- Gold reaches an all-time excessive whereas the crypto market loses $100 billion in worth inside hours.

- Peter Schiff says gold’s rise displays demand for safe-haven belongings amid world tensions and commerce dangers.

- Gold’s new highs might sign an early stage of the cycle because the crypto rally continues.

Whereas gold costs rose to an all-time excessive on Sunday, the worldwide cryptocurrency market suffered important losses, wiping out round $100 billion in market worth inside hours, in keeping with market information.

This motion exhibits that investor conduct is polarizing, with cash flowing into conventional protected belongings whereas threat belongings are below stress.

Tariff announcement triggers market response

The decline got here after President Donald Trump introduced that america would impose a ten% tariff on imports from Denmark, Finland, France, Germany, the Netherlands, Norway, Sweden, and the UK beginning February 1.

The tariffs had been linked to those nations’ opposition to the US’ plan to buy Greenland. The announcement raised issues about rising commerce tensions and potential retaliation from Europe.

Bitcoin falls, then stabilizes

Cryptocurrencies had been fast to react to this information. Bitcoin fell to a low round $91,900, however recovered barely to commerce round $92,800.

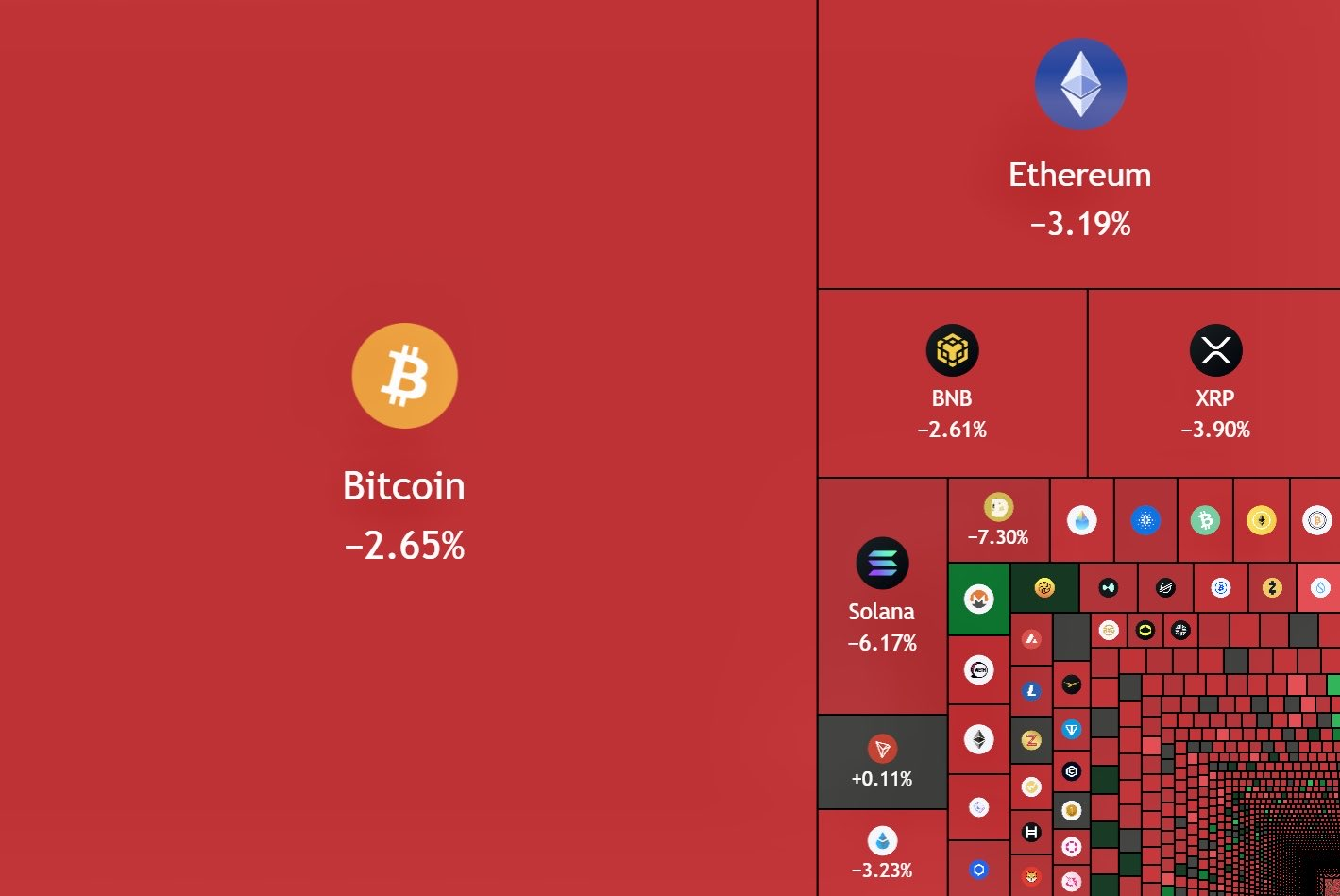

Ethereum and different main digital belongings additionally fell, and the cryptocurrency market capitalization fell by about 2.6% on the day to about $3.13 trillion.

Greater than 245,000 leveraged positions had been liquidated in the course of the selloff as merchants rushed to scale back threat, in keeping with business information.

Gold attracts demand for protected haven

Gold rose as cryptocurrencies and inventory futures fell. Treasured steel costs rose above $4,670 per ounce, setting a brand new report. Silver additionally rose, buying and selling above $93.

Peter Schiff, a longtime gold advocate, mentioned the rally mirrored rising confidence within the treasured steel amid world tensions and warned that commerce tensions might weaken the greenback’s world standing.

Historic patterns counsel the crypto rally could proceed

Nevertheless, one analyst famous that gold’s latest highs may very well be an early sign slightly than the top of the transfer.

In earlier market cycles, gold has usually peaked earlier than huge features in cryptocurrencies. In 2020, gold hit a brand new excessive in August, adopted by a pointy rise in Bitcoin into 2021. Altcoins have since skyrocketed, usually with even bigger proportion features.

In response to this view, this order tends to repeat itself. Gold strikes first, Bitcoin follows, and altcoins rise final. If this sample holds true, a broader crypto rotation should be in its early phases, analysts mentioned.

Associated: US authorities broadcasts it won’t promote the Bitcoin confiscated within the Samurai Pockets incident

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any variety. Coin Version is just not answerable for any losses incurred because of using the content material, merchandise, or providers talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.