- A 3-year compliance interval has been proposed for digital asset firms.

- Democrats elevate considerations about nationwide safety and cash laundering.

- Crypto leaders say the US dangers falling behind Europe and Asia on rules.

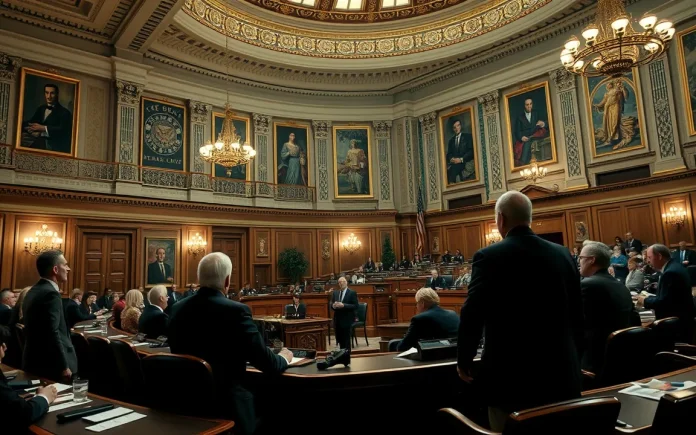

Coinbase CEO Brian Armstrong is looking for a debate on the bipartisan genius legislation geared toward growing stress on the US Senate, appearing on cryptographic rules, and establishing a secure nationwide framework.

With over $1 trillion Stablecoin volumes resolved every month and world opponents pushing ahead with regulatory regimes, Armstrong’s urgency comes amid fears that the US may lose its foothold in digital finance.

His enchantment highlights the rise from crypto leaders due to legal guidelines that help innovation, whereas offering clear guidelines and client safety.

The Genius Act units a uniform customary for Stablecoins

Formally often called the Lummis-Gillibrand Cost Stablecoin Act, the Genius Act requires that every one stubcoins be totally supported on US {dollars}, insured financial institution deposits, or in Treasury payments.

Solely nationally licensed firms are allowed to problem these tokens, and may put an finish to the present patchwork of state-by-state rules.

Utilizing a three-year compliance window offers companies time to adapt. In the meantime, digital asset service suppliers might want to modify their techniques to the brand new requirements.

Supporters argue that this not solely protects customers, however encourages institutional adoption by establishing a transparent regulatory rank meter.

Different platforms that deal with dollar-covered tokens, akin to Coinbase, are anticipated to profit if the legislation turns into legislation.

Democrats cite AML, safety hole as concern

Regardless of preliminary bipartisan help, the invoice faces inside hurdles.

Senate Democrats have raised objections to nationwide safety, cash laundering and client safety, arguing that the invoice’s present provisions might not be sufficiently superior in curbing unlawful funds.

Whilst Republicans and lots of business leaders encourage instant motion, this hesitation may gradual progress earlier than the August break.

With out compromise, the invoice may have stagnated on the committee and remained entrenched in ongoing regulatory scope.

Armstrong warned X that the longer the US waited, the extra probably it could fall behind in areas just like the European Union, which already handed the MICA framework, and areas like Hong Kong, that are planning to finalize this yr’s Stubcoin Rule.

Analysts say this regulatory delay may push innovation offshore and take the US away with blockchain-driven finance.

The business calls payments a turning level

If handed, this legislation offers Stablecoin Corporations a inexperienced mild to work with confidence, and maybe attracts extra conventional monetary gamers to the house.

Coinbase’s advocacy, together with Armstrong’s direct enchantment to lawmakers and different lobbying efforts in Washington, exhibits that the change sees regulatory certainty as the important thing to unleashing the following stage of crypto adoption.

Nonetheless, the trail to passing the invoice stays unsure. You want 60 votes within the Senate to advance. Meaning it is advisable to affect some holdout Democrats.

If time was taken earlier than the August break, it could rely closely on whether or not lawmakers may steadiness danger mitigation with business development.

(tagstotranslate) Market