- LINK approaches a significant resistance cluster as merchants look ahead to a definitive pattern change

- Derivatives positioning stays cautious, however sustained spot outflows dampen momentum

- Sturdy debut for ETFs will increase institutional investor consideration, however sustained demand stays unsure

Chainlink is approaching a decisive technical zone after weeks of volatility, and merchants are watching to see if the token lastly adjustments its general pattern. The market has skilled a number of sharp swings since mid-year, however the latest rally has returned LINK to ranges that might form the subsequent huge transfer.

Worth approaches a big barrier

LINK has rebounded strongly from the November lows close to $11.60 and returned to the resistance cluster close to $14.45. This degree coincides with the 0.382 Fibonacci retracement.

This rebound additionally pushed the worth above the 20, 50, and 100 EMAs, suggesting improved short-term power. Nevertheless, the 200-EMA stays close to $15 and continues to restrict any upside makes an attempt.

A breakout above the $15 space would point out a change in construction and a strong pattern change. Moreover, the subsequent resistance degree is situated close to $15.33, which represents the 0.50 Fibonacci degree. If these limitations will be overcome cleanly, the trail to $16.20 after which $17.46 could possibly be paved. Nevertheless, failure on this space dangers a return to the assist between $13.40 and $13.80.

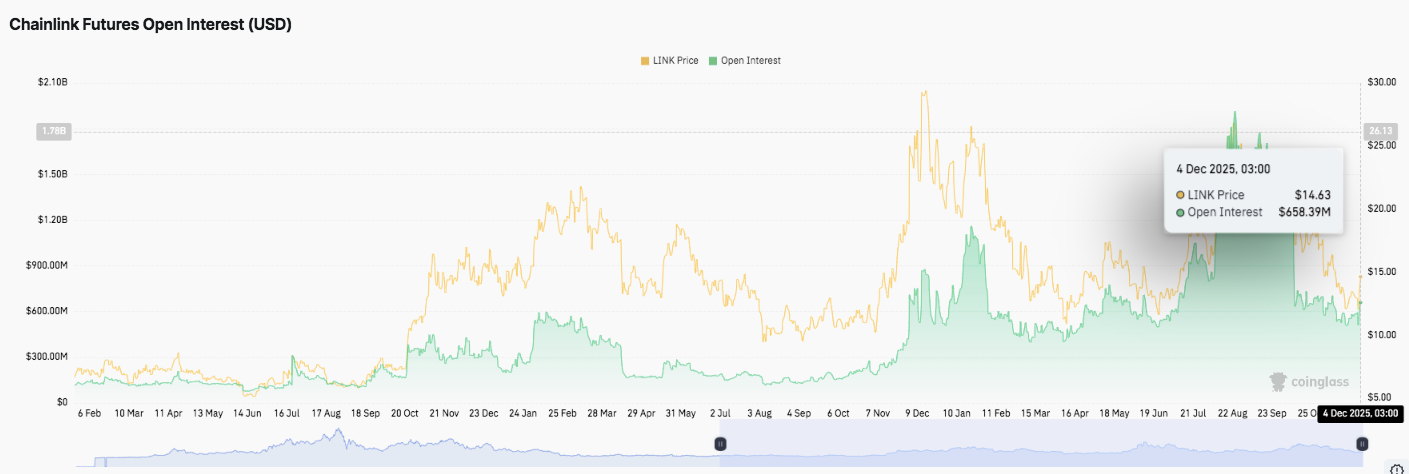

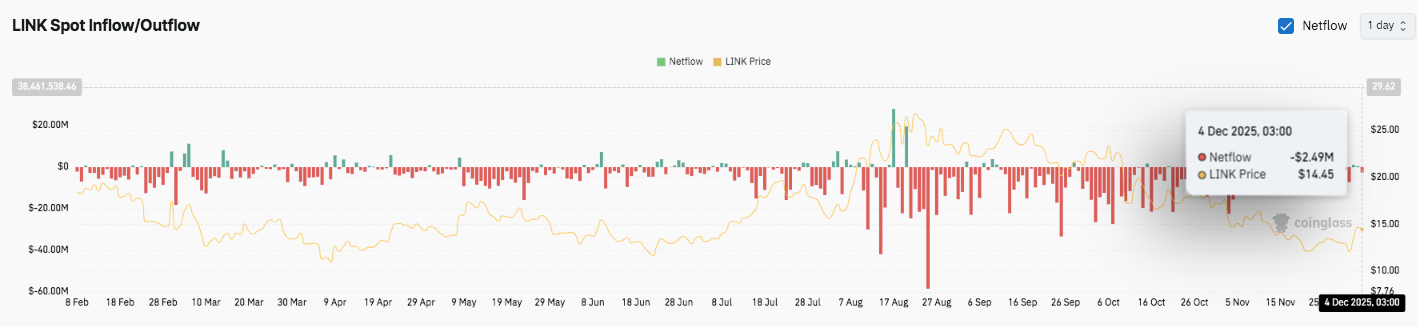

Open curiosity and spot flows point out cautious positioning

Open curiosity is near $658 million. This degree displays secure however cautious positioning throughout the derivatives market. Moreover, open curiosity will observe worth actions all through 2025, increasing throughout robust rallies and contracting throughout corrections. Subsequently, present readings point out that the market is ready for affirmation.

Spot circulate exhibits sustained outflow and builds up strain. LINK noticed an outflow of $2.49 million on December 4th, and this sample has continued for a number of months. Importantly, the sustained inflows that might assist a robust financial restoration haven’t emerged. So till demand strengthens, any upside bids stay susceptible.

Associated: Bitcoin Worth Prediction: Sellers Block Restoration as Worth Compresses…

