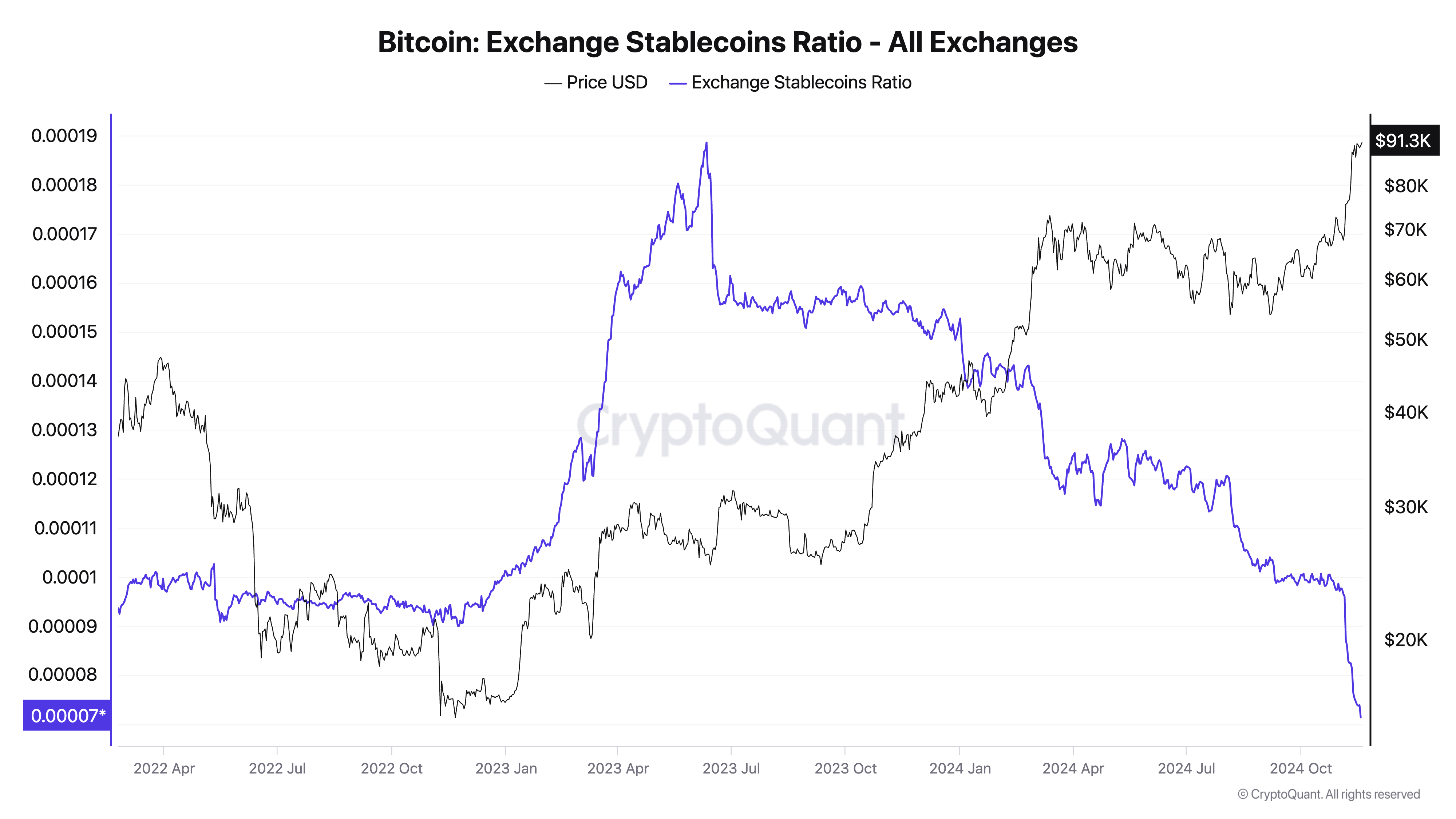

Change Stablecoin Ratio (ESR) is an on-chain metric that reveals the liquidity stability between Bitcoin and stablecoins held on exchanges.

This metric is calculated because the ratio of Bitcoin's whole reserves to the overall stablecoin reserves, and primarily signifies the market's shopping for energy and promoting strain.

A low ESR signifies that stablecoin reserves are considerably greater than Bitcoin reserves, suggesting that considerable liquidity is able to circulate into BTC. Masu. This disparity has traditionally correlated with bull markets and rising markets, as stablecoins have all the time been most well-liked when buying BTC on exchanges.

Conversely, a excessive ESR means that BTC dominates reserves in comparison with stablecoins, which usually limits buying energy on exchanges and may result in important promoting strain. means intercourse.

There are a lot of completely different indicators of a bull market, however ESR is especially beneficial as a result of it provides us an thought of the readiness of capital to maneuver into Bitcoin. Not like particular person value indicators, this ratio displays underlying liquidity developments and displays investor sentiment.

