- Cardano value is buying and selling round $0.40 as we speak after dropping the important thing weekly assist of $0.48, indicating a significant structural change.

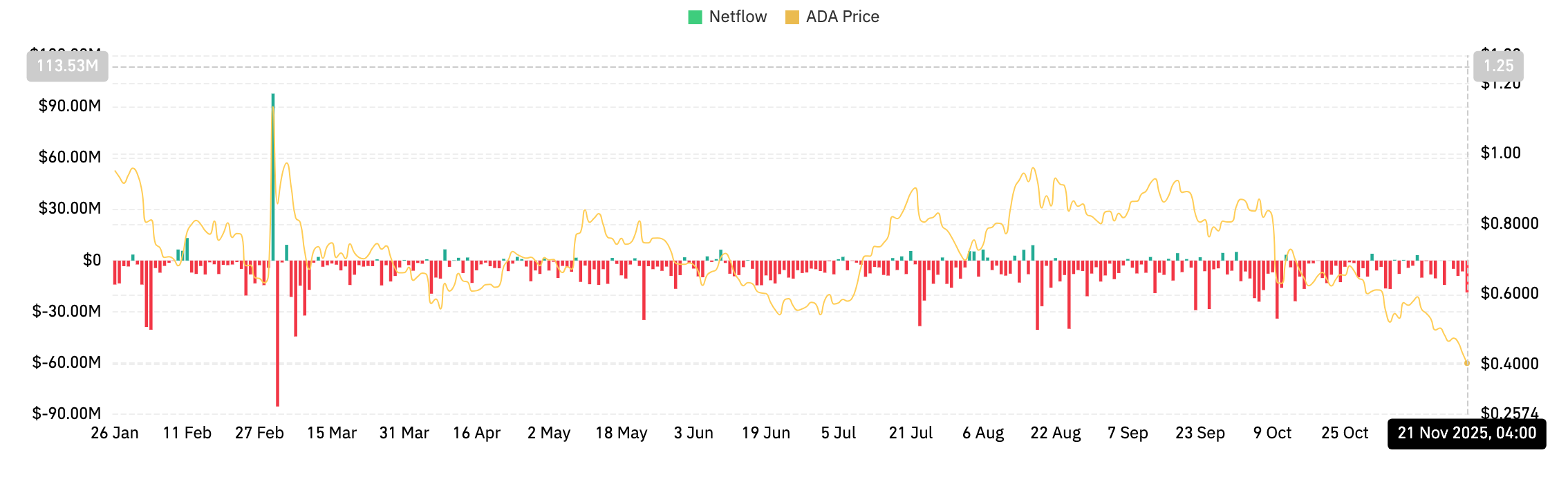

- Spot flows stay bearish with $19.8 million in outflows, extending the distribution interval by a number of weeks as liquidity continues to stream from the change.

- ADA is presently above the $0.32-$0.36 demand zone, however the EMA has became resistance and sellers are in management on all time frames.

Cardano value as we speak is buying and selling round $0.40 after a pointy weekly decline that pushed ADA by the $0.48 assist shelf. This transfer confirms a structural change brought on by sustained spot outflows and regular lack of development assist over larger time frames.

Spot outflow turns into extra critical as sellers take management

There was one other $19.8 million in internet outflows on November twenty first, extending the multi-session streak of distributions, in keeping with Coinglass knowledge. ADA has been experiencing constant pink flows for a number of weeks now, indicating that liquidity continues to stream out of the change reasonably than accumulating.

This sample is per a broader downtrend. All corrections since early September have resulted in giant outflows, indicating that sellers stay in command of short-term sentiment. Till flows stabilize, any restoration makes an attempt danger impacting provide.

Weekly breakdown resets construction in direction of low demand zone

The weekly chart confirms a decisive loss within the construction. ADA closed with assist at $0.48. This degree remained for practically a yr and served as a midpoint between a number of restoration makes an attempt.

The worth is presently positioned simply above the mass demand zone between $0.32 and $0.36. This band represents a cluster of bullish momentum returns that occurred twice in 2023 and early 2024. When the ADA returns to the realm, the fluidity tends to thicken and a response kinds, however solely after a deeper wash.

Associated: Tensor Worth Prediction: TNSR breakout sparks renewed curiosity after months of decline

The overhead of the downtrend line capped any features this yr, making a clear collection of lows. The sample exhibits a transparent distribution. The 33-week RSI displays continued weak spot and has not but reached the degrees related to a significant reversal. The Cash Circulation Index close to 20 signifies that sellers proceed to have the higher hand.

The longer this compression lasts, the extra seemingly the value will drift in direction of the decrease assist band the place consumers traditionally restructure the construction.

EMA reverses to resistance on all time frames

Quick-term charts have gotten more and more bearish. ADA is buying and selling under the two-hour 20, 50, 100, and 200 interval EMAs, with every band stacking downward. This has created a clear resistance ceiling that has repeatedly rejected value since early November.

The Supertrend indicator stays within the pink and hovering round $0.44, confirming that the intraday path favors sellers. Any rally in direction of the supertrend line has been overshadowed, indicating that consumers lack momentum.

Rapid resistance is presently positioned on the EMA cluster between $0.44 and $0.48. These ranges are per failed weekly assist and add to the confluence of broader modifications in construction.

An in depth above the 50 EMA at $0.45 can be the primary signal of momentum resetting. Till that occurs, the intraday rally stays corrective reasonably than constructive.

outlook. Will Cardano go up?

The bullish case hinges on whether or not ADA sustains above the $0.36 assist band and reclaims $0.45 with growing quantity. An in depth above the 50 EMA would recommend that consumers are prepared to problem the EMA stack and restructure it. If this transfer holds, $0.52 would be the subsequent upside checkpoint.

If ADA declines by $0.36, the bearish case will prevail. A each day shut under this zone exposes a deeper pocket of liquidity round $0.32, a degree that marks the decrease finish of the long-term demand space.

If ADA regains $0.45, momentum will begin to enhance. A lack of $0.36 confirms a continuation in direction of $0.32, giving the vendor full management.

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any type. Coin Version isn’t chargeable for any losses incurred on account of using the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.