- Cardano is buying and selling round $0.398 after dropping the multi-month $0.52 assist zone that had anchored the construction.

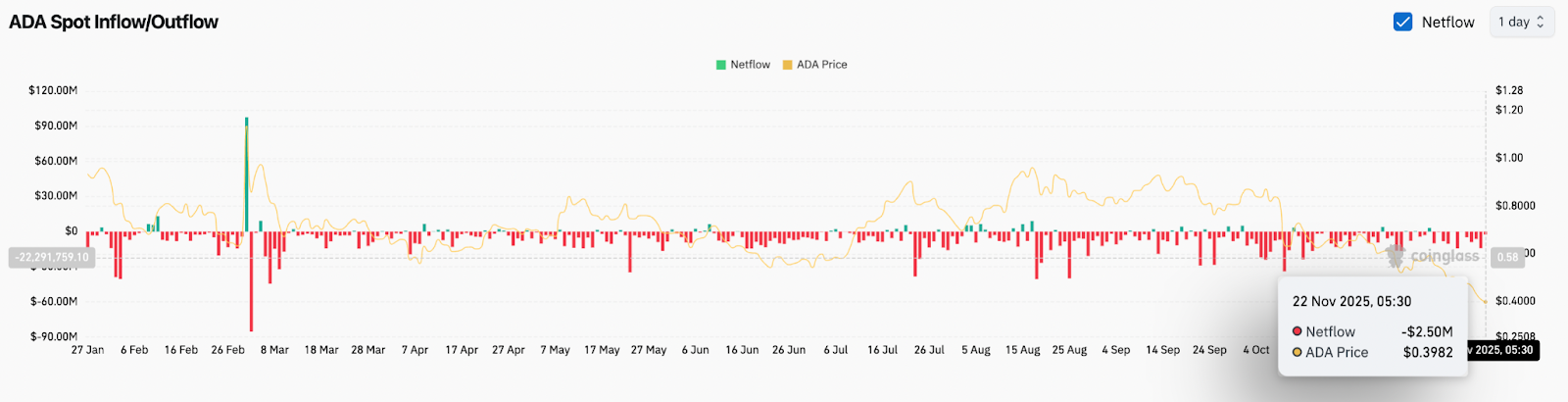

- Spot outflows proceed, with $2.5 million leaving the alternate as sellers have the higher hand as ADA assessments its long-term pattern line.

- Hoskinson stated the “assault failed” resulting from community disruptions, however the chart reveals continued momentum favoring a deeper draw back in the direction of $0.38-$0.32.

Cardano worth right now is buying and selling round $0.398 after falling beneath a multi-month assist zone. This decline locations ADA going through a key take a look at alongside its long-term uptrend line as sellers proceed to place stress available on the market following a surge in detrimental spot flows and broad-based danger weak spot.

Purchaser loses essential weekly assist

On the weekly chart, ADA has decisively misplaced its horizontal assist round $0.52, which has served as a draw back many instances over the previous yr. The present candle has expanded past that vary and tapped an uptrend line ranging from the 2023 low.

This trendline is at the moment appearing because the final structural protection for ADA. A clear shut beneath this could affirm a whole breakout of the multi-year wedge and open the door to the decrease demand zone round $0.32. The extension of the draw back is obvious, however consumers haven’t but proven a robust response.

The weekly RSI is hovering round 33, drifting in the direction of oversold territory. The MACD continues to pattern downward, with the hole between the sign strains widening, indicating that momentum remains to be aligned with sellers.

Downtrend strengthens on decrease time frames

The 4-hour chart reveals that ADA is buying and selling beneath the descending channel. Value remains to be beneath the 20, 50, 100, and 200 EMA clusters, confirming a persistent bearish construction.

All bounces are confined across the $0.43 to $0.46 zone. The channel’s decrease trendline and EMA cluster reinforce this higher certain. Till ADA closes above these ranges, merchants will proceed to deal with every restoration as a pullback slightly than a pattern formation.

The parabolic SAR dot remains to be above worth, indicating continued downward stress. ADA’s failure to interrupt above the channel midline confirms that sellers proceed to regulate each micro and macro developments.

Spot outflows improve as sentiment cools

Based on CoinGlass knowledge, there was a internet outflow of $2.5 million up to now 24 hours, extending a multi-week sample of constant crimson prints. Since early October, ADA has recorded extra outflows than inflows.

This displays a lower within the urge for food for holding and a rise in liquidity transferring to exchanges slightly than remaining in wallets.

Community incidents add short-term noise, however the fundamentals stay the identical

Cardano’s current community points gained consideration throughout social media after some group members advised the chain was down. A core contributor shortly clarified the scenario.

LaPetiteADA’s submit said that Cardano “by no means went down,” stating that block era by no means stopped and the protocol continued to run all through the incident. She highlighted the resiliency of the community and praised the worldwide coordination between SPO and builders who deployed the repair.

Charles Hoskinson bolstered this place in one other video, saying, “The community is alive, it is not happening, and finally the assault failed.” He urged SPOs to improve to model 10.5.3, arguing that model 10.5.3 is important to restoring built-in chain operations.

Though these statements helped stabilize sentiment, market reactions had been nonetheless tied to broader danger habits slightly than the incident itself. The technical construction reveals that Cardano’s decline began lengthy earlier than the occasion and remains to be pushed by macro pressures and sustained capital outflows.

Will Cardano go up?

The bullish case hinges on whether or not ADA sustains its multi-year trendline and closes above $0.46 on follow-through. This may enable sign power to return to the construction and scale back the chance of extended correction.

The bearish case could be triggered on a break beneath $0.38, confirming a whole violation of trendline assist and exposing $0.35 and $0.32 as the subsequent draw back targets. If ADA regains $0.46 on elevated quantity, momentum will shift in favor of the consumers. A lack of $0.38 turns the transfer right into a deeper correction.

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any sort. Coin Version just isn’t answerable for any losses incurred on account of the usage of the content material, merchandise, or companies talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.