- ADA broke above the short-term pattern line with outflows of $6.48 million and an 11% decline in open curiosity, indicating elevated strain on consumers.

- The rejection at $0.48 flipped the EMA cluster into resistance and ADA is presently buying and selling under the 20 and 50 EMAs on the 4-hour chart.

- Momentum weakens below VWAP, leaving $0.41-$0.40 uncovered except consumers take again $0.44-0.45 and reset the short-term construction.

Cardano worth is buying and selling round $0.426 as we speak after falling under the short-term trendline that has supported its restoration since early December. The transfer comes amid renewed spot outflows and a greater than 11% decline in futures open curiosity, suggesting strain on consumers as ADA struggles to keep up above the 20 and 50 EMAs on the 4-hour chart.

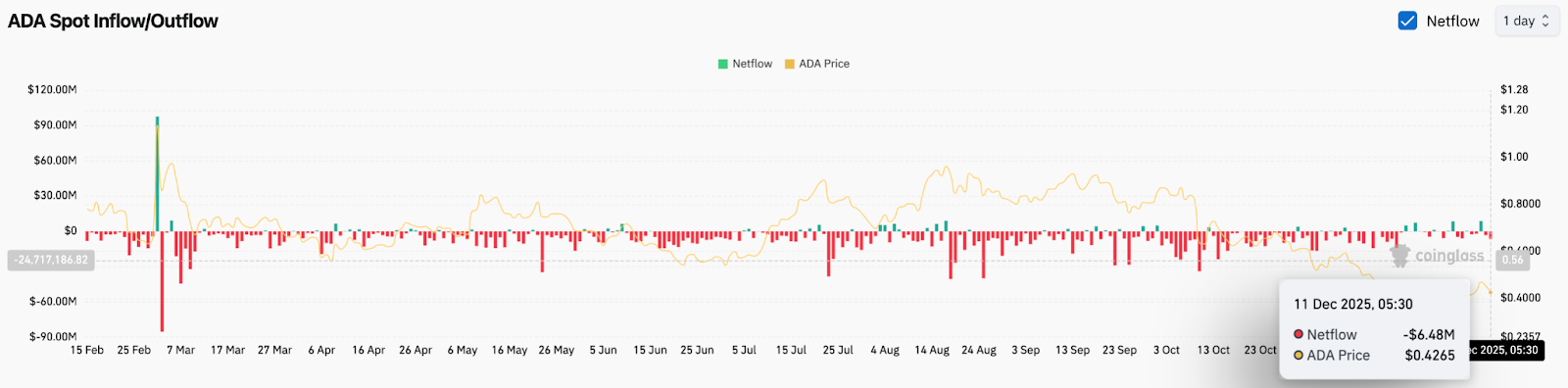

Spot outflows enhance as consumers exit

ADA recorded internet outflows of practically $6.48 million on December 11, in keeping with Coinglass knowledge. This pattern has been constant all through the previous week, with reds repeatedly dominating the board. This means that liquidity is flowing out of the market quite than accumulating.

When outflows are concentrated round main resistance failures, worth usually loses follow-through on breakout makes an attempt. You’ll be able to see that dynamic right here. ADA was pushed into the $0.48 zone, sparking a pointy intraday rally, however fell nearly instantly as soon as provide returned on the exchanges. Sentiment stays cautious because of the incapability to translate upward momentum into sustained demand.