ETF debut alerts rising curiosity from institutional buyers

The introduction of the Grayscale Chainlink Belief ETF underneath the ticker GLNK provides new consideration to this asset. It had a internet influx of $40.9 million on its first day, in keeping with SoSoValue information. Whole belongings reached $67.55 million, indicating robust early engagement.

Peter Mintzberg described the launch as an indication of rising curiosity in Chainlink publicity. The ETF permits monetary establishments to entry LINK by way of acquainted channels, probably supporting long-term adoption.

Chainlink worth technical outlook

As LINK enters the essential stage, the important thing ranges stay nicely outlined.

- Prime degree: The rapid hurdles are $14.45, $15.00, and $15.33. A get away of this cluster might lengthen the momentum to $16.20 and $17.46.

- Lower cost degree: $13.80 acts as a trendline and EMA assist, adopted by $13.00, and $11.60 is an enormous swing low.

The $15.00 resistance ceiling coincides with the 200-EMA and the downtrend line, making it a key degree to recuperate for medium-term bullish continuation. The technical construction exhibits a compressing hyperlink between rising short-term assist and vital overhead resistance. Subsequently, a decisive break from this squeeze might set off a pointy improve in volatility in both route.

Will chain hyperlinks break greater?

Chainlink’s near-term route will depend upon whether or not the bulls can defend the $13.80 assist zone lengthy sufficient to problem the $14.45-$15.00 resistance band. Market construction, coupled with cautious open curiosity and sustained spot outflows, suggests a pivotal interval of testing forward. If inflows strengthen and the worth strikes above $15.00, LINK might retest $16.20 and even $17.46.

Nevertheless, if $13.80 fails to carry, the market shall be uncovered to $13.00 and probably $11.60, which stays a broadly void degree. For now, LINK is in a critical compression zone. The upcoming periods will depend upon momentum, confidence circulate, and market response to the 200-EMA wall.

Associated: BOB (Bitcoin Base) Worth Prediction 2025, 2026, 2027-2030

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any form. Coin Version will not be chargeable for any losses incurred on account of using the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.