- Because of the important drop in value, ADA's rating dropped to tenth place by market capitalization.

- In distinction to BTC and ETH, solely 35% of ADA holders are at present making income.

- ADA's on-chain exercise decreases, reflecting decrease engagement attributable to value declines.

Cardano (ADA), a layer 1 blockchain community, is going through tough instances as its value continues to fall and its market rating declines. Notably, ADA at present ranks because the tenth largest cryptocurrency by market capitalization following a major drop in worth. In keeping with CoinMarketCap, ADA's value has fallen 28% within the final month alone and is down practically 22% year-to-date.

Moreover, latest knowledge from IntoTheBlock shared on X revealed that solely about 35% of ADA holders are at present benefiting. That is in sharp distinction to different main cryptocurrencies corresponding to Bitcoin (BTC) and Ethereum (ETH), the place 86% and 81% of holders have profited, respectively. This case has led to elevated scrutiny of Cardano's short-term demand potential as extra traders face losses.

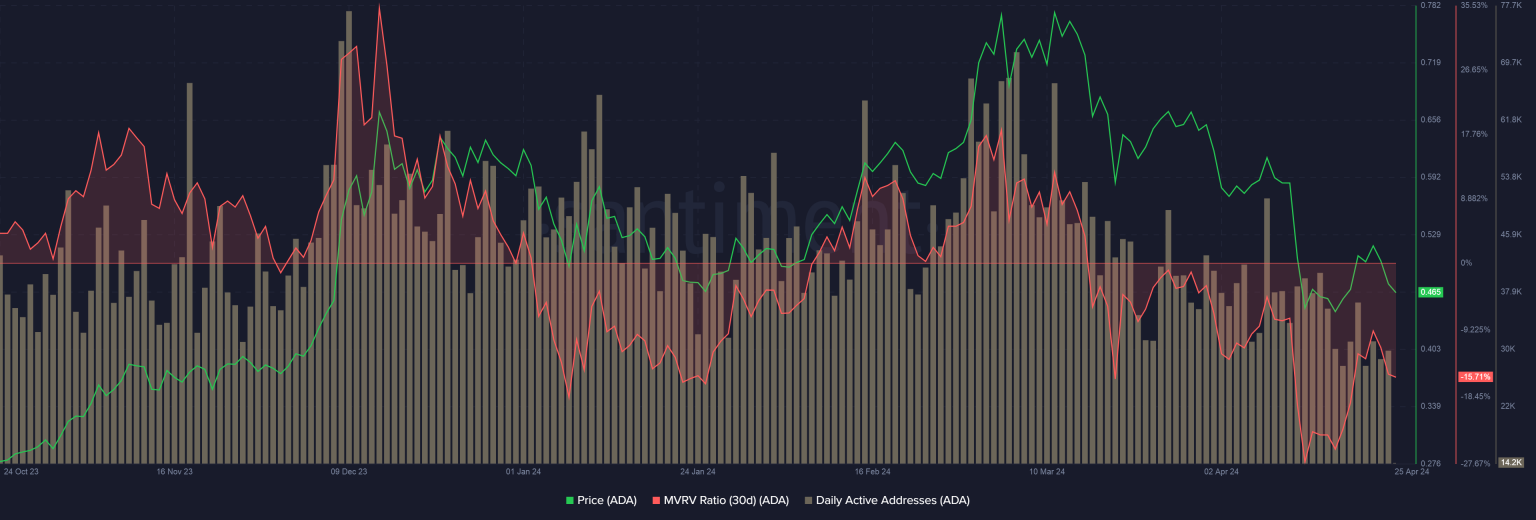

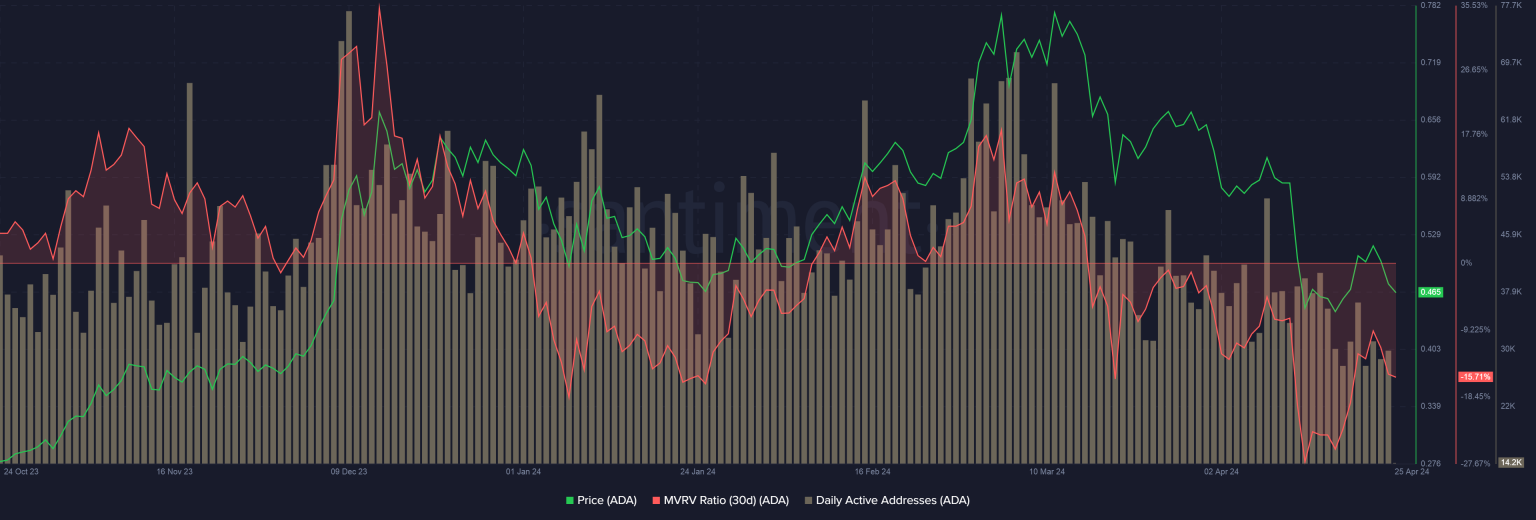

ADA's market efficiency additionally influences its place relative to different cryptocurrencies. Over the previous month, its market valuation has surpassed that of Dogecoin (DOGE) and Toncoin (TON). Moreover, the common unrealized loss has widened to fifteen.71% within the community, indicating that if the holder had been to promote his ADA on the present value, he would incur a mean lack of 15.71%.

With the decline in ADA's market worth, on-chain exercise has decreased considerably. Each day energetic addresses on the Cardano community have fallen from greater than 70,000 on the value peak to about 30,000 at present, based on Santiment knowledge. This drop in exercise displays a decline in engagement and transaction quantity on the community.

Regardless of present market situations, an ADA restoration remains to be potential. Historic knowledge means that ADA may enter a supercycle in 2025 and attain all-time highs, following the sample noticed one 12 months after the 2020 Bitcoin halving.

