- Cardano is buying and selling round $0.44 after rebounding from $0.38, however stays constrained by the downtrend line since August.

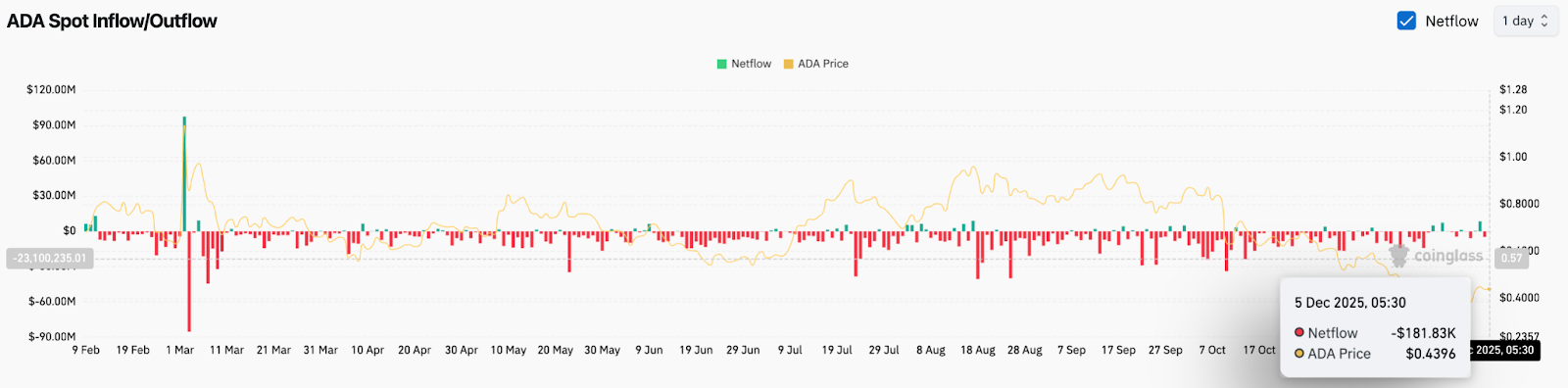

- Spot movement stays unfavorable with an outflow of $181,000, indicating weak accumulation and excessive danger of rejection at resistance.

