- Cboe has filed a 19B-4 submitting permitting Spot Ethereum ETF to listing and commerce choices.

- This proposal follows excessive demand for Ethereum ETFs.

- NYSE American has made related proposals, though it has not but been authorised by the SEC.

CBOE BZX Alternate has formally filed its 19B-4 submitting with the US Securities and Alternate Fee (SEC) looking for approval of the Spot Ethereum Alternate Commerce Fund (ETF) itemizing and buying and selling choices.

The transfer marks an important step for CBOE to develop investor entry to Ethereum, reflecting the rising demand throughout the cryptocurrency market.

CBOE goals to develop its funding instruments

The CBOE proposal goals to develop the numerous funding instruments out there to market members. By permitting choices buying and selling on Ethereum ETFs, buyers acquire an accessible technique of partaking in Ethereum value actions.

The 19B-4 submitting contains funds managed by Bitwise and Grayscale, significantly funds such because the Grayscale Ethereum Belief and the Grayscale Ethereum Mini Belief.

Exchanges assume that these choices serve not solely as various means for buyers to be uncovered to Ethereum, but additionally as vital hedging gadgets towards the inherent volatility of the cryptocurrency market.

Specifically, the filling of the CBOE follows an analogous proposal by NYSE American. This isn’t but SEC authorised. Regulators cite issues about market manipulation, investor safety and making certain a good buying and selling setting.

The SEC’s reluctance is rooted in Part 6(b)(5) of the Securities and Alternate Act 1934, highlighting the safety of buyers and the upkeep of a good and orderly market.

Regardless of these challenges, Cboe’s proposal is surrounded as a aggressive response to the NYSE initiative, suggesting the market’s potential enthusiasm to see these monetary merchandise come to fruition .

CBOE’s method in submitting emphasizes that Ethereum ETF choices are ruled by the identical strict guidelines as different fund sharing choices on the platform, corresponding to listing necessities, margin guidelines, and buying and selling terminations. This regulation integrity is meant to reassure the SEC of compliance with proposals towards present frameworks, in addition to these utilized to Bitcoin ETF choices authorised below related regulatory scrutiny. .

Ethereum ETFS buyers’ curiosity surges

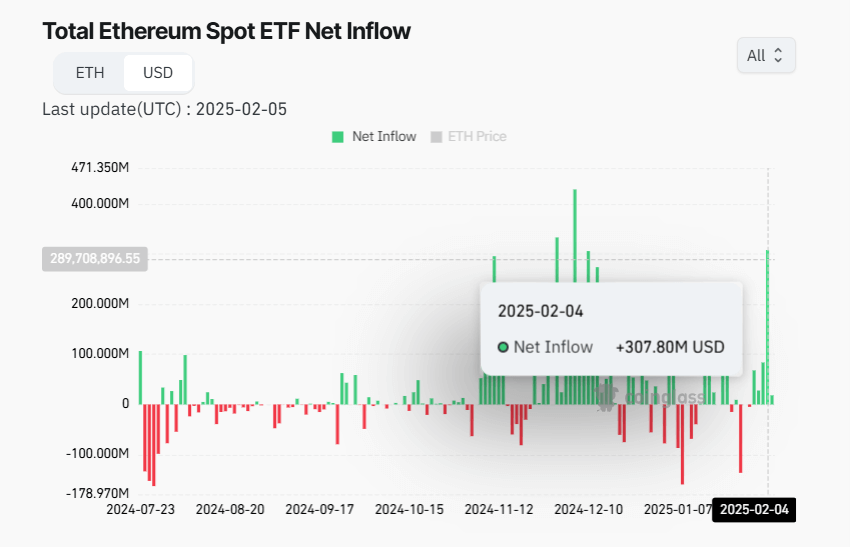

The timing of the CBOE submitting coincides with a surge in investor curiosity in Ethereum ETFs. Not too long ago, these funds have seen unprecedented buying and selling quantity and web inflows.

For instance, on February 4, 2025, Ethereum ETFS recorded a web influx of $377.7 million.

This efficiency not solely helps the rationale behind the introduction of choices buying and selling, but additionally highlights the market’s preparation for such monetary innovation.

The introduction of choices to Ethereum ETFs may stabilize Ethereum costs by growing market liquidity.

Choices present institutional buyers with subtle danger administration instruments and permit them to hedge value fluctuations. Retailers might make the most of these choices for speculative earnings.

This might result in a extra mature and secure market setting for Ethereum, fostering better institutional adoption and contribute to mainstream monetary integration of cryptocurrency.

Business specialists like ETF retailer Nate Geraci have proven that the approval course of may comply with an analogous timeline to Spot Bitcoin ETF, which took about 8-9 months from launch to choice transaction approval .

If this precedent applies, we are able to see that Ethereum ETF will turn into a actuality within the close to future, probably subsequent month, assuming the regulatory hurdles are cleared.

(tagstoTranslate) Market