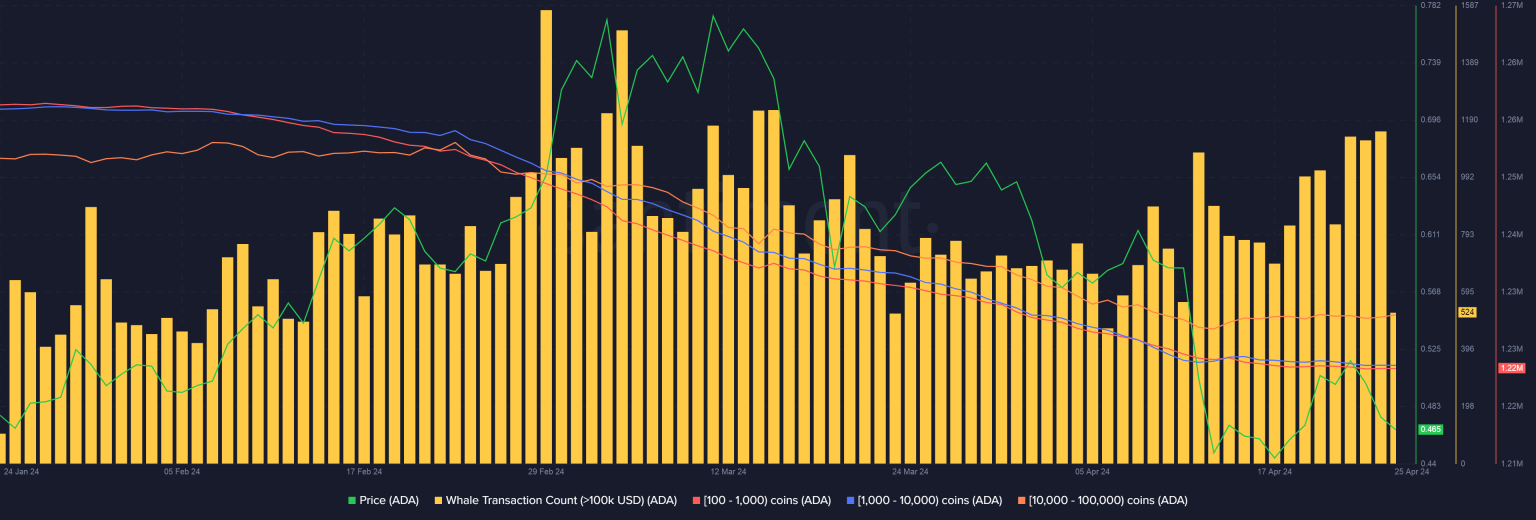

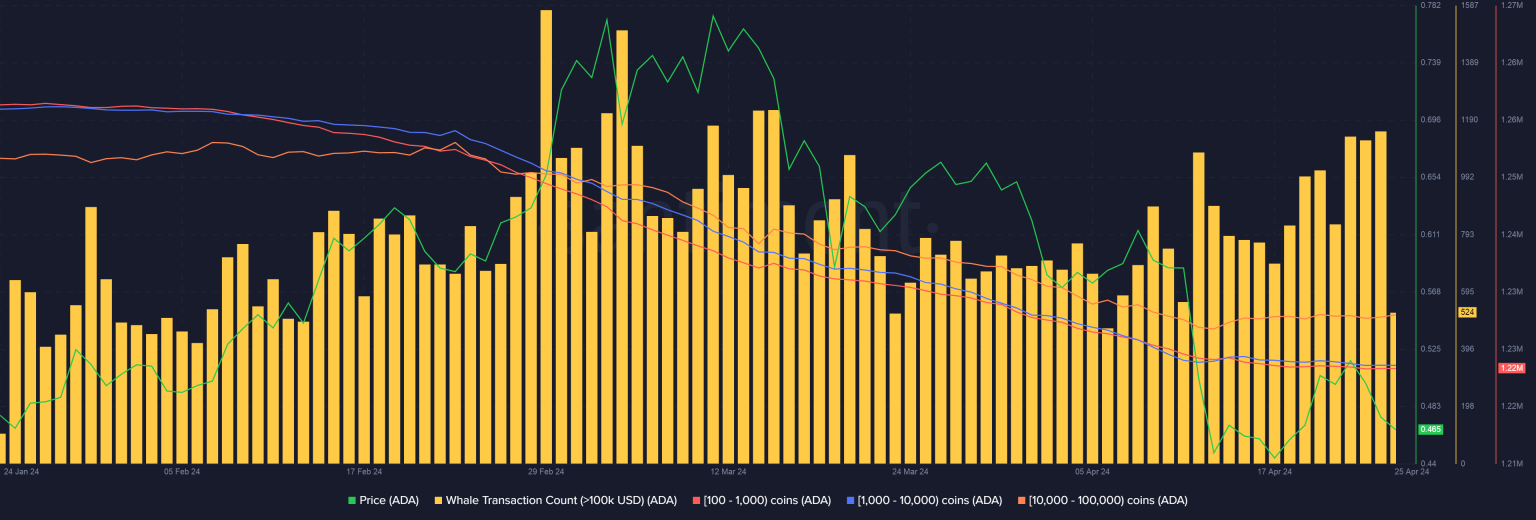

Nonetheless, investor sentiment stays subdued, with knowledge from Santiment displaying that the whale inhabitants is a internet vendor and has persistently decreased its holdings over the previous few months. The shortage of noticeable shopping for exercise in the course of the value drop raises questions in regards to the depth of investor curiosity in ADA at decrease costs.

