- Circle reported a 202% year-over-year improve in third-quarter web revenue to $214 million.

- USDC in circulation elevated 108% to $73.7 billion, reflecting sturdy world adoption.

- The corporate is contemplating launching a local Arc token that may energy the brand new layer 1 blockchain ecosystem.

Circle Web Group, the issuer of USD Coin (USDC), reported a 202% year-over-year improve in web revenue to $214 million in its 2025 third-quarter monetary outcomes launched Wednesday. The corporate’s sturdy monetary efficiency was pushed by elevated curiosity revenue from USDC reserves, fast adoption of stablecoins, and enlargement of institutional partnerships.

USDC circulation reaches $73.7 billion

USDC’s circulation reached $73.7 billion, a rise of 108% for the 12 months, and whole income and reserve revenue rose 66% to $740 million, in response to the submitting. Adjusted EBITDA elevated 78% to $166 million, highlighting Circle’s profitability amid rising world demand for stablecoins.

CEO Jeremy Allaire stated the corporate’s purpose stays to construct an “financial OS for the Web” and emphasised that the digital greenback is evolving right into a programmable and dependable means of worldwide commerce. He famous that the rising curiosity from institutional traders exhibits that the market is prepared for interoperable and clear monetary infrastructure powered by blockchain.

Arc Community attracts 100 establishments

A serious spotlight of the quarter was Circle’s Arc Community. It’s a newly launched layer 1 blockchain optimized for stablecoin transactions, that includes sub-second finality and stablecoin gasoline funds. Greater than 100 establishments, together with main banks and fintech firms, are collaborating within the public testnet, exploring use circumstances starting from immediate funds to tokenized asset issuance.

Circle revealed in its earnings report that it’s contemplating launching a local Arc token to encourage community participation and align stakeholders because it expands the Arc ecosystem. This potential token can be an necessary milestone marking Circle’s deeper integration into the on-chain economic system.

Transaction quantity will lower, however fee community will develop

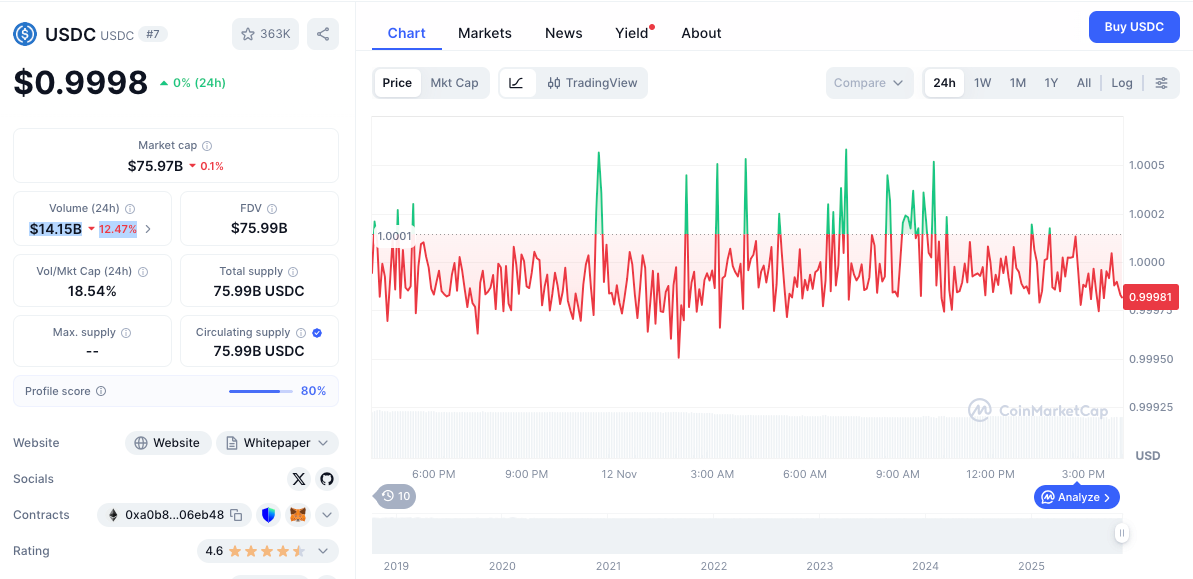

In the meantime, USDC buying and selling quantity fell by 13.04% to $14.17 billion up to now 24 hours as traders reacted to the continuing market turmoil, in response to CoinMarketCap information.

Circle additionally revealed that 29 monetary establishments have joined the Circle Funds Community (CPN), with a further 55 present process eligibility evaluate and greater than 500 in preparation.

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any type. Coin Version will not be accountable for any losses incurred on account of the usage of the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.