2025 was a brutal instructor for retailers chasing the fast-paced income of memecoin and superstar tokens. Some cash spiked for a short while, however most crashed simply as rapidly, worn out hundreds of thousands and left hundreds with large losses.

In line with Dappradar and Chain Detectives, rug pulls are more likely to be extra frequent than the 2021-2022 bull run. Specifically, lag pulls have decreased by 66% in comparison with the earlier yr. However what occurs is way extra dangerous, typically linked to superstar hype and political assist. As a result of context, greater than $6 billion has been misplaced because of Ragpur this yr alone.

From the Yzy Token in Kanye West to the Libra Cash in Argentine, these crashes present widespread issues: big insider holdings, unclear groups, and insufficient liquidity safety. For the Crypto group, classes are straightforward. Hype does not imply that the challenge continues.

Case Research: 2025’s greatest lag and quick crash

- yzy (kanye west/ye)

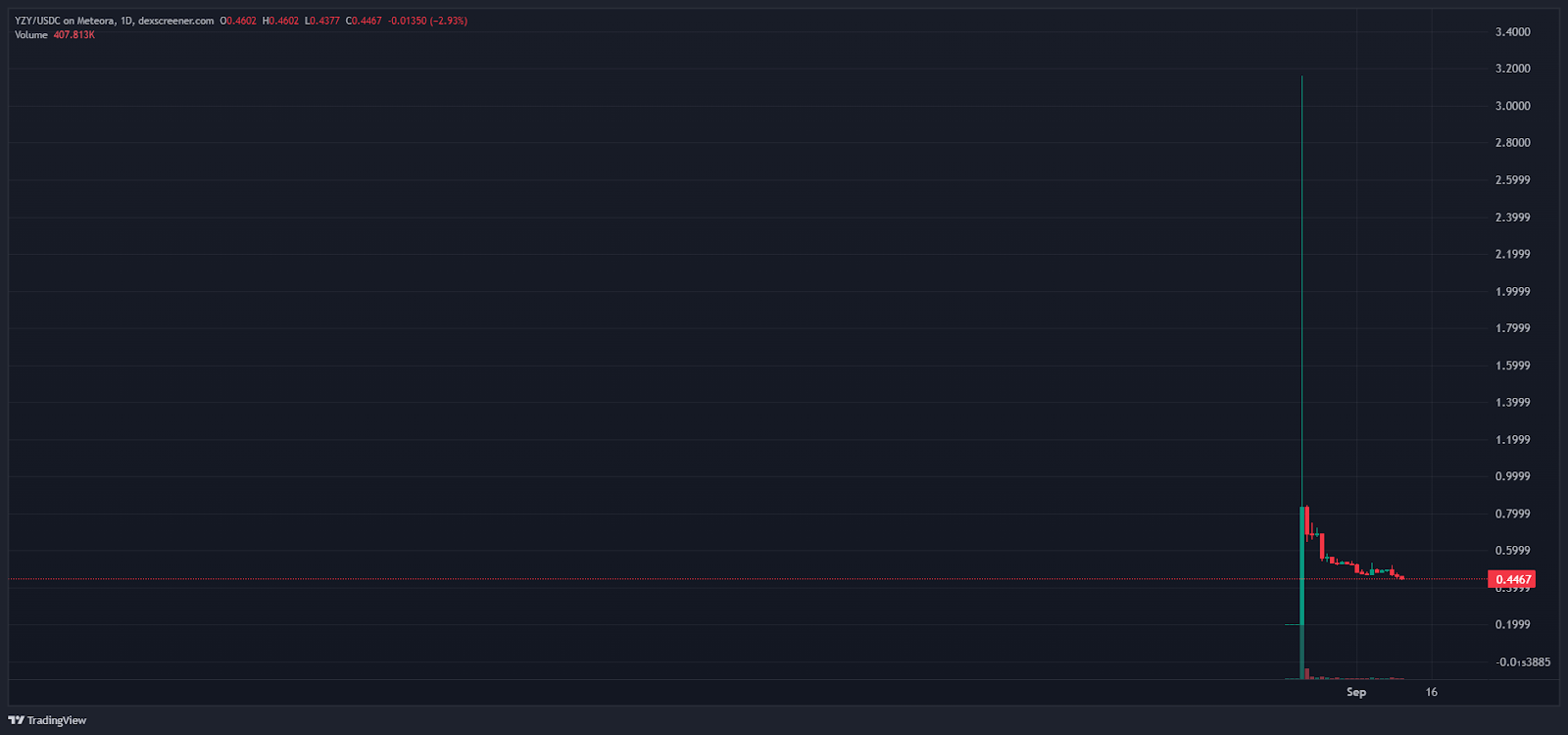

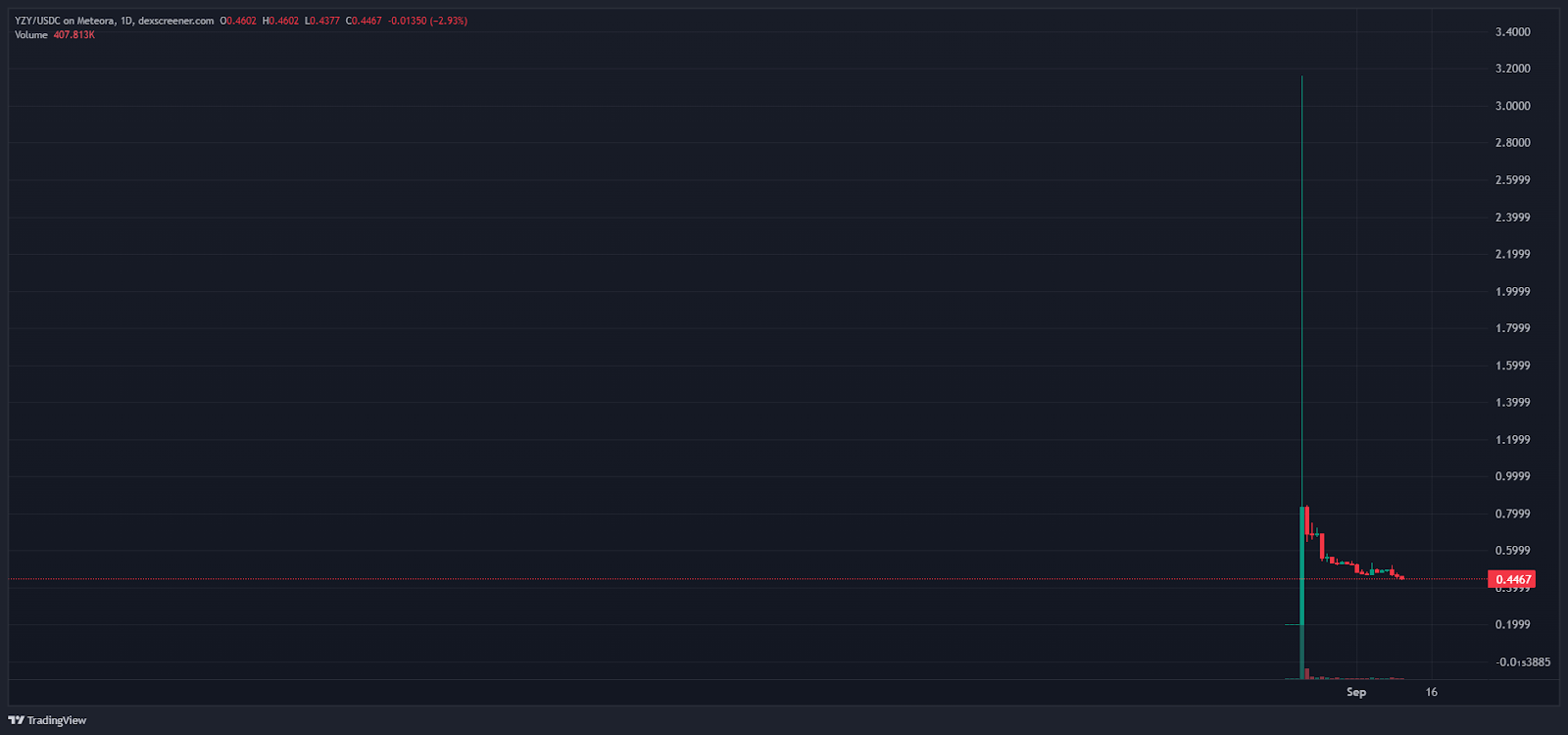

Launched on August twenty first, Kanye West’s Yzy Coin is the most recent within the 2025 Movie star Coin collection.

