- ETH is buying and selling round $3,500 after falling under $3,400 earlier at the moment. Binance Market Feed Alerts Chapter

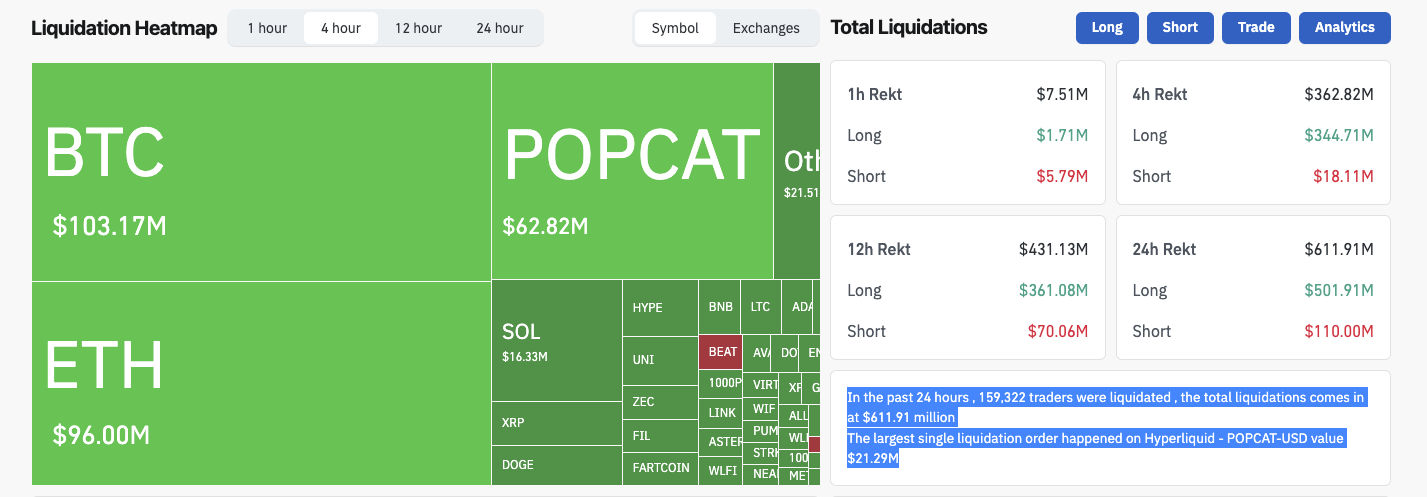

- Greater than $362 million in liquidations occurred inside 4 hours as volatility soared.

- SoftBank’s sale of Nvidia shares and the uncertainty of the US authorities shutdown deepened the risk-off sentiment.

Cryptocurrency markets suffered probably the most intense wave of liquidations this quarter, with greater than $362 million in leveraged positions worn out in lower than 4 hours on Wednesday. The transfer was triggered by the sharp decline in Ethereum (ETH), which fell under $3,400 for the primary time in November.

Reduce danger with macro narratives even after the shutdown ends

SoftBank’s resolution to promote a few of its Nvidia shares initially rattled world tech property and adjoining crypto property on Tuesday. Wednesday’s looming U.S. authorities shutdown vote added to the uncertainty, prompting merchants to unwind positions and sending derivatives markets into a sequence of liquidations.

Greater than 160,000 merchants have liquidated previously 24 hours, with a complete of $613.16 million in eradicated positions, in line with Coinglass knowledge. Of this quantity, lengthy merchants accounted for $503.23 million, whereas quick merchants accounted for roughly $110 million. The most important single liquidation occurred on Hyperliquid’s POPCAT-USD pair, with a price of $21.29 million.

On the hourly liquidation chart, the $9.09 million rekt place was cut up into $3.24 million lengthy and $5.85 million quick, highlighting the intense intraday volatility.

Bitcoin futures and Solana futures additionally noticed important drawdowns, with open curiosity falling by practically 8% throughout main exchanges as trades lowered danger publicity.

Ethereum Value Evaluation: What’s subsequent for ETH under its 20-day common?

Ethereum’s 12-hour chart exhibits ETH down 2.86% and buying and selling round $3,448 after being rejected at $3,587. This breakdown pushed the worth under the 20-day easy shifting common (SMA) of roughly $3,463, an necessary short-term equilibrium line for merchants.

The Bollinger Bands point out the enlargement of volatility, with an higher certain close to $3,701 and a decrease certain close to $3,225, defining the subsequent zone of compression. An in depth under $3,225 might invite additional promoting stress in direction of $3,100, whereas a rally above $3,463 might sign a near-term bullish try to regain management.

The MACD continues to be in bearish territory with a sign hole of -73.12, suggesting a decline in momentum regardless of a slight restoration within the histogram. Bulls must defend the $3,300 to $3,350 assist vary to stop additional decline to the psychological $3,000 stage.

Conversely, a sustained bounce above $3,550 might goal resistance at $3,700 and reestablish upward momentum. Till volatility stabilizes, the outlook for Ethereum value stays impartial to bearish amid rising liquidation danger and macro uncertainty.

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any variety. Coin Version will not be accountable for any losses incurred because of using the content material, merchandise, or companies talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.