- Bitcoin dropped to $57,500 and briefly went impartial earlier than the market went again into concern mode.

- Merchants are divided as they await the Federal Reserve's resolution to chop rates of interest.

- Analysts have warned {that a} huge charge minimize might spook traders and dampen market optimism.

After a multi-day uptrend that noticed Bitcoin surpass $60,000, the cryptocurrency market confronted sudden bearish stress on Monday. Bitcoin dropped to $57,500 yesterday, and the cryptocurrency market's Concern and Greed Index went again into concern mode simply someday after hitting impartial.

Whereas the market is at the moment in concern mode, well-liked neighborhood determine Sheldon the Sniper is advising towards panic promoting, stating that regardless of the non permanent drop, he’s at the moment extra bullish on altcoins than ever earlier than.

Sheldon acknowledged that the market stays unstable, primarily on account of intervals of relative stability, or what he referred to as “boring components,” at key resistance ranges. He warned that if these resistance ranges are breached, the ensuing value actions might catch many individuals off guard.

Deal with Federal Reserve Financial Coverage Choices

A significant component driving his optimism is the upcoming assembly of the Federal Open Market Committee (FOMC), the place key financial choices might be made, together with a potential rate of interest minimize for the primary time in a number of years.

Traditionally, rate of interest cuts have had a constructive influence on threat property, together with cryptocurrencies. Many traders are hoping for the same final result this time round. The reason being that larger rates of interest make money extra engaging for producing passive revenue. Nevertheless, when rates of interest are minimize, traders typically shift their focus to property that provide larger returns, equivalent to Bitcoin.

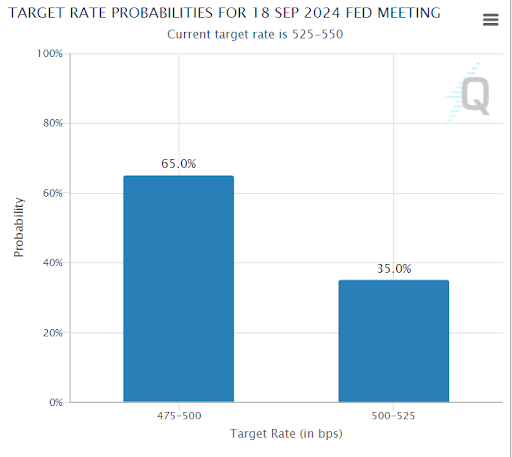

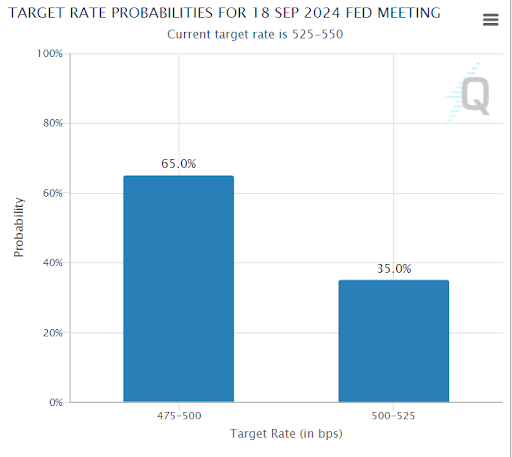

Specifically, the dimensions of the speed minimize may have a significant influence on market response, with merchants at the moment break up between two potentialities: a reasonable 25 foundation factors (bps) minimize or a extra aggressive 50 bps minimize.

At press time, CME Watch Software information confirmed a 35% probability of a 25 bps minimize, which might put rates of interest within the 5% to five.25% vary, and a 65% probability of a 50 bps minimize, which might put rates of interest within the 4.7% to five% vary.

Nevertheless, analysts at 10x Analysis have warned {that a} 50 foundation factors minimize might not have the specified impact: as an alternative of boosting the market, a bigger minimize might spook traders by signaling issues concerning the well being of the economic system and making them extra cautious about riskier property like Bitcoin.

On the time of writing, Bitcoin and the broader cryptocurrency market are already increase for tomorrow’s anticipated occasion, with Bitcoin as soon as once more trying to surpass $59,000 and re-enter the psychological $60,000 vary.

Disclaimer: The data introduced on this article is for informational and academic functions solely. This text doesn’t represent any sort of monetary recommendation or counsel. Coin Version shouldn’t be chargeable for any losses incurred on account of using the content material, merchandise, or providers talked about. Readers are suggested to train warning earlier than taking any motion associated to our firm.