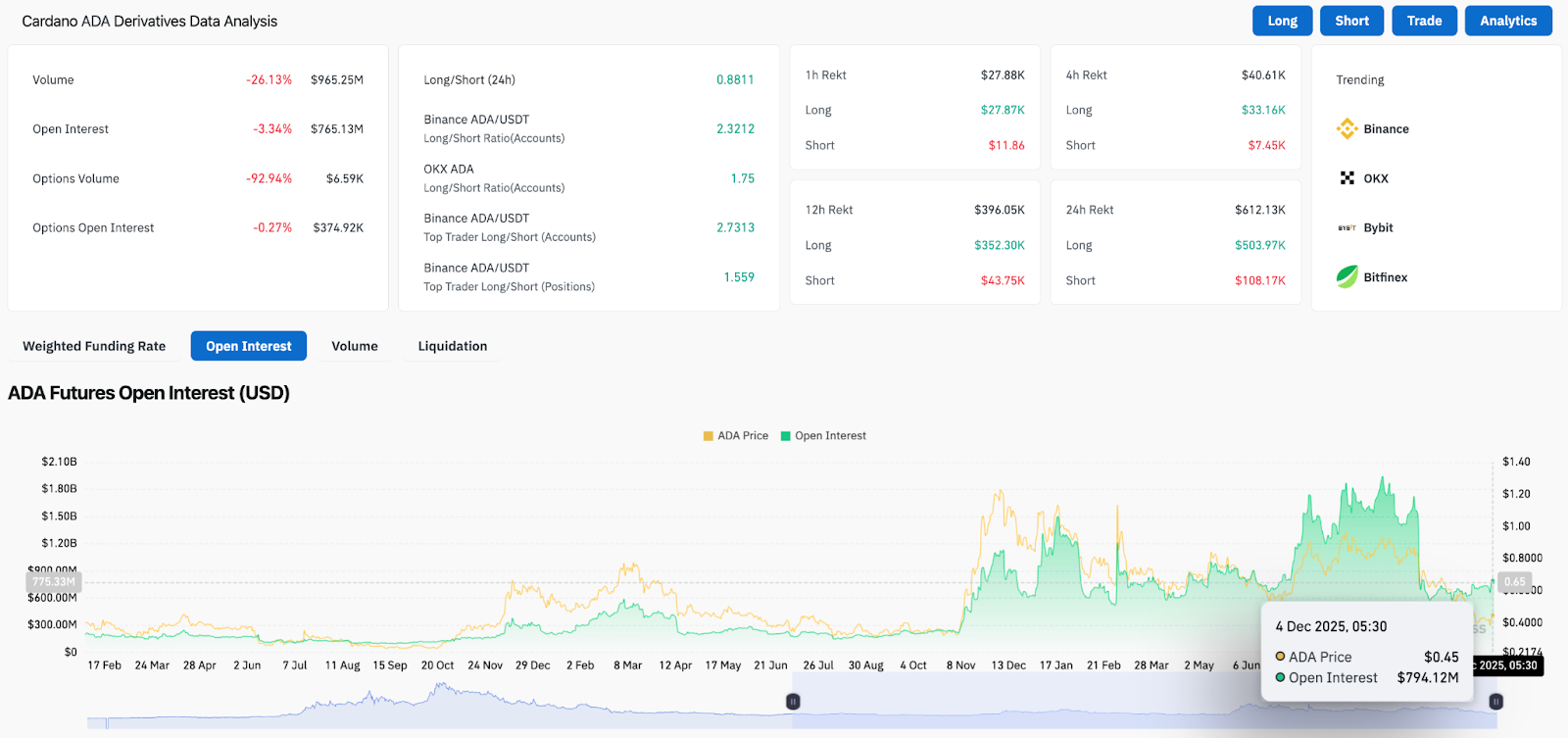

- Open curiosity is down greater than 3% and quantity is down, indicating decrease conviction and restricted breakout potential.

Cardano worth is buying and selling round $0.44 right now after a short rebound from multi-month lows failed to interrupt out of the downtrend line that has capped positive aspects since August. Whereas this rebound has eased strain from sellers, the broader construction stays unchanged and costs are actually approaching the resistance line the place sellers have repeatedly intervened.

Consumers scuffling with extreme downtrend

On the 4-hour chart, ADA is buying and selling beneath the 20, 50, 100, and 200 EMAs. These averages are trending down and sit between $0.44 and $0.48, forming a wall of resistance above the present worth. The lengthy development line drawn from the August peak sits instantly above this zone, making it a significant reversal degree quite than a delicate breakout goal.

The latest rebound from $0.38 regained short-term momentum however occurred inside a downtrend channel that is still intact. Till ADA breaks via the higher restrict with acceptable quantity, the rally is prone to weaken with sellers nonetheless controlling the value motion.

Supertrend help is positioned close to $0.41. A break beneath that degree would erase the present stabilization try and return consideration to the decrease finish of the vary.

Every day chart highlights rebound to resistance

The day by day chart reveals a broad draw back construction that can dominate most of 2025. The value rebounded from the lows round $0.38, with a number of bids occurring at this degree. It’s now approaching the cap once more, however earlier makes an attempt have failed and rejection stays potential except a purchaser reveals clear power.

The Bollinger Bands present that worth has recovered from the decrease band and is pushing in direction of the center band round $0.48. That space coincides with the development line and varieties a dense cluster of resistance. Traditionally, ADA has struggled to maneuver via this zone with out the assistance of quantity and movement.

The RSI has rebounded from 33 to round 43, however stays beneath ranges usually related to a sustained rally. ADA usually requires a momentum of greater than 50 to show a rebound right into a sustained motion.

Spot runoff displays weak accumulation

Web outflows on Dec. 5 had been $181,000, in accordance with Coinglass information, persevering with a largely unfavorable outflow development for a number of weeks. This transfer means that the rally has not led to significant accumulation and that individuals should not poised for a significant reversal.

The earlier bull market, which lacked capital inflows, has quickly declined, and with costs now coming into resistance, there’s a rising danger that the market will stall once more within the absence of constructive flows.

Open curiosity decreases as merchants scale back danger

Open curiosity fell 3.34% to $765 million, whereas buying and selling quantity fell 26% to $965 million, in accordance with derivatives information. Choices buying and selling collapsed, with possibility buying and selling quantity down 92 p.c. This alteration displays a scarcity of perception quite than constructive positioning.

Prime merchants preserve a protracted bias, however the decline in open curiosity means their positions are shrinking quite than rising. The present atmosphere doesn’t present sturdy directional bets or confidence in a breakout.

outlook. Will Cardano go up?

Cardano wants to interrupt above $0.48 on sturdy quantity to reverse construction and goal increased territory round $0.52 and $0.57. This degree contains the development line, Bollinger’s midband, and a cluster of shifting averages, and is the zone that determines whether or not the rebound turns into an precise development shift.

If the value fails to interrupt out above $0.48, the transfer will proceed to right. Whether it is rejected and continues to shut beneath $0.41, $0.38 shall be uncovered once more, and in case you lose $0.38, you’ll be focusing on $0.35. If the value fails to succeed in resistance, sustained capital outflows and falling open curiosity favor this situation.

The following transfer will depend upon how ADA reacts to the $0.46 to $0.48 zone. Breakouts point out intent. If rejected, verify that the downtrend stays underneath management.

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any type. Coin Version will not be chargeable for any losses incurred because of using the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.