- The CoinMarketCap Cryptocurrency Worry & Greed Index fell to a seven-month low of 20/100 following $2 billion in liquidations.

- Binance co-founder CZ questioned the acute bear market, pointing to historic pullbacks from comparable ranges.

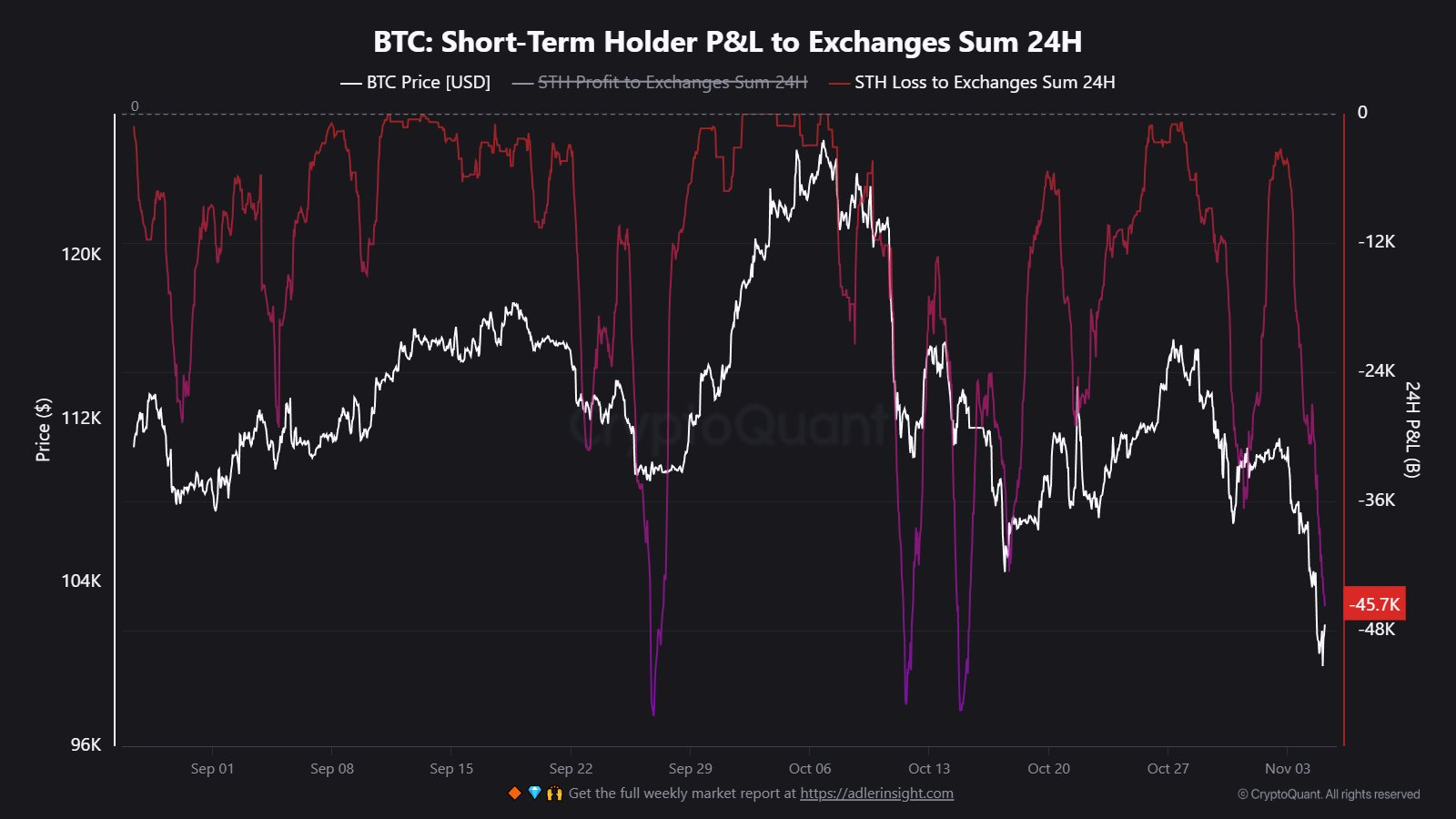

- CryptoQuant information revealed that short-term holders transferred 45,700 BTC to exchanges at a loss, suggesting panic promoting.

The cryptocurrency market has undergone a extreme correction prior to now 24 hours, leading to roughly $2 billion in liquidations. Because of this, the CoinMarketCap Crypto Worry & Greed Index fell to a seven-month low of roughly 20/100. This degree of maximum bearish sentiment has not been seen since April 2025.

Regardless of widespread panic, Bitcoin (BTC)’s value motion close to the $100,000 degree is testing upside for the primary time since June, prompting contrarian feedback from business leaders.

Associated: ETH whales purchase the push as Ethereum revisits $3,000: The place is the worth headed?

Binance’s CZ calls into query the worth of great concern within the crypto market

Binance co-founder and former CEO Changpeng Zhao (CZ) questions the worth of excessive issues over additional crypto capitulation. CZ has triggered bullish assist as crypto merchants anticipate a rubber band pullback within the coming weeks with supporting fundamentals.

For instance, Rishabh Singhal, founding father of CryptoWaly, commented that Bitcoin costs skyrocketed by 50% after the Worry and Greed Index fell under 20/100 in April 2025. Nevertheless, Singhal argued that the potential of a full-scale collapse can’t be utterly dominated out.

It’s price noting that CZ not too long ago revealed its acquisition of ASTER, which can point out a pattern in direction of a bullish outlook.

Brief-term merchants accept low liquidity

CryptoQuant’s on-chain information evaluation reveals that short-term holders are absorbing fears of additional declines within the cryptocurrency. Following experiences of Bitcoin whale capitulation final month, CryptoQuant revealed that short-term holders had transferred 45,700 BTC to exchanges at a loss, suggesting panic promoting.

The dearth of bullish enthusiasm is believed to be because of low capital inflows into the crypto market. Based on main market Wintermute, the crypto market has but to profit from elevated world liquidity amid world rate of interest cuts led by the Federal Reserve.

“The market backdrop stays sturdy, as evidenced by inventory market efficiency. Liquidity simply hasn’t reached crypto but,” Wintermute stated. seen.

Liquidity lag and macro outlook

The crypto market is anticipated to backside out forward of the Federal Reserve’s much-anticipated quantitative easing (QE). Moreover, Wall Road buyers are betting on a bullish fourth quarter much like the crypto summer time of 2017.

Cumulative supportive fundamentals, together with a transparent crypto regulatory framework within the US, are bullish indicators. Furthermore, the current decline in cryptocurrencies was not brought on by huge unfavorable information, however by large-scale liquidations of leveraged merchants.

Associated: Why are cryptocurrencies down? Information reveals Bitcoin monitoring US liquidity drain

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any form. Coin Version just isn’t accountable for any losses incurred on account of using the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.