- Chainlink traded round $17.23 after defending $16.70, rebounding on the Ondo Finance partnership information.

- The mixing with Ondo’s $1.8 billion in tokenized belongings strengthens Chainlink’s institutional market footprint.

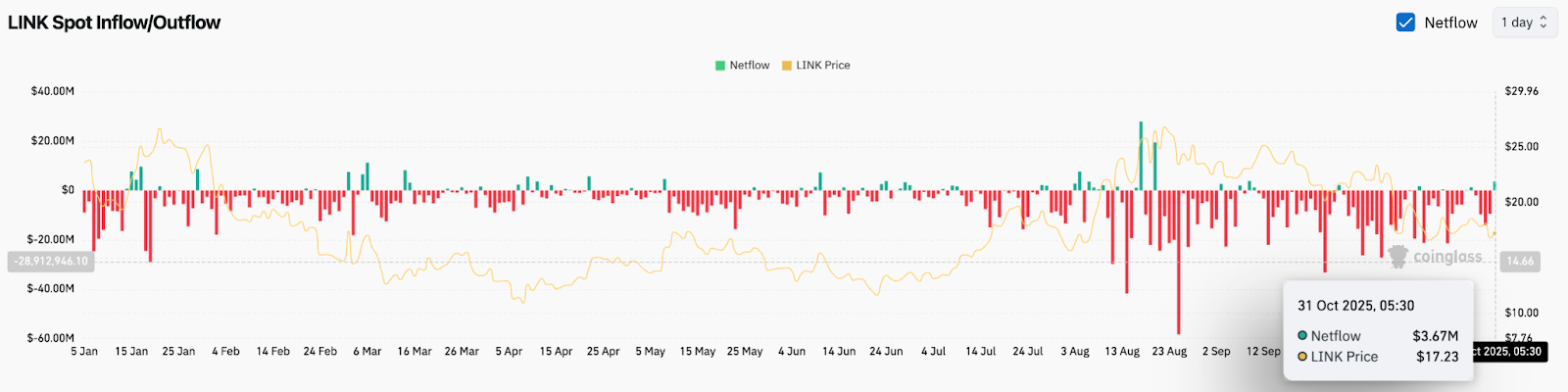

- Web inflows of $3.67 million point out contemporary accumulation as LINK is predicted to rise above $18.80.

Chainlink worth is buying and selling at $17.23 right this moment, recovering after defending the $16.70 help zone. The rally comes because the market digests Chainlink’s new partnership with Ondo Finance, a transfer that strengthens Chainlink’s function in institutional-level tokenization and might be the subsequent catalyst for elevated volatility.

Partnership strengthens Chainlink’s institutional attain

The partnership with Ondo Finance positions Chainlink because the main oracle and interoperability supplier for tokenized shares and ETFs. Ondo goals to offer safe cross-chain transfers to institutional prospects utilizing Chainlink’s Cross-Chain Interoperability Protocol (CCIP).

Ondo already manages over $1.8 billion in tokenized belongings throughout a number of blockchains. Chainlink’s oracle system integration offers conventional establishments with a path to on-chain markets with transparency and auditable information. This can be a use case that straight helps Chainlink’s core worth proposition.

This partnership reinforces the popularity that Chainlink’s worth efficiency is tied to actual infrastructure demand within the rising tokenized asset market, fairly than speculative hype.

Hyperlink Worth Motion Take a look at Key Compression Zone

Technically, Chainlink’s worth stays inside a big symmetrical triangle, suggesting an prolonged interval of consolidation earlier than a breakout. The worth is at present fluctuating round $17.20, surrounded by resistance round $18.25-$18.80 and upward help round $16.00.

Associated: Shiba Inu worth prediction: Fed rate of interest cuts and commerce truce paving the way in which for a rebound

The 20-day EMA at $18.24 and the 50-day EMA close to $19.62 have converged, indicating decrease volatility and potential for extra volatility in early November. A breakout of the 0.382 Fibonacci stage at $18.67 might open the way in which to the important thing resistance factors of $20.54 (Fibonacci 0.5) and $23.00 (Fibonacci 0.618) that may be seen on the day by day chart.

On the draw back, failure to maintain the $16.00 trendline might set off a retest of the $15.04 zone, a stage the place patrons have been actively intervening.

Movement signifies new accrued curiosity

Web inflows had been optimistic at $3.67 million on Oct. 31, breaking an extended streak of detrimental outflows that dominated a lot of October, in response to Coinglass information. The rise was one of many largest single-day inflows this month and means that accumulation could also be returning amongst whales and institutional traders.

Traditionally, LINK worth usually reverses course after such a surge in inflows, indicating renewed confidence in native help ranges. Whereas constantly detrimental internet flows all through the third quarter mirrored long-term holders rotating into stablecoins, this week’s inflows sign new positioning forward of the tokenization rollout.

Outlook: Will Chainlink go up?

For now, Chainlink’s worth prediction stays constructive. So long as the token maintains help above $16.00, technical and basic momentum favors an upside breakout in direction of $20-21 within the quick time period. An in depth above the $18.80 resistance stage would affirm a bullish continuation sample and will lengthen to $23.00 if inflows persist.

If macro headwinds strengthen and Bitcoin is unable to maintain current features, LINK might revisit the $15.00 zone earlier than stabilizing once more. Nonetheless, institutional catalysts such because the Ondo partnership and Chainlink’s rising oracle dominance present a strong basis for a long-term restoration.

Associated: Dogecoin worth prediction: Doge consolidates as open curiosity rises

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any form. Coin Version will not be answerable for any losses incurred because of the usage of the content material, merchandise, or companies talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.