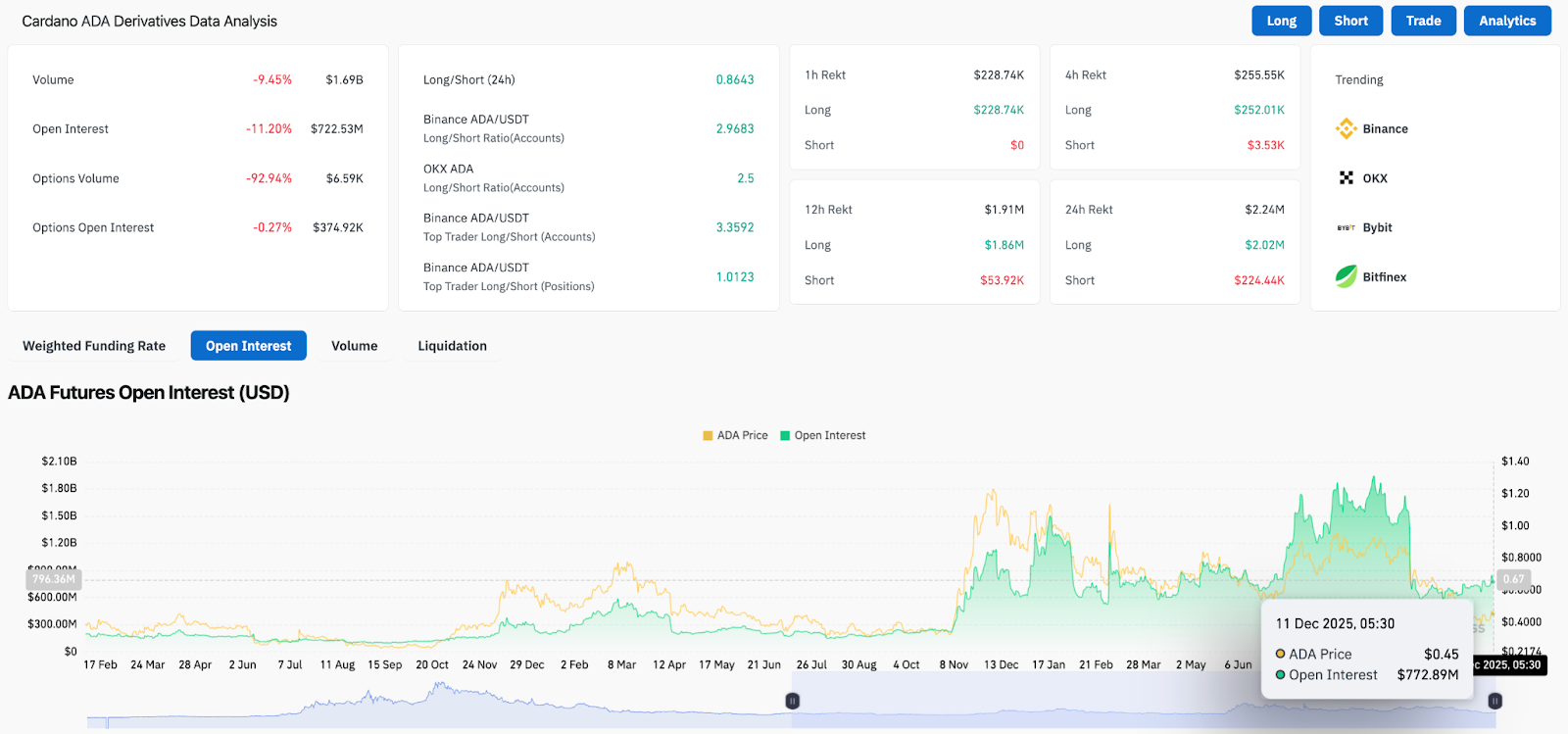

So long as easing continues, open curiosity will lower

Derivatives knowledge additional strengthens the bearish bias. Open curiosity decreased by 11.20% to $722.53 million, marking one of many steepest unwinding classes this month. After a failed breakout, liquidity is being taken away from leveraged positions as merchants scale back their publicity.

Choices quantity and choices open curiosity stay subdued, indicating an absence of directional urge for food. Throughout main exchanges, the long-short ratio of high merchants has elevated, however the widespread decline in OI means that longs have already began lowering threat quite than rising their positions at decrease costs.

Associated: Solana Worth Prediction: SOL maintains corrective construction as dealer…

This alteration sometimes signifies two situations. First, longs are shedding confidence because the market fails to maintain breakout ranges. Second, sellers are prone to proceed to place strain on intraday good points, particularly whereas ADA trades under the short-term EMA cluster.

Rejection at $0.48 turns pattern line into resistance

The 4-hour chart exhibits a transparent rejection at horizontal resistance close to $0.48, a degree that coincides with the higher Bollinger band and the decrease aspect of the multi-week downtrend line. The failed breakout produced a pointy core, adopted by a gentle return by way of the 20EMA and 50EMA. The worth is presently under each ranges and the short-term construction has moved right into a bearish coil.

The upward help line from the December third low was breached in the course of the day, destroying the clear uptrend construction that consumers have been counting on. ADA is presently buying and selling inside the mid-band of Bollinger settings, indicating neutrality with a downward slope.

The 100 EMA and 200 EMA are excessive at $0.44 and $0.47, forming a resistance block that can be troublesome to clear with out a spike in quantity. Sellers defended this zone cleanly in the course of the current push, reinforcing its significance going ahead.

The overhead of the dotted downtrend line nonetheless overshadows the broader construction. ADA has not damaged above this degree since mid-October and stays in a long-term downtrend regardless of current benchmark makes an attempt.

When ADA falls under VWAP, intraday momentum weakens.

On the 30-minute chart, ADA continues to be buying and selling under VWAP and close to the decrease certain of the Keltner channel. The RSI is close to 20, indicating oversold situations, however now we have not seen a transparent reversal but. Consumers tried a small bounce round $0.43, however nobody reclaimed the $0.4400 VWAP or preliminary provide zone.

Intraday sentiment stays weak whereas ADA trades under these ranges. An in depth above VWAP is required to stabilize momentum. With out that, costs are prone to proceed testing $0.41 to $0.40.

outlook. Will Cardano go up?

ADA must regain $0.44 to $0.45 to regain pattern management. This zone contains the 20 and 50 EMAs on the 4-hour chart and is the primary affirmation that momentum is shifting again in the direction of the consumers. A break above $0.48 will pave the way in which for $0.50 and a bigger pattern reversal try.

If the EMA cluster fails to get better, the construction will stay bearish. The $0.41 loss places the following help at $0.39, and if the outflow continues, we will anticipate a deeper draw back in the direction of $0.37.

If quantity improves and ADA closes above $0.45, consumers will regain short-term energy. A decline under $0.41 would sign a deeper correction into the early December vary.

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any form. Coin Version will not be answerable for any losses incurred on account of the usage of the content material, merchandise, or companies talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.