- Cardano worth is buying and selling round $0.64 right this moment after falling 20% this week, with consumers defending the $0.60 to $0.62 zone.

- Futures open curiosity fell 12% as merchants decreased leverage, whereas forex outflows eased following heavy promoting.

- Analysts consider that if ADA regains the resistance ranges of $0.68 and $0.72, it might rebound in direction of $0.77.

Cardano worth is regular round $0.64 right this moment, making an attempt to stabilize after falling greater than 20% this week. This transfer follows a big liquidation that pushed ADA under the uptrend line and the 20/50/100/200 EMA concentrated between $0.77 and $0.82. Consumers are presently guarding the $0.60-$0.62 space, which is the final structural help forward of the $0.50 degree seen in April.

Cardano worth finds help after break

ADA Technical Worth Evaluation (Supply: TradingView)

The every day chart reveals ADA breaking properly under the uptrend line that related the July and September lows. This breakdown triggered a wave of promoting stress as worth slipped by all main EMAs, reversing the short-term development bearishly.

Momentum stays weak. The RSI is hovering round 30, indicating close to oversold situations, however doesn’t but point out a particular reversal. If the $0.60 zone holds, there’s a chance of a rebound in direction of $0.68 and $0.72. Nevertheless, if the rejection continues round $0.70, ADA will probably retest the $0.55-$0.50 vary.

