Constancy's Spot Bitcoin (BTC) exchange-traded fund (ETF) rapidly secured its place because the second ETF supplier to surpass $1 billion in property below administration (AUM) inside every week of launch.

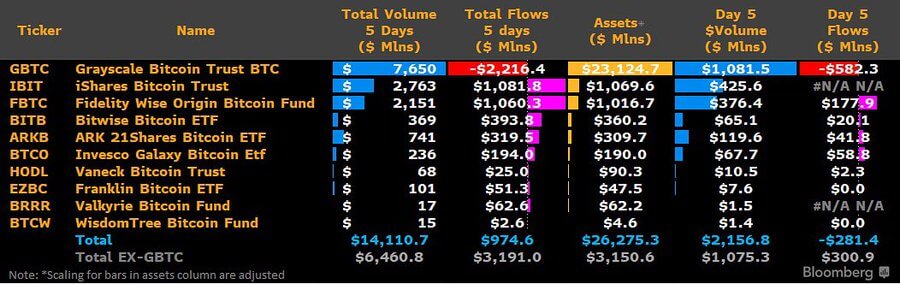

Constancy’s WiseOrigin Bitcoin Belief reached this milestone on its fifth day of buying and selling, with flows reaching $1.01 billion in whole property below administration, in line with Bloomberg information. BlackRock's iShares Bitcoin Belief (IBIT) reached the identical milestone the day earlier than, with property below administration now at $1.06 billion.

This achievement is notable given the quick time because the ETF's launch and highlights the fast rise of not too long ago authorised issuers. This fast development displays vital investor curiosity in these merchandise, regardless of earlier challenges for ETFs in gaining approval from the U.S. Securities and Trade Fee (SEC).

Market contributors have emphasised the significance of attaining $1 billion in whole property below administration in a brief time period, noting that this achievement is outstanding for any ETF. Moreover, the inflows into these ETFs in only one week exhibit sturdy demand from buyers for publicity to Bitcoin by way of regulated funding autos.

particularly, crypto slate Perception famous that enormous inflows into these ETFs have pushed BTC previous silver when it comes to property below administration, pushing it to the place of the second-largest commodity within the US. This variation reveals that crypto merchandise are more and more accepted and built-in into conventional funding portfolios.

GBTC outflow exceeds $2 billion

In the meantime, general outflows from Grayscale's GBTC are actually price $2 billion.

This vital outflow continues a constant pattern because the fund's inception, with a notable outflow of $582 million recorded on the fifth day of market opening.

With capital outflows, GBTC's low cost rose to round 96 foundation factors. Analysts have instructed that this low cost adjustment could also be in response to present promoting stress out there.

Buying and selling exercise stays sturdy.

Bloomberg ETF Analyst Eric Balciunas highlighted the spectacular development in buying and selling exercise for the “New child 9” ETF regardless of having solely been in existence for every week.

Remarkably, buying and selling quantity for these ETFs surged 34% between the fourth and fifth enterprise day, defying the everyday post-launch decline seen within the hype.

“Usually, when you will have an enormous launch, you see a gentle decline in gross sales quantity on daily basis after the launch. It’s uncommon (that) to see it reverse. All however one firm additionally rose, however GBTC was flat. (remained), so it wasn't a query of volatility,” Balciunas added.

(Tag translation) Bitcoin

Comments are closed.