- Chainlink Consideration Rebounds as $20.84 Resistance Checks the Energy of Bullish Momentum

- Elevated open curiosity exhibits dealer optimism however will increase short-term volatility danger

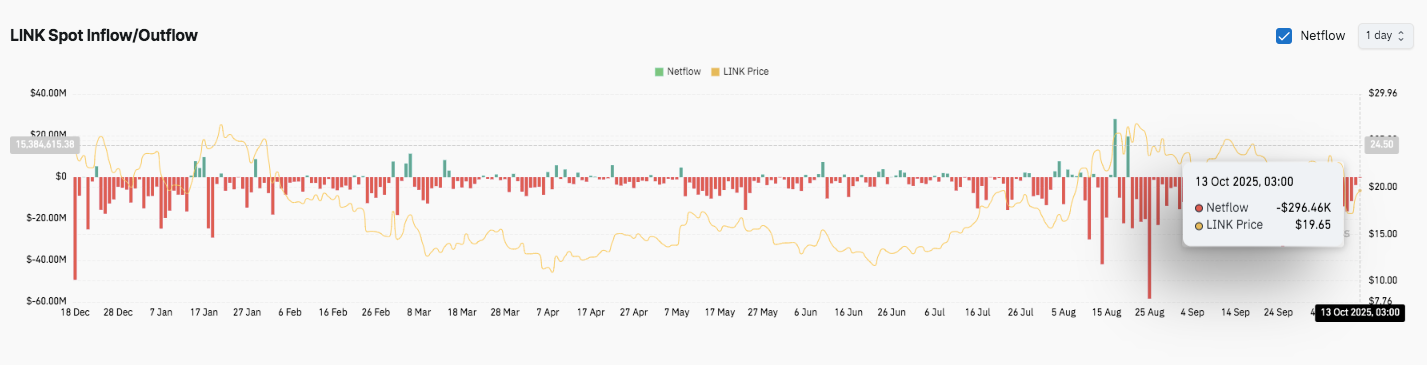

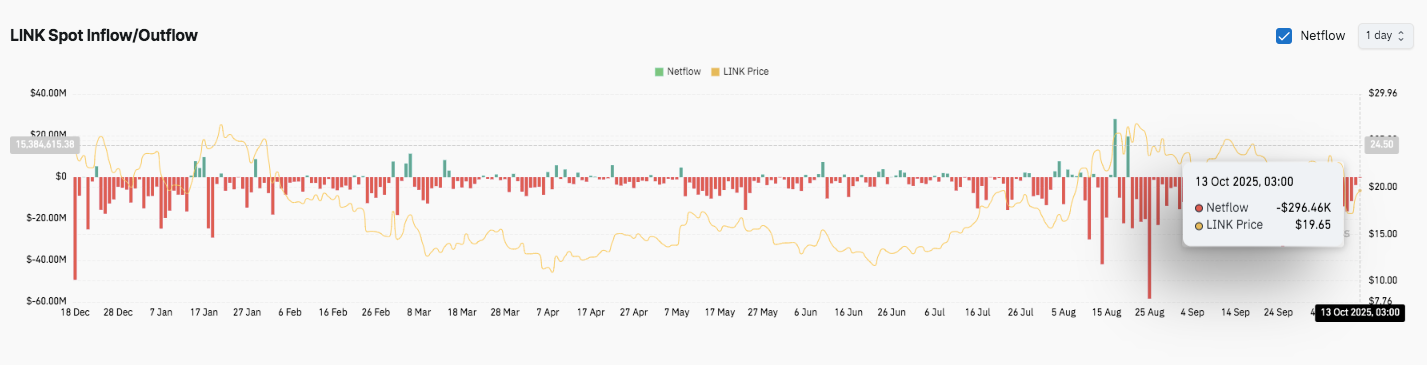

- Regardless of an enchancment within the value construction, continued outflows spotlight the decline in spot demand.