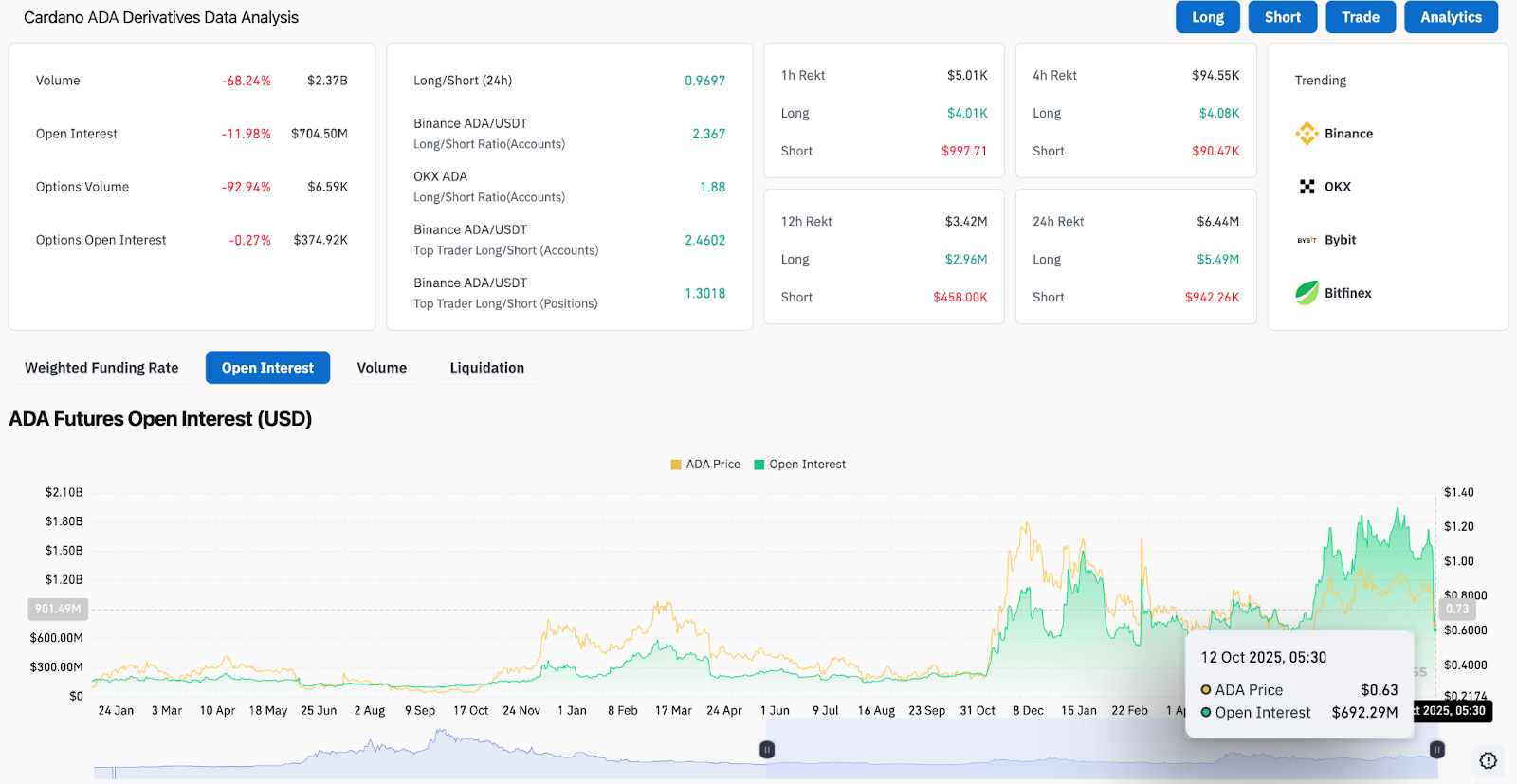

Futures information reveals derivatives merchants have gotten cautious

ADA Derivatives Evaluation (Supply: Coinglass)

Cardano’s open curiosity fell by about 12% to about $704 million as merchants exited leveraged positions, in response to information from Coinglass. Buying and selling quantity fell 68% to $2.37 billion, with choice buying and selling quantity down greater than 90%.

Binance’s lengthy/brief ratio is close to 2.36, suggesting that high merchants stay web lengthy regardless of the decline in exercise. Funding charges stay impartial, with liquidation information displaying $94,000 erased from primarily brief positions up to now 4 hours. This means that the sharp decline could have flushed out weak shorts whereas robust fingers began to re-accumulate.

