- The CRO merges almost $0.205 to stability momentum between consumers and sellers.

- The rise in futures opens up curiosity in extra of $106 million, growing speculative bullish sentiment.

- A serious resistance of $0.216 and a help of almost $0.20 defines the fast buying and selling vary for CROs.

Cronos (CRO) is navigating the mixing part after rebounding from the lows in late September, with costs near $0.205. The 20- and 50-day exponential shifting common (EMA) cryptocurrency actions recommend a tug of conflict between consumers and sellers. Regardless of modest value motion, buying and selling actions between derivatives will speed up, pointing to updating speculative curiosity and potential volatility within the close to future.

Market integration and expertise setup

CRO’s latest buying and selling vary ranges from $0.20 to $0.216, highlighting a cautious market stance. The token faces fast resistance of almost $0.216, with prior rejection and 100-EMA converging.

A breakout above this degree might drive the value to $0.241, similar to the 1.618 Fibonacci enlargement. Past this, the subsequent resistance band sits between $0.256 and $0.266, forming an vital check space for continued momentum.

On the draw back, $0.20 serves as the primary line of protection, adopted by stronger help, almost $0.191. The decisive drop beneath that area might open a cross to $0.175 at its September low. Nevertheless, so long as CROs preserve a foothold of over $0.20, the Bulls might proceed to build up in anticipation of breakout makes an attempt.

Associated: Ethereum Value Forecast: Samsung Staking and Bitmine Finance Ministry Gas Demand

Open curiosity and market sentiment

The notable growth in latest weeks is a fast surge in open curiosity throughout CRO futures. It rose from underneath $40 million in late August to round $106.7 million as of October seventh, reaching its highest degree in a couple of months.

This enhance means that merchants are actively positioning their shorts for continued value quite than protecting them. Traditionally, such simultaneous costs and open curiosity level to a strengthened bullish story.

Moreover, this shift happens when CRO doubles from $0.10 to $0.21, signaling buyers’ belief within the derivatives market. Larger participation typically precedes stronger value actions, suggesting that volatility might enhance as speculative curiosity grows.

