coin base

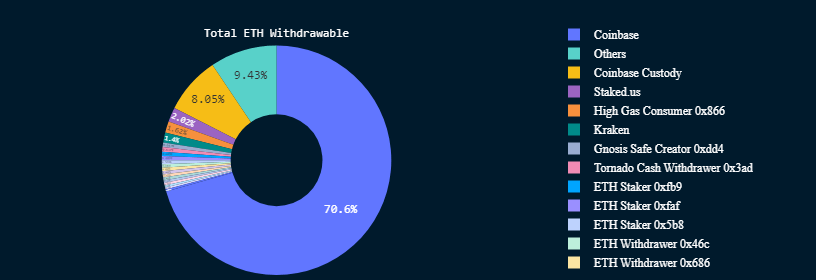

The alternate desires to withdraw 70,057 ETH (roughly $129 million) of the 88,121 ETH tokens pending withdrawal on the time of writing.

Coinbase has persistently insisted it’s going to proceed its staking service.

In the meantime, this isn’t the primary time regulatory stress has pressured US-based entities to course of staked ETH withdrawals. In February, Kraken ended its staking service for US customers, mechanically unstaking property after finishing the Shanghai improve.

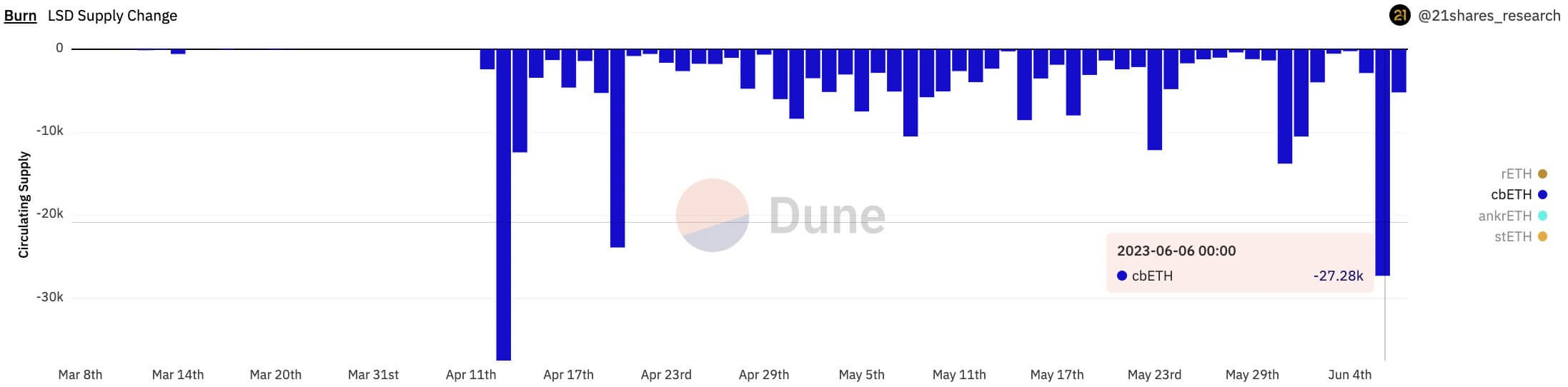

Coinbase redeemed 2% of cbETH on June 6

This is proof of SEC stress: Coinbase Wrapped Stake ETH (cbETH) is on fireplace. In line with Coinbase 21Shares researcher Tom Wan burnt Roughly 27,280 cbETH tokens, or 2% of the cbETH provide, have been provided on June 6 after the lawsuit.

This pattern continued till June seventh, when the alternate burned off 8,530 cbETH tokens, and the whole redemption exceeded 35,000 tokens inside two days, in keeping with information from Dune Analytics. That is the quickest tempo in a month.

In the meantime, Coinbase stays the second largest ETH liquid staking firm after Lido. In line with DeFiLlama information, the whole quantity of property locked on cryptocurrency exchanges is $2.1 billion (1.14 million ETH tokens).

Will decentralized staking service suppliers profit?

Because the SEC continues to place stress on the centralized our bodies it serves, Alpha Please contributor Pickle mentioned: Mentioned The transfer may result in “Elevated migration to different decentralized suppliers” corresponding to Lido.

Beneath Chairman Gary Gensler, the SEC has urged cryptocurrency exchanges that supply staking applications and interest-bearing merchandise to adjust to securities legal guidelines.

An article about Coinbase withdrawing over 70,000 stake ETH amid an SEC lawsuit first appeared on currencyjournals.

(Tag Translation) Ethereum

Comments are closed.