- LINK has rebounded close to $18.34, indicating renewed bullish sentiment amongst merchants.

- Open curiosity development of over $692 million suggests elevated momentum and leverage exercise.

- Whale’s accumulation of 9.94 million hyperlinks signifies rising long-term investor confidence.

Chainlink (LINK) is regaining momentum after a giant correction in mid-October, and there are indicators of renewed bullish sentiment amongst merchants. The token is buying and selling round $18.34, steadily recovering from this month’s lows. Analysts notice that this restoration is in line with elevated open curiosity and adjustments in whale habits, each of which point out stronger market confidence. Because of this, LINK’s technical construction suggests a potential continuation part if present assist ranges are strong.

Key ranges of elevated resilience

The token is at present buying and selling close to the confluence of short-term transferring averages, with the 20, 50, and 100 EMAs clustered between $18.09 and $18.46. A breakout above this pivot zone may sign a short-term bullish breakout.

The subsequent resistance lies on the 0.618 Fibonacci retracement degree close to $18.55, adopted by a spread of $19.45 to $20.84, in line with the 200-EMA. An in depth above $19.50 may verify sustained restoration momentum and pave the way in which for a swing excessive at $23.70.

Associated: Hedera Worth Prediction: HBAR Beneficial properties Investor Momentum as ETF Launch Nears

On the draw back, speedy assist is situated close to $16.98, with secondary ranges at $15.39 and $13.42. A break under these ranges may expose LINK to additional losses and will retest the cycle low of $10.24. Due to this fact, sustaining the present vary stays vital for bulls trying to re-establish a long-term uptrend.

Rising open curiosity and market confidence

In response to knowledge as of October 28, LINK is buying and selling round $18.21 with open curiosity rising to $692.91 million. This represents a robust restoration from mid-year ranges, when open curiosity was under $400 million.

Moreover, this improve alerts a renewed participation in leverage as merchants guess on worth continuation. Traditionally, rising open curiosity and rising costs assist a bullish setup, and if worth rises above $18 and open curiosity approaches $800 million, it suggests momentum could proceed.

Whale alerts accumulate, analysts notice long-term optimism

Bitcoinsensus knowledge exhibits that giant traders are accumulating Chainlink once more. Since October tenth, 39 new wallets have withdrawn 9.94 million LINK (price roughly $188 million) from Binance. This massive outflow underscores confidence amongst institutional traders and rich people who’re poised for a possible rally.

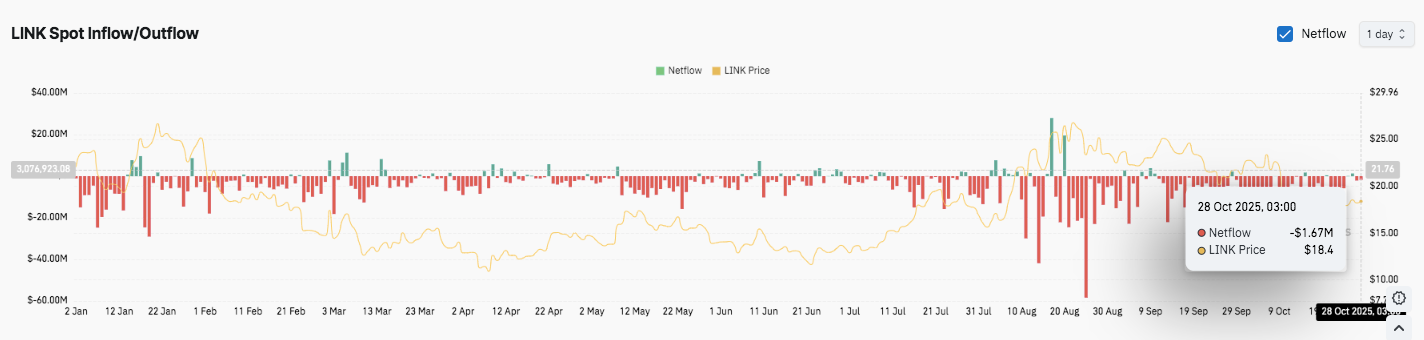

Moreover, on-chain knowledge has persistently proven internet outflows since early 2025, suggesting traders are transferring their tokens to non-public storage. Whereas the surge in massive outflows in late July and September coincided with vital corrections, latest modest internet inflows of $1.67 million counsel lessening promoting strain.

Associated: Bitcoin Worth Prediction: Fed QT Suspension and Trump-Xi Summit Will Inject $118,000

Chainlink worth technical outlook

Chainlink (LINK) key ranges stay effectively outlined heading into November. The upside worth targets are positioned as speedy hurdles at $18.55, $19.45, and $20.84. If confirmed above $20.84, it may lengthen in the direction of $23.70 and retest the earlier cycle highs.

On the draw back, the primary assist lies at $16.98 (0.5 Fibonacci), adopted by $15.39 and $13.42. The 200-day EMA close to $19.45 serves as a key resistance ceiling that should reverse to verify a medium-term bullish reversal.

Technically, LINK has fashioned a good vary between the 100-day and 200-day EMA, suggesting an impending improve in volatility. Previous actions throughout such compression levels have usually preceded vital directional actions.

Can Chainlink proceed its restoration?

Chainlink’s worth outlook will depend on whether or not patrons can maintain the energy above $18. Holding this zone may problem the $19.45-$20.84 cluster, the place a decisive shut may set off an upside transfer towards $23.70. Nonetheless, a lack of the $16.98 assist may shift momentum again to the sellers and expose the $15.39-$13.42 vary.

For now, LINK stays in a pivotal consolidation zone, however rising open curiosity, whale accumulation, and sustained foreign money outflows point out energy of confidence in continued restoration in coming classes.

RELATED: Dogecoin Worth Prediction: $812M Choices Surge Market Prepares for Breakout

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any sort. Coin Version just isn’t answerable for any losses incurred because of using the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.