- LINK has stabilized round $17.80, the 0.618 Fib degree, which is necessary for a doable restoration.

- Regardless of the continued exodus of traders, the rise in open curiosity suggests an accumulation of hypothesis.

- A breakout of the EMA cluster above $19.45 may set off a short-term rally in the direction of $21.00.

Chainlink (LINK) continues to commerce below short-term strain, however worth motion on the 4-hour chart suggests a key second is close to. The construction of the token reveals consolidation between key Fibonacci ranges the place each patrons and sellers are actively vying for management. Amid elevated volatility throughout the market, LINK seems to be stabilizing close to current lows, with futures and on-chain information reflecting elevated market engagement.

Technical overview and pricing system

On the time of writing, LINK is buying and selling round $18.34 after recovering barely from the $17.80 zone. This degree coincides with the 0.618 Fibonacci retracement from $8.21 to $23.73, which regularly acts as a turning level throughout a correction part.

Regardless of the rebound, costs are nonetheless beneath the most important exponential transferring averages. The 20 EMA at $18.64 and 50 EMA at $19.45 are at present performing as resistance, whereas the 100 EMA at $20.36 and 200 EMA at $21.20 point out stronger restoration boundaries. Subsequently, the near-term outlook stays in favor of consolidation till the market confirms a directional breakout.

If the value falls beneath $17.80, draw back targets will emerge round $15.97 and $14.14, ranges that coincide with the preliminary accumulation zone. Conversely, a clear break above $19.45 may spark recent bullish curiosity, with a possible goal between $21.00 and $22.00. Sustaining stability across the 0.618 Fib degree is important to revive purchaser confidence.

Associated: Tron Worth Prediction: TRX tries to get well as merchants give attention to main resistance

Open curiosity and market participation

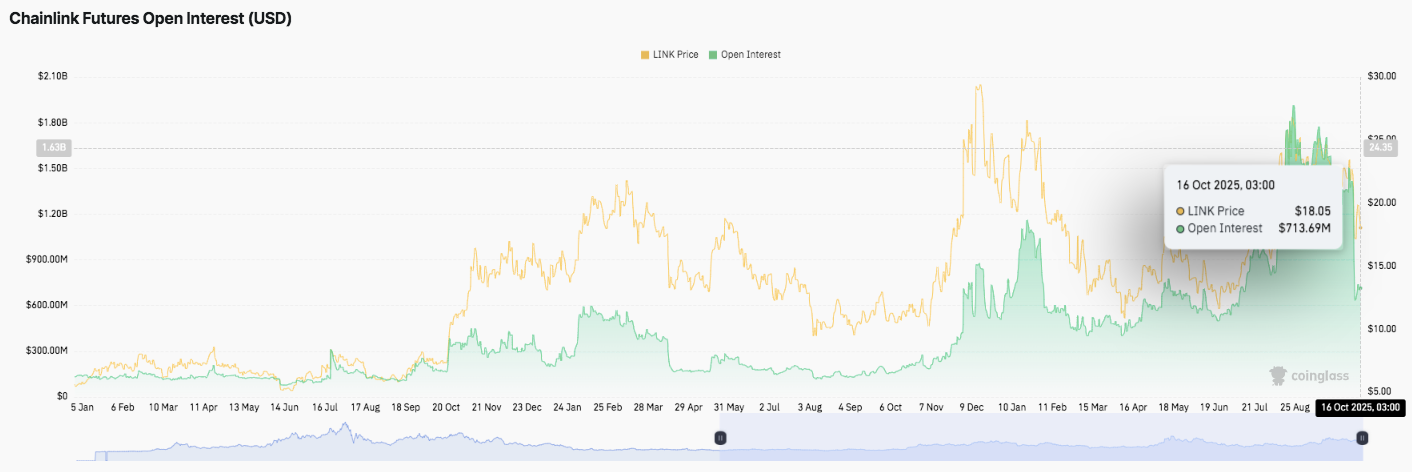

Derivatives market information reveals rising optimism amongst merchants. Chainlink’s open curiosity soared from lower than $400 million in early June to roughly $713 million by mid-October 2025. This constant rise signifies the buildup of leveraged positions and elevated market exercise.