Associated: SUI Value Prediction: Mainnet Upgrades Will increase Momentum

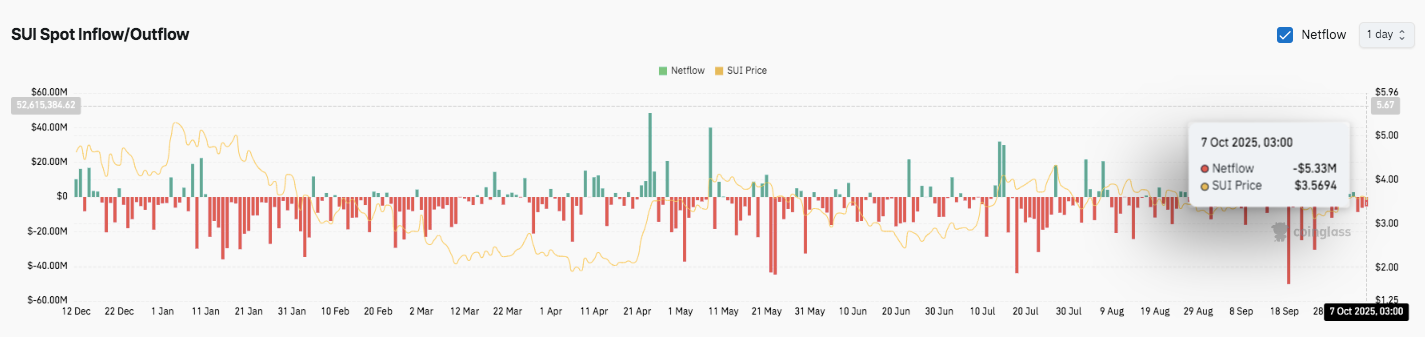

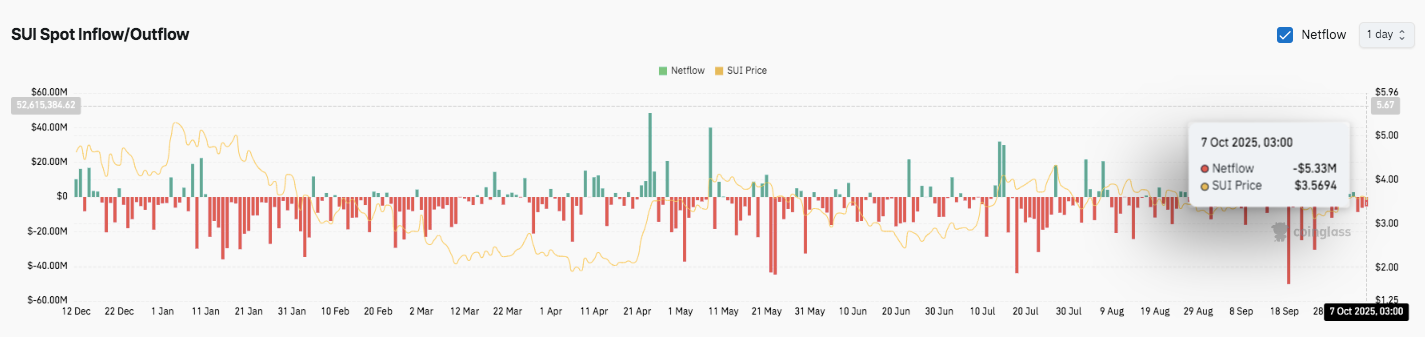

The pattern of spills signifies cautious accumulation

Regardless of enhancements in expertise situations, on-chain information reveals constant outflows all through 2025, reflecting buyers’ consideration. The most important withdrawal spike occurred in late August, adopted by a light restoration part. As of early October, the each day web spill was round $535,000.

In consequence, market sentiment stays restrained, however a gradual accumulation of almost $0.20 means that long-term holders are constructing publicity. As soon as momentum exceeds $0.216, Chronos re-enters a wider uptrend, with the $0.241-$0.266 vary serving because the Bulls’ subsequent main check.

Cronos Technical Outlook (CRO)

Cronos (CRO) continues to merge inside a well-defined vary in direction of mid-October, displaying a balanced momentum between consumers and sellers.

- Upside Degree: Instant resistance is $0.216, working with 100 days of EMA and former rejection zones. A breakout that surpasses this mark might push the value to $0.241 for the 1.618 Fibonacci enlargement, adopted by $0.266 as an prolonged upside goal of $0.256 and $0.266.

- Drawback degree: Quick-term help is $0.20, adopted by $0.191 as a stronger flooring linked to the three.618 Fibonacci enlargement. If gross sales had been strengthened, the subsequent key help was $0.175, decrease September rebounds.

- EMA Construction: 20-EMA ($0.2088) and 50-EMA ($0.2069) keep firmly aligned, tidying signaling compression and potential volatility enlargement. 200 Emma ($0.2125) acts as a dynamic pivot held on it, reinforcing medium-term bullish feelings.

Will Chronos prolong the rebound?

Cronos Value Outlook in October is determined by a sustained accumulation above $0.20 and a rights energy above $100 million. Rising derivatives exercise suggests a rise in speculative confidence, whereas on-chain outflows recommend extended consideration amongst long-term holders.

Associated: XRP Value Prediction: Trump’s Crypto Recognition Causes Rippling Momentum

If the Bulls handle clear closings above $0.216, the subsequent goal vary may very well be within the vary of $0.241 to $0.266. Conversely, dropping a help band of $0.19-0.20 can put a pullback to $0.175 in peril, inflicting short-term momentum to stall.

Disclaimer: The knowledge contained on this article is for data and academic functions solely. This text doesn’t represent any form of monetary recommendation or recommendation. Coin Version isn’t responsible for any losses that come up because of your use of the content material, services or products talked about. We encourage readers to take warning earlier than taking any actions associated to the corporate.