7200 and the upper timeframe barrier $0.7700.

Draw back ranges lie at structural assist at $0.6200, adopted by the 0.786 Fibonacci retracement at $0.5200, with October lows at $0.4219 remaining the final line of protection.

Technical situations recommend that ADA is compressed inside a horizontal construction carved between $0.62 and $0.69, the place repeated rejections point out continued provide overhead.

This compression part follows a whole retracement to the 1.0 Fibonacci stage, which locks within the present assist base. A decisive every day shut above $0.6930 may set off elevated volatility and shift momentum again to consumers.

Will Cardano recuperate?

Cardano’s near-term course will rely upon whether or not consumers can defend $0.6200 lengthy sufficient to problem the resistance cluster between $0.6550 and $0.6930. Technical compression and cooling futures buying and selling recommend decrease volatility, however a confirmed breakout may revive bullish territory and permit ADA to retest $0.7200 and even $0.7700.

If $0.6200 can’t be defended, ADA dangers being uncovered to a deeper retracement at $0.5200 and doubtlessly reaching the assist ground at $0.4219. For now, ADA is in a pivotal zone the place sentiment stays cautious. A sustained improve in spot inflows, stronger open curiosity, and a clear break above resistance will decide whether or not Cardano is ready to get away of the consolidation and resume the broader uptrend.

Associated: XRP Value Prediction: Consumers keep upside base as ETF demand recovers

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any form. Coin Version is just not liable for any losses incurred because of using the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.