- The Solana-based coin, tied to Yeezy’s model, surged almost 1,400% in its first hour. It reached $3.16.

- Inside 24 hours it fell under $0.83, later reaching $0.44, eliminating as much as 90% from the height worth.

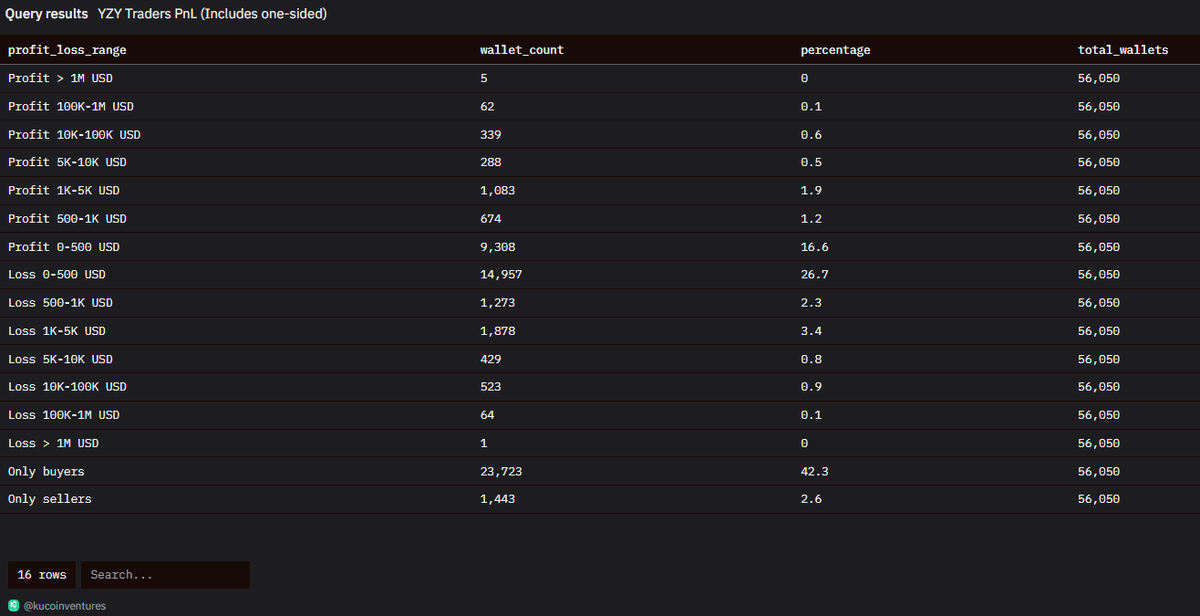

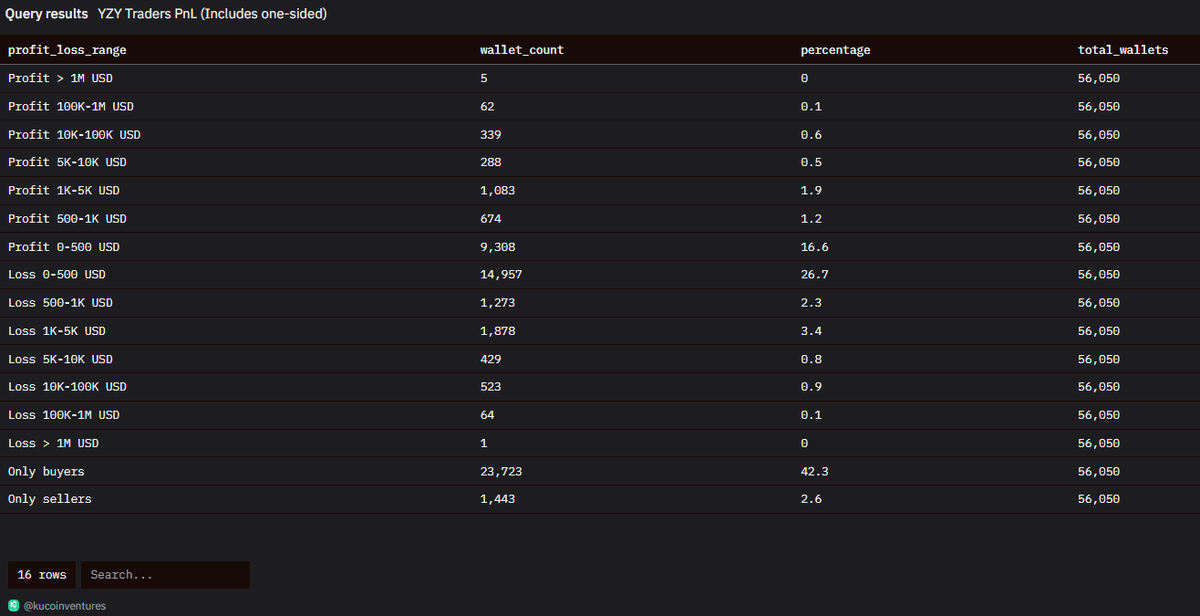

- Over 51,000 merchants reportedly misplaced $75 million, however a handful of wallets have earned unbiased insiders income.

On-chain knowledge reveals the exits for pockets clustering and enriched insiders. The hype for Yeezy-Linked Token lasted a number of hours earlier than unraveling it into considered one of Solana’s quickest crashes.

- Trump (Donald Trump)

The Trump Meme Coin, backed by US President Donald Trump, was launched on January 18, 2025. It was launched on the eve of the presidential inauguration for $1.2.

- It peaked on January nineteenth at a file excessive of $75.

- By April, its costs had dropped by about 90% from the height and sank to $7 as liquidity was emitted and whales evicted.

- Tokens are buying and selling at $8.83 after a average 6.2% rise up to now week.

- Trump initially surpassed Shiba Inu and have become the largest meme out there amidst the frenzy warmth. At the moment I am in seventh place.

Trump, promoted by Donald Trump himself, noticed vertical development at a completely diluted higher restrict of $75 billion earlier than bleeding. Retailers had been politically influential, however whales had been dumped, leaving nearly all of their homeowners with nice losses.