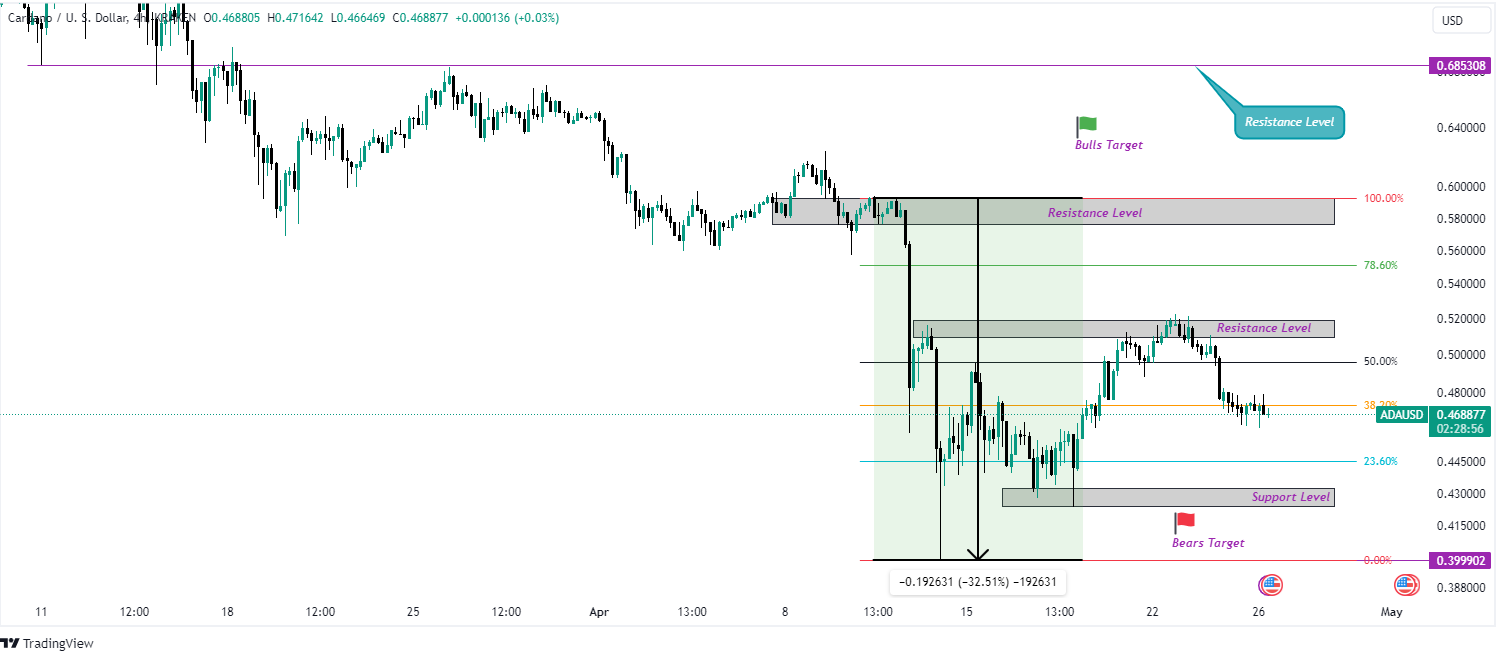

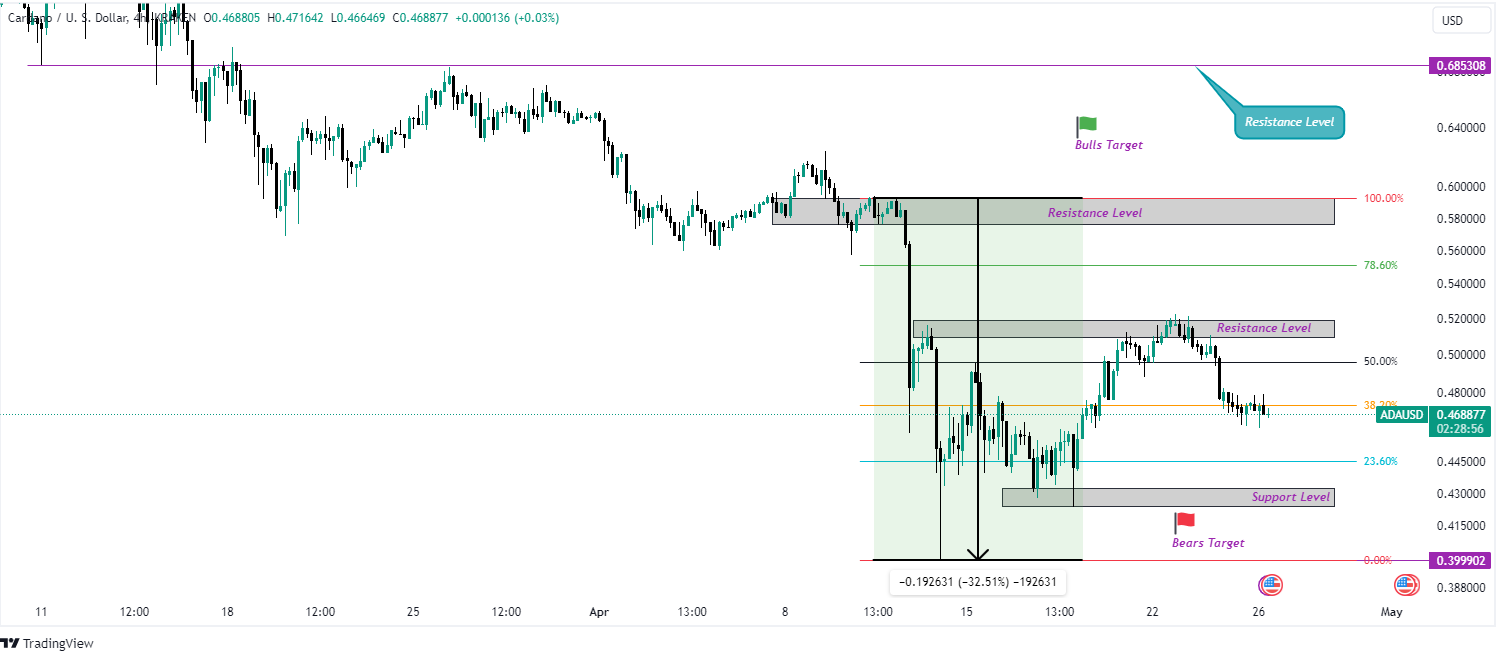

ADA/USD Value Motion

On the 4-hour chart, ADA Token is underneath the affect of bearish sentiment, indicating the potential for additional value decline. As proven by the worth vary device, ADA has recorded a major decline of 32.15% since reaching the important thing stage on his April twelfth. Presently, ADA value is hovering across the 38.20% Fibonacci retracement stage.

If ADA manages to shut above this level, it may point out an upward trajectory, difficult the 50% Fibonacci stage and even doubtlessly breaking above the bulls' most popular resistance stage. Conversely, if ADA continues its bearish momentum and closes beneath the 38.20% Fibonacci stage, it may sign a continuation of the draw back and retest the assist stage beneath. If this assist stage is efficiently damaged, ADA value may fall additional and align with the bearish goal.

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any form. Coin Version isn’t liable for any losses incurred on account of using the content material, merchandise, or companies talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.