- XRP futures submissions made primarily based on CFTC’s self-certification course of.

- Ripple paid a $50 million settlement final month.

- Grayscale, Franklin Templeton and others have utilized for XRP ETFs

Coinbase has taken one other main step in the direction of increasing its derivatives providing by looking for regulatory approval to launch XRP futures contracts. US-based Crypto Change filed paperwork with the Commodity Futures Buying and selling Fee (CFTC) on Thursday, with a launch date set for April twenty first.

Transfer positions Coinbase, providing its third Crypto Futures product in 2024, following earlier lists of Solana (SOL) and Hedera (HBAR). Not like spot buying and selling, futures contracts permit buyers to deduce worth transfers of belongings with out retaining the underlying token.

The addition of XRP may considerably improve institutional entry to the coin, significantly within the wake of Ripple’s partial settlement with the US Securities and Change Fee (SEC) final month.

The XRP futures launch set was set in April

The most recent submission of COINBase Derivatives by CFTC outlines plans for XRP futures, which is able to start buying and selling on April 21, when regulatory clearance is pending.

This submission is underneath the CFTC self-certification course of. This can be a mechanism that enables for fast truck product listings and interactions, supplied that every one relevant guidelines are met. If the agent doesn’t object, the product can run immediately.

Coinbase’s resolution so as to add XRP to its regulated futures lineup highlights a broader technique to help each encryption and conventional buyers.

Over the previous few months, Change has launched Solana and Hedera futures merchandise, each of which have been accredited by CFTC by way of the identical route. Along with XRP, Coinbase is at present awaiting regulatory sign-off for futures contracts associated to Cardano (ADA) and Pure Fuel (NGS) which can be scheduled to be made public by the tip of April.

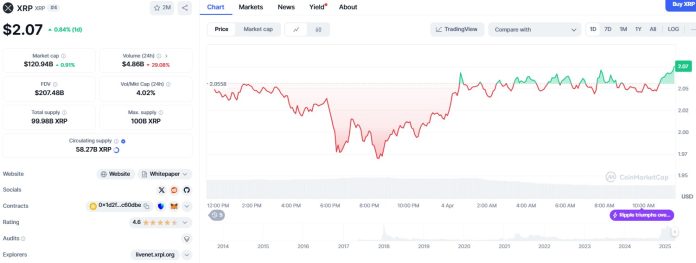

XRP costs are over $2

At this level, XRP was simply over $2 with minimal volatility. The comparatively secure efficiency of the coin is in distinction to the broader crypto market, with costs persevering with to be extremely conscious of macroeconomic indicators and regulatory updates.

Supply: CoinMarketCap

XRP’s core utility is in its perform as a fee token for quick and cheap cross-border funds. The initiation of a regulated futures contract permits buyers to hedge or publicity to token worth transfers with out straight proudly owning it.

This can be significantly interesting to establishments and radio frequency merchants seeking to keep away from detention dangers related to Spot Crypto Holdings.

Moreover, elevated spinoff exercise can have an effect on the liquidity of the XRP spot market, as it’s usually correlated with stronger buying and selling volumes and worth discovery mechanisms.

Authorized readability might unlock ETFs

Coinbase’s XRP Futures Push comes shortly after Ripple, the corporate behind the token, resolves a long-term authorized dispute with the SEC. In March 2024, the company dropped its attraction in a lawsuit that started in December 2020.

Ripple agreed to pay $50 million as a part of the settlement, a major drop from the initially proposed $125 million. Ripple additionally retracted its personal cross attraction and successfully ended its multi-year lawsuit.

The decision spurs hypothesis that the SEC can now approve the Spot XRP Change-Traded Fund (ETF). A number of main fund managers, together with Grayscale, Franklin Templeton, Bitwise, 21shares, Coinshares, Wisdomtree, and Canary Capital, have been filed with the XRP ETF.

Proshares and Volatility shares are additionally looking for regulatory approval for associated funding merchandise. Analysts consider that the readability of laws concerning XRP’s authorized standing may pave the way in which for big monetary establishments similar to BlackRock and Constancy to discover new product choices.

Though the SEC has not but introduced approval, business contributors recommend that the settlement has eradicated a major barrier to XRP adoption inside a extra conventional monetary framework.

Coinbase extends crypto differentiation

Coinbase’s self-certification mannequin has emerged as a check case for a way Crypto-Native firms can function inside conventional monetary laws.

Change’s rising futures portfolio reveals how crypto firms are adapting to CFTC surveillance regardless of the continued wider regulatory tensions between US establishments.

CFTC has expressed curiosity in increasing its position within the crypto derivatives market, usually clashing with the SEC in its jurisdiction.

Coinbase’s skill to navigate this atmosphere may decide how rapidly new digital asset futures merchandise attain the market. As institutional advantages enhance, regulatory responsiveness can form which platforms can compete on a big scale.

The enlargement of post-Coinbase cellular XRP futures launch derivatives continued, making its first look in Coinjournal.