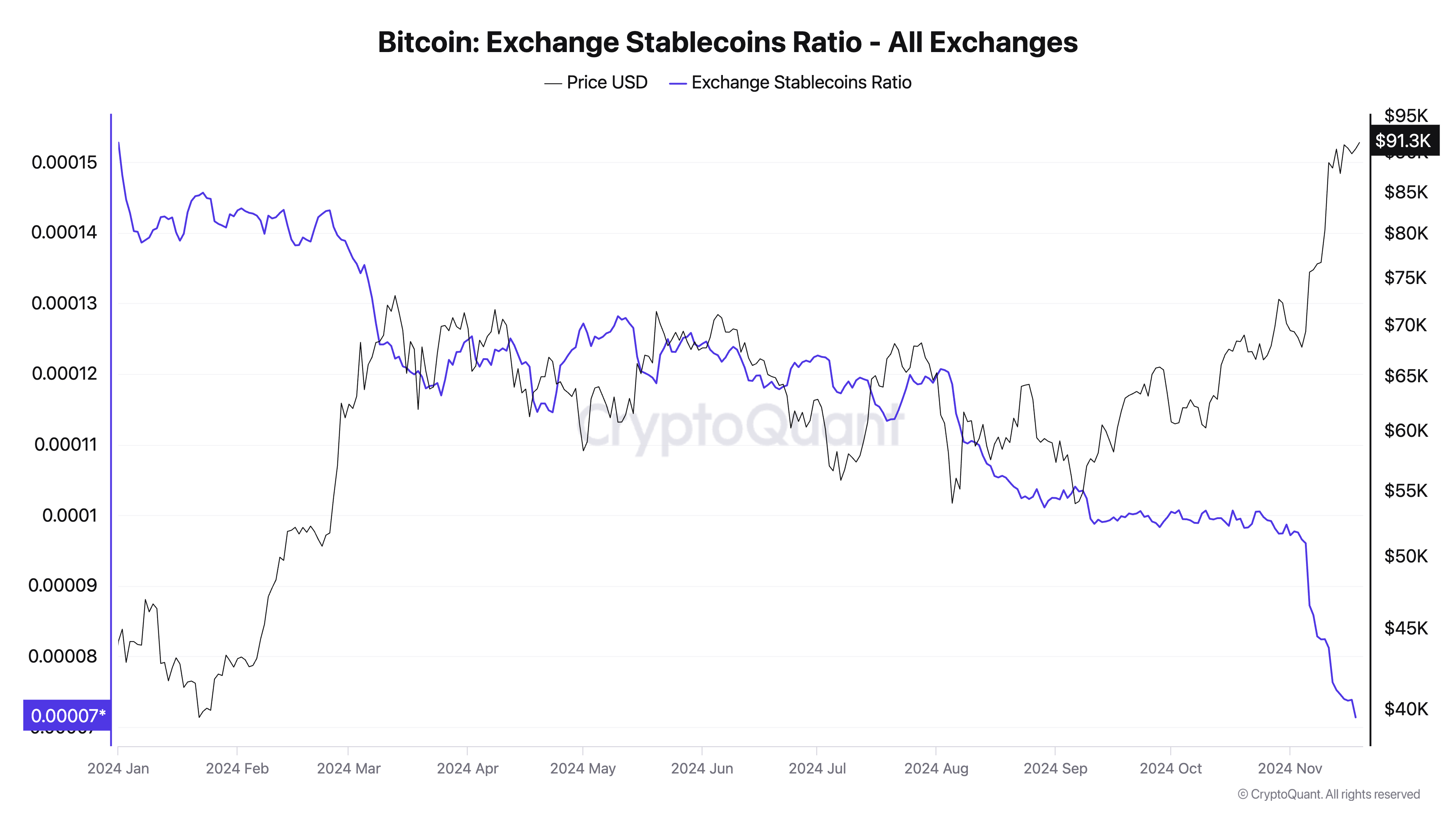

On November 18, the ESR fell to an all-time low following a downward pattern that may intensify in 2024. For the reason that starting of the 12 months, the ESR has decreased by over 95%, dropping utterly from 0.0015276 on January 1st. The bottom worth till November 18th was 0.00007317. Over the identical interval, the value of Bitcoin skyrocketed from $44,200 to $90,500, with a transparent inverse relationship between ratio and value.