Associated: Justinsan rejects claims of bribery after Trump and memo coin gala

- Melania (Melania Trump)

Simply two days after Trump, the spouse of US President Melania Trump, launched her Melania token.

- With a gap of almost $8.40, it surged to $13.16 earlier than collapsed inside hours and collapsed to $3.74.

- Analysts flagged huge revenue acquisitions from insiders and early patrons who acquired tokens at close to zero prices.

- The token has not recovered since. It’s presently buying and selling at $0.1988, a lack of 98.54% from an all-time excessive.

- Libra (Javier Milei, Argentina)

Promotion by Argentinean President Libertarian, Libra made its debut on February 14th at a launch value of $0.216.

- Inside hours, the tokens surged to $4.57, then collapsed nearly 90% to $0.88 as insiders dumped it.

- The scandal sparked a political rebellion in Argentina, and investigations linked it to a broader “superstar coin” scheme.

- Native media referred to as it “ragpur,” triggering investigations and fostering debates on corruption.

Deleted tweets from President Javier Mirei who promoted Libra cash

Associated: Argentine President Javier Miley closes $libra memecoin scandal investigation

- Aquabot Buying and selling Bot

Extra lately, Aquabot carried out a pre-sale of 21,770 SOL ($4.65 million) earlier than it was launched in September.

- Inside 75 minutes of buying and selling at $0.03303 on September eighth, Aqua plunged to 61% to $0.0129.

- On-Chain Thruce ZACHXBT flagged the suspicious pre-selling routing, however the staff went silent and locked the reply with an X.

