Coinbase’s market share rose to its highest level since January 2023 in June, regardless of a lawsuit towards the corporate by the U.S. Securities and Change Fee, in response to Kaiko. information.

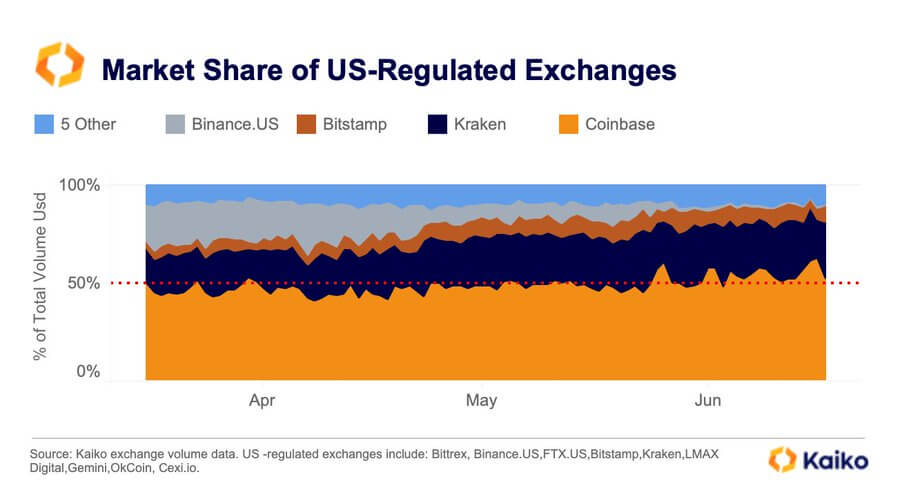

In line with the chart beneath, Coinbase has persistently managed about 50% of buying and selling exercise on US-regulated exchanges because the starting of the yr. However because the SEC sued the corporate and Binance for violating federal securities legal guidelines, its market energy surged to 64% in June.

In the meantime, different US platforms corresponding to Kraken and Bitstamp additionally elevated their market share throughout this era.

Conventional Monetary Establishments Nonetheless Proceed to Commerce with Coinbase

Regardless of the SEC lawsuit, a number of conventional monetary establishments, together with BlackRock, Constancy, and ARK Investments, have signed oversight sharing agreements with Coinbase for spot Bitcoin exchange-traded fund (ETF) functions.

BlackRock, the world’s largest asset supervisor, has chosen Coinbase Custody because the custodian of its belief’s BTC holdings.

Messari founder Ryan Serkis was prompt These partnerships underscore Coinbase’s legitimacy as a U.S. monetary establishment and reveal the rising acceptance of cryptocurrency corporations within the conventional monetary sector.

XRP Professional-Lawyer John Deaton backed up Serkis’ view added that greater than 2,000 Coinbase customers are “taking part in what could also be tried as authorized advocates” within the SEC’s lawsuit towards cryptocurrency corporations.

Courtroom briefs, generally referred to as “mates of the courtroom” briefs, are written submissions made by people or organizations in a roundabout way concerned as plaintiffs or defendants in a lawsuit, however who’ve a fabric curiosity within the matter. It is a calligraphy. The aim of courtroom briefs is to offer the courtroom with further views and opinions which will affect the ultimate authorized resolution.

Binance’s US Market Share Evaporates

The SEC lawsuit seems to have had a extreme impression on Binance US, with the corporate’s market share plummeting from its April peak of 20% to lower than 1%.

Binance US, migrating to a crypto-only platform, is going through important liquidity points after associate banks shut down US greenback settlement channels, posing operational challenges and impacting market place is giving

On June 21, BTC was flush pumped to $138,000 as a result of shallow market depth. Till then, the flagship digital asset was buying and selling at a 3% low cost on his platform in comparison with different competing exchanges.

Regardless of the SEC motion that first appeared on currencyjournals, Coinbase’s market share is rising.

(Tag Translation) Bitcoin