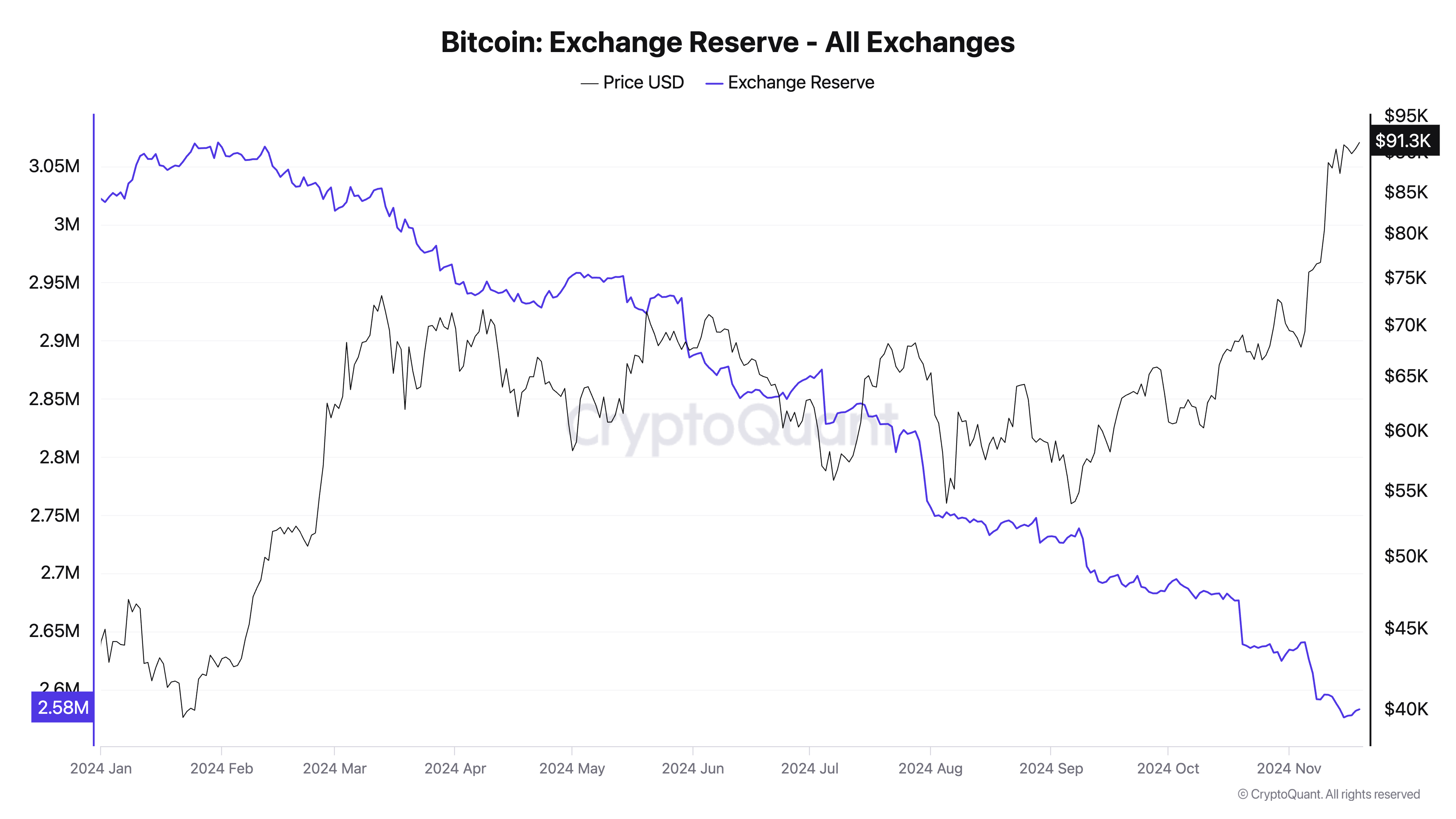

The US presidential election on November 5 had a huge effect available on the market, inflicting Bitcoin to soar to an all-time excessive of $93,000. This triggered report buying and selling volumes in each spot and derivatives markets, as institutional and retail buyers rushed to reap the benefits of Bitcoin's rising story as a hedge and retailer of worth. These excessive buying and selling actions drove up the value of Bitcoin, whereas accumulating stablecoin reserves and additional compressing the ESR.

Bitcoin buying and selling at an all-time low ESR and between $90,000 and $92,000 reveals that the market is in a novel place. A low ESR throughout a rising value interval signifies sturdy demand as a result of stablecoin's giant capital reserves.

Such an surroundings limits Bitcoin's draw back danger, because the abundance of stablecoins creates a form of liquidity cushion prepared to soak up promoting strain. On the identical time, the restricted provide of BTC on exchanges additional will increase shortage and drives up costs.

Taking a look at year-to-year modifications, the steepest drop in ESR occurred proper after the US election, when Bitcoin entered its most aggressive rally this 12 months. This means that the market gathered stablecoins throughout a interval of value energy earlier this 12 months and deployed them to purchase BTC as quickly as sentiment turned bullish.

The interplay between stablecoin accumulation and value appreciation that we now have seen to this point reveals that these reserves have a strategic nature, performing as each a buffer and a development catalyst.

The affect of this ESR drop within the coming weeks and months can be important.

If the value of Bitcoin will increase whereas the extent stays low or falls additional, it signifies that the market is closely capitalized in dry powder. Underneath such a situation, we are able to count on additional regular beneficial properties.

Nevertheless, there may be additionally the potential for extra aggressively introducing stablecoins to BTC. Whereas this will increase costs and advantages the market within the quick time period, it additionally reduces exchanges' stablecoin reserves and should result in elevated volatility sooner or later.

The post-Change stablecoin ratio hit an all-time low, fueling Bitcoin’s surge appeared first on currencyjournals.