- Pretend CR7 (Cristiano Ronaldo) token

On August twenty fifth, 2025, a gust of faux Solana-based $CR7 tokens appeared in step with rumors that Cristiano Ronaldo had launched the coin.

- One model briefly touched on a market capitalization of $143 million earlier than dumping 98% in quarter-hour.

- Ronaldo himself had no tokens and solely had earlier NFT transactions. This highlights the dangers of apes based mostly on rumors. Analysts name it the “basic rumor” lag.

https://twitter.com/hate_ofx/standing/1959953322682486925

Why retail continues to be locked up

All of those circumstances share a crimson flag:

- An unsure staff

- Elementary Movie star Affect

In every instance, early insiders dumped at retail shops, however communication channels had been silent. Analysts typically warn that such “superstar meme cash” find yourself disproportionately in pump and dump.

It is a easy sample. When celebrities promote one thing, folks rush out in worry of lacking out. In Argentina, Libra Fiasco confirmed how even politicians can burn hype. And Solana’s faux CR7 tokens had been sufficient to boost the worth by $143 million.

Plus, there’s a weak safeguard.

- The fluidity isn’t locked

- The focus of provide to a handful of wallets.

Many of those cash had no liquidity locks, no finest schedules, no code audits. Pockets evaluation reveals that insiders typically maintain most of their provide and might simply be dumped into the market.

These rug pulls usually are not one-time solely. Observe the identical sample each time. Hype, sudden value spikes, insider gross sales, silence.

How you can discover a rug in entrance of a monkey

The 2025 lag cycle emphasizes the significance of dyor (doing its personal analysis). It is a guidelines that each one merchants have to run.

A. Fundamentals (Tasks and Groups)

- Workforce Transparency: Are founders doxxed with verifiable historical past or nameless accounts?

- Docs & Roadmap: Are there any actual merchandise, demos, or imprecise guarantees of “SOON”?

- Toconomics: truthful distribution and vesting, not large-scale insider allocations. Instruments like Bubblemaps can reveal pockets clustering.

B. Expertise (contracts and liquidity)

- Liquidity Lock: Is Dex’s liquidity locked and visual?

- Contract Security: Scanning blacklists, mint authority, buying and selling blocks, or price switches.

- Audit: Reliable Audit or Scanner Verify (Rugcheck, Solanatracker, Geckoterminal).

C. Market Habits

- Holder focus: In case your prime 3 wallets are above 70-80%, anticipate an adjusted dump.

- Hype script: Sudden celebrities/political assist, vertical pumps, blocked feedback, and funds crammed.

- PRESALE CUSTODY: If funds sit in a single EOA and begin shifting to work together earlier than launch (like AQUA), it is a crimson flag.

D. A sensible guidelines for Lugsense

- Contract scans (mint, blacklist, tax > 10%).

- Liquidity lock expiration date examine.

- Prime holder distribution map.

- Workforce communication channels are open and verifiable.

- Third-party audit/KYC present.

- Checking the story: If utility = solely superstar affect, it is pure hypothesis.

As Coingecko factors out, a single examine doesn’t assure security, however ignoring them nearly ensures losses.

Associated: Crypto Lagpur Risk Shift: Not Regularly in 2025, however A lot Extra Injury

Bull Run classes in 2025

The 2025 rug reveals a nasty change, from Kanye’s Yzy to Milei’s Libra. Retail continues to endure as FOMO has overridden analysis and insiders are leveraging its psychology.

For cryptography to mature, retailers have to develop self-discipline. Bull runs current new alternatives, however the price of ignoring due diligence has by no means been increased. If the one utility the token gives is hype, it might be that it is a lag setup.

As an analyst identified after Libra crashed, “Probably the most harmful utility in ciphers in 2025 is fame.”

Disclaimer: The knowledge contained on this article is for info and academic functions solely. This text doesn’t represent any type of monetary recommendation or recommendation. Coin Version isn’t chargeable for any losses that come up because of your use of the content material, services or products talked about. We encourage readers to take warning earlier than taking any actions associated to the corporate.