Chainlink (LINK) rose to $19.61 after a powerful rebound from the $16.98 degree, displaying indicators of a cautious rebound after current volatility. The asset’s near-term momentum has improved with the pair breaking above the 0.618 Fibonacci retracement degree close to $18.57, suggesting shopping for curiosity is step by step returning. Nevertheless, the broader outlook stays unsure as technical indicators and market information recommend a blended image in each spot and futures markets.

Brief-term tendencies and key ranges

The current rally represents a partial restoration from LINK’s sharp decline from a swing excessive of $23.72. The value motion is at the moment going through a big check close to the $20.84 zone, the place the 0.786 Fibonacci retracement coincides with the descending 50-period EMA. A break above this resistance might set off a short-term shift in the direction of $23.7, the higher finish of the continued correction.

On the draw back, there may be additionally the power of short-term help at $18.57, adopted by the $16.98 degree, which has been a serious reversal level up to now. The 0.382 and 0.236 retracement ranges are supported by deeper costs at $15.39 and $13.42, suggesting potential value targets if sellers regain management.

Associated: XRP Worth Prediction: ETF Countdown Sparks New Optimism

Market indicators and construction

The RSI is hovering round 50, reflecting balanced momentum after recovering from oversold territory. A sustained transfer above 55 might verify the start of a stronger bullish wave. In the meantime, whereas the 20-period EMA is flat, the 50-, 100-, and 200-period EMAs are hovering between $19.14 and $21.71, forming a resistance cluster that would restrict upside room.

Moreover, open curiosity in Chainlink futures has skyrocketed since August 2025, rising from lower than $400 million to roughly $674 million. This enhance signifies new participation of merchants and elevated speculative publicity. Traditionally, such progress has typically been preceded by continued growth in costs, however throughout unstable actions it additionally amplifies short-term liquidation danger.

On-chain stream and sentiment

All through 2025, Chainlink’s on-chain information exhibits continued outflows, reflecting continued promoting stress. The most recent statistics on October thirteenth revealed an outflow of $296,460 whereas LINK’s buying and selling value was $19.65. Whereas the earlier surge in inflows has coincided with a restoration in costs to close $25, continued outflows since mid-July point out diminished spot demand and profit-taking habits.

Chainlink value technical outlook

As Chainlink consolidates within the mid-cycle restoration part, key ranges will proceed to be tightly outlined.

- High degree: The primary hurdle is $20.84 (confluence of 0.786 Fib and 50-EMA). The breakout might widen in the direction of the higher bounds of the correction channel at $23.72 and $25.40. If momentum sustains above $23.72, a short-term bullish reversal will probably be confirmed and the trail to $27.80 will probably be paved.

- Cheaper price degree: $18.57 (0.618 filib) acts as short-term help, adopted by $16.98 (0.5 filib) and $15.39 as secondary defensive zones. A break beneath $16.98 might expose LINK to $13.42 (0.236 Fib space), representing a deeper retracement degree.

- Higher restrict of resistance: $21.70 (EMA cluster area) stays a key degree for reversing medium-term bullish momentum. Convergence of the 50-, 100-, and 200-EMA indicators compression in volatility and sometimes portends a pointy directional transfer.

Will Chainlink proceed its restoration?

Chainlink’s October efficiency will depend upon whether or not the bulls can preserve management above the $18.5-$19.0 help space. Holding this zone might retest the upside in the direction of $20.84 and $23.7. Historic value actions throughout related durations of compression have brought on robust volatility breakouts as liquidity builds across the EMA cluster.

Associated: BNB Worth Prediction: Analysts Bullish on $96M Influx Alerts Accumulate

Nevertheless, sustained outflows and revenue taking throughout the community proceed to constrain aggressive positive aspects. If LINK fails to reclaim the $21-$22 resistance band, contemporary promoting might happen and push it again towards $17.

Subsequently, the following few classes will assist decide whether or not LINK’s restoration will probably be a development reversal or a plateau in consolidation. At this stage, LINK is in a pivotal build-up part the place closing worth and broader market sentiment will decide the following leg.

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any variety. Coin Version will not be answerable for any losses incurred on account of the usage of the content material, merchandise, or providers talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.