- CBOE plans to checklist 5 Ethereum exchange-traded funds (ETFs) on July 23.

- We’ll start buying and selling the next spot ETFs: 21Shares Core Ethereum ETF, Constancy Ethereum Fund, Franklin Ethereum ETF, Invesco Galaxy Ethereum ETF, and VanEck Ethereum ETF.

- Bitwise CIO Matt Hogan believes the Ethereum ETF may see web inflows of round $15 billion in its first 18 months in the marketplace.

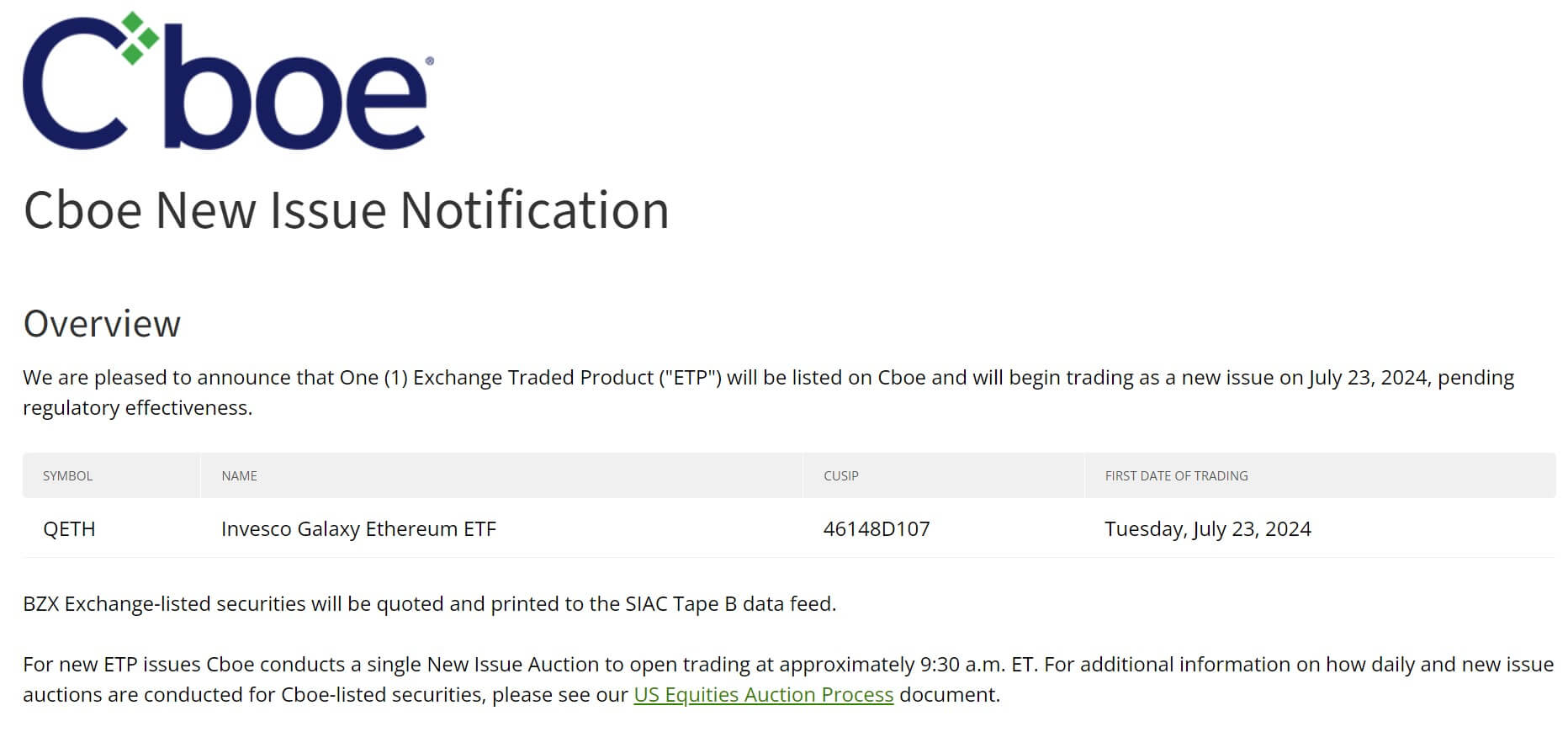

The Chicago Board Choices Change (Cboe) introduced that it plans to checklist 5 Ethereum exchange-traded funds (ETFs) on July 23, pending the implementation of rules.

The 5 spot Ethereum ETFs anticipated to start buying and selling are 21Shares Core Ethereum ETF, Constancy Ethereum Fund, Franklin Ethereum ETF, Invesco Galaxy Ethereum ETF, and VanEck Ethereum ETF.

In Might, the U.S. Securities and Change Fee (SEC) authorized rule adjustments to highlight Ethereum’s 19b-4 submitting, however the S-1 registration must be authorized by regulators earlier than it may possibly start.

Earlier this month, the SEC required asset managers to file their remaining S-1s by July 16. Asset supervisor Bitwise filed an amended S-1 type on July 3. One of many amendments included a six-month price waiver for as much as $500 million.

Because the July 23 launch date approaches, consideration shall be centered on the SEC and people seeking to launch new funding merchandise onto the market. In June, Bitwise CIO Matt Hogan mentioned the Ethereum ETF was anticipated to see web inflows of round $15 billion in its first 18 months in the marketplace.

Solana ETF

Wanting to supply extra funding merchandise to buyers, Cboe submitted two purposes earlier this month to checklist a spot Solana ETF on its platform.

The change has requested the SEC to approve the itemizing of the 21Shares and VanEck Solana ETFs, which it expects to file Kind 19b-4 with the SEC and concern a choice by March 2025.

On the finish of June, VanEck filed its S-1 type with the SEC, changing into the primary U.S. firm to take action. Equally, 21Shares filed its personal S-1 with the SEC in June, stating in its submitting that it “believes this can be a essential step for the cryptocurrency business.”

With curiosity in a bitcoin ETF rising and an Ethereum ETF set to start buying and selling on Cboe, asset managers are contemplating different sorts of choices they may provide buyers, pending regulatory approval from the SEC.