Moreover, the mix of elevated open curiosity and gradual worth restoration suggests an inflow of recent capital fairly than place rotation. In consequence, derivatives markets are exhibiting early indicators of bracing for a possible interval of elevated volatility.

Alternate fee flows and investor conduct

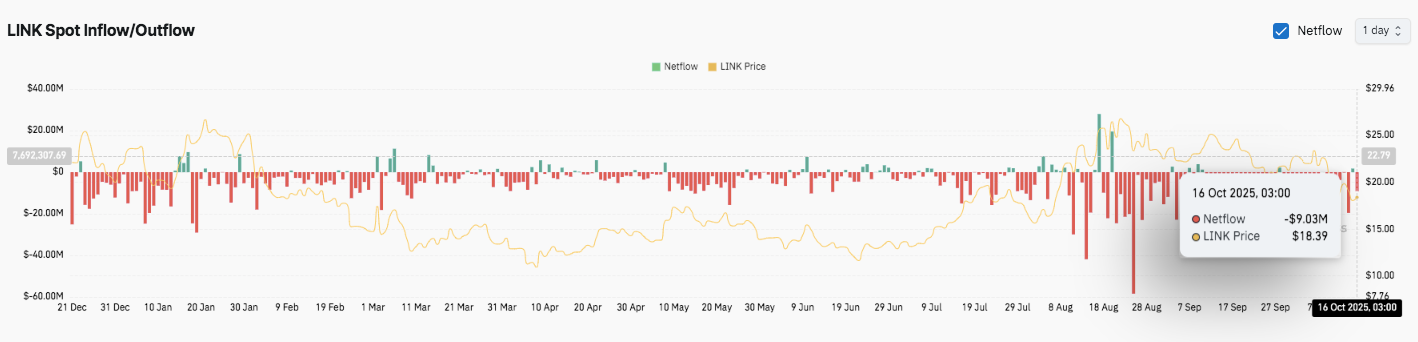

Regardless of the derivatives optimism, on-chain flows are expressing a special sentiment. Chainlink recorded web outflows of $9.03 million on October 16, persevering with a pattern seen all through 2025. Persistent outflows usually point out traders are taking income or decreasing publicity after small worth will increase.

The restricted variety of influx occasions means that accumulation stays weak relative to distribution. Nevertheless, if LINK stabilizes close to assist and open curiosity continues to rise, confidence will step by step return and a stronger rebound may emerge within the coming weeks.

Associated: Cardano Worth Prediction: ISO 20022 Hype Positive factors Consideration

Chainlink technical outlook (hyperlink)

Chainlink’s key ranges stay properly outlined because the token navigates a key assist space round $17.80. This zone coincides with the 0.618 Fibonacci retracement of the $8.21 to $23.73 swing, a degree that usually determines whether or not corrections deepen or reverse.

- High degree: Speedy resistance seems between $18.64 and $19.45, the place the short-term exponential transferring common is clustered. A break above this vary may open the way in which to $20.41 (0.786 Fib) and even $21.20 to $23.70, which might be the subsequent medium-term resistance space. A sustained transfer above these ranges may shift momentum again in favor of patrons.

- Cheaper price degree: On the draw back, $17.80 stays the principle line of protection. A break beneath this might lengthen the pullback to $15.97 and $14.14, each of which coincide with the preliminary accumulation zone. These ranges characterize potential demand areas if promoting strain will increase.

Will Chainlink rebound quickly?

Chainlink’s worth outlook is determined by whether or not patrons can maintain the $17.80 zone lengthy sufficient to regain bullish momentum. Elevated open curiosity suggests speculative accumulation, whereas sustained outflows mirror cautious investor conduct. LINK may retest $21.00 within the quick time period if momentum improves with the general market restoration.

Nevertheless, a sustained decline beneath the EMA cluster may end in an prolonged consolidation earlier than a stronger pattern reversal happens. For now, LINK is buying and selling in a pivotal space the place stability above $17.80 is essential to confirming the restoration part.

Associated: Ethereum Worth Prediction: Merchants Eye Key Assist as BitMine Provides $417 Million to ETH

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any type. Coin Version isn’t answerable for any losses incurred on account of using the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.