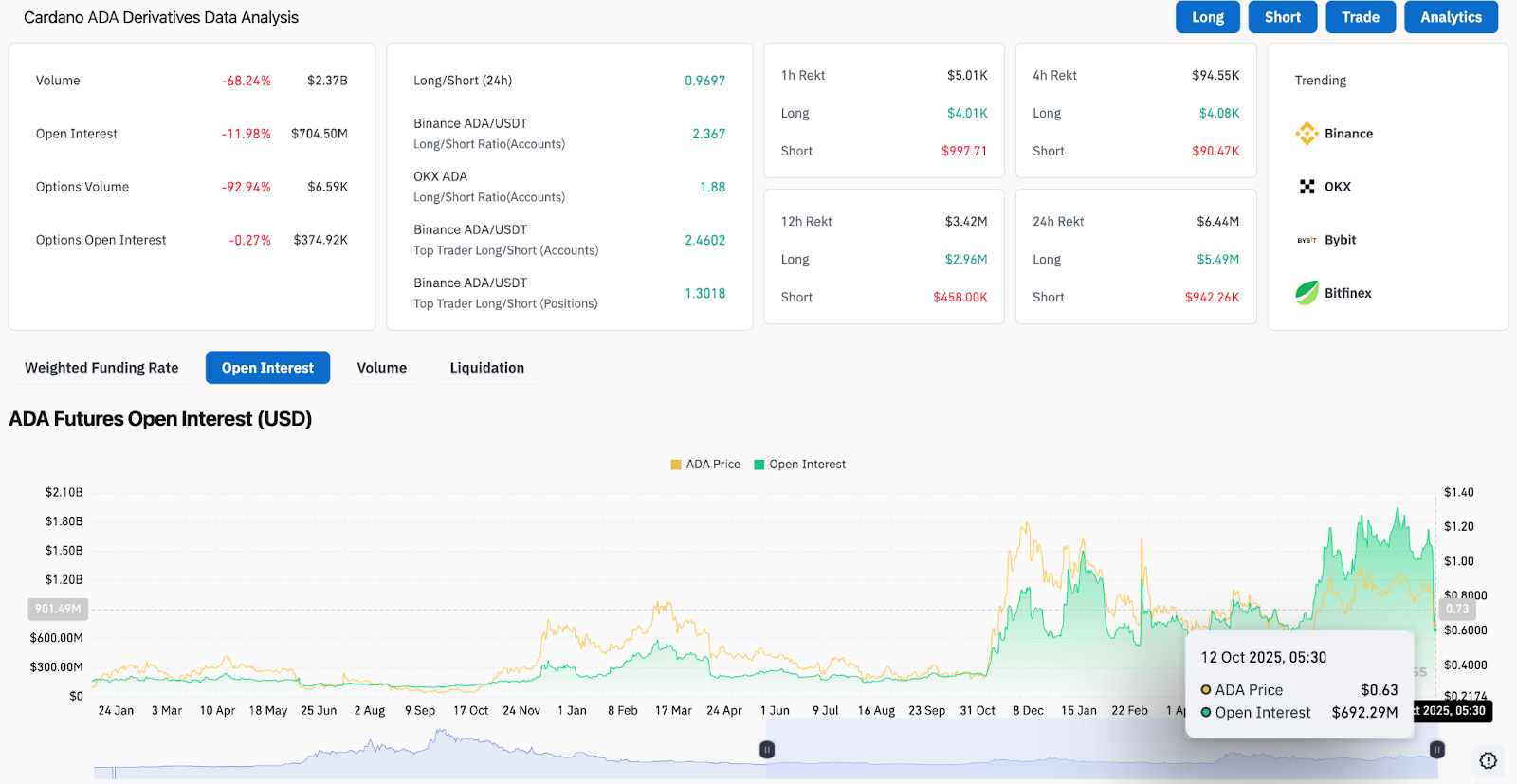

On-chain flows present emotional stability

ADA Netflows (Supply: Coinglass)

Spot circulate information revealed $48 million in web outflows over the previous two days, adopted by a noticeable slowdown right this moment, with reported outflows remaining minimal. Traditionally, brief intervals of stability in ADA have been preceded by important declines adopted by decreased outflows.

The trade’s web circulate on October 12 was simply $276,000, in contrast with tens of hundreds of thousands earlier within the week, suggesting that sellers could also be exhausted. Though this doesn’t but verify the buildup, easing stress gives a foundation for the value to rise above the $0.60 degree within the brief time period.

Factors of technical setup to find out the potential of aid

The following resistance degree for ADA is situated close to $0.68, which is in line with the 20-day EMA and the earlier help development line. Above that, the $0.72 and $0.77 ranges signify steady resistance.

On the draw back, $0.60 stays the defensive degree in the meanwhile. Dropping this threshold might expose the $0.53-$0.50 demand block the place historic accumulation occurred in April. The broader development stays beneath stress till the value regains the 50-day EMA close to $0.79, which has capped upside since early September.

outlook. Will Cardano go up?

Cardano’s near-term path depends upon whether or not consumers can defend $0.60 lengthy sufficient to set off a momentum reversal. On-chain flows counsel that panic promoting is subsiding, and oversold readings on the RSI might appeal to bullish shopping for.

A detailed above $0.68 would point out a short-term restoration in direction of $0.72-$0.77. Conversely, a every day shut under $0.60 invalidates this pullback situation, paving the best way to $0.50.

At its present degree, Cardano remains to be at a technological inflection level. With outflows slowing and leverage reset, the market could also be gearing up for a bailout rebound, however solely a sustained transfer above $0.70 will verify that sellers have lastly exited.

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any sort. Coin Version is just not chargeable for any losses incurred because of using the content material, merchandise, or providers talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.