- Warren requested the OCC to cease reviewing functions for World Liberty Monetary Financial institution, which is linked to Trump.

- Lawmakers have warned that approval might not directly enable the president to control his personal crypto companies.

- Stablecoin USD1 and the GENIUS Act increase considerations about battle and regulatory impression.

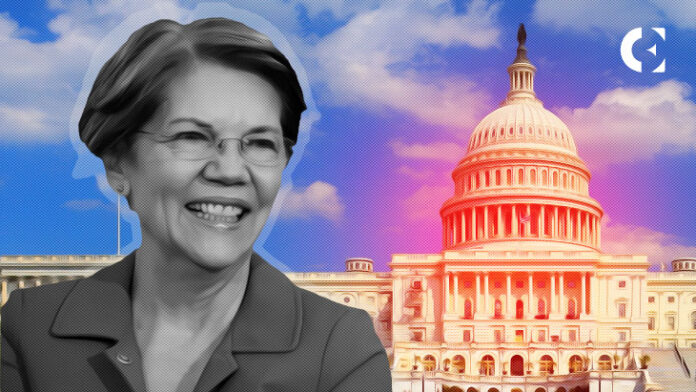

Elizabeth Warren is taking a tough line as Congress prepares for a significant committee vote on cryptocurrency regulation.

A Massachusetts senator is asking the Workplace of the Comptroller of the Foreign money (OCC) to droop the overview of financial institution functions associated to Donald Trump till he absolutely divests and resolves all monetary disputes involving him, his household, and his firm.

On the heart of the controversy is World Liberty Monetary, a cryptocurrency firm co-founded by Trump and his two sons. Simply as new crypto market guidelines are being debated in Congress, the corporate has utilized to kind a Nationwide Belief financial institution specializing in stablecoin providers.

Why Warren says it is a breaking level

Warren argues that the timing could not be worse. The present draft of the fee’s value improve cryptocurrency market construction invoice doesn’t deal with President Trump’s private cryptocurrency disputes, though his firm is looking for approval from regulators that finally reply to the president.

Her warning is blunt. Approving the applying now would additional erode public belief and probably plunge the OCC itself into unprecedented battle.

In a letter to Comptroller Jonathan Gould, Warren stated the questions he raised final yr had been now not “hypothetical.” The OCC declined to remark as a result of World Liberty Monetary was not beneath its oversight on the time. Properly, that is proper.

The president regulates his personal enterprise?

Warren says the scenario is historic and alarming.

If the OCC approves the corporate’s banking constitution:

- The company will create guidelines that straight impression Trump’s firm’s profitability.

- The OCC would oversee and implement the regulation in opposition to the identical firms.

- Regulators shall be doing so in response to the president’s needs.

“In impact,” Warren argues, a president will oversee his personal monetary firm for the primary time in U.S. historical past.

stablecoin angle

World Liberty Monetary was based in 2024 and launched a stablecoin referred to as USD1 in March 2025. Later that yr, Congress handed the GENIUS Act, which made the OCC the first regulator of federally licensed stablecoin issuers, and was signed into regulation by Trump himself.

In July 2025, Warren opposed the invoice, warning that it failed to forestall the president and his household from benefiting from stablecoins. She stated World Liberty Monetary’s present submitting proves these considerations are legitimate.

He and different Democratic senators additionally warned that the greenback was being utilized in high-profile worldwide transactions, creating new channels for overseas cash to move into Trump-related companies.

Warren’s long-running crypto motion

This newest transfer matches into a well-known sample. Warren spent 2025 actively focusing on Trump’s cryptocurrency actions.

She warned that Trump’s stablecoins pose a nationwide safety danger, accused Congress of enabling corruption, and pushed for federal investigations into crypto platforms linked to Trump.

On December 16, Warren requested Scott Bessent and Pam Bondi to launch a federal investigation into Trump’s cryptocurrency actions. She pointed to PancakeSwap and its function in selling Trump-related tokens, in addition to stories that the platform dealt with funds tied to North Korean hackers.

Warren has requested a written dedication from the OCC to delay reviewing the corporate’s software till President Trump sells it fully, by January 20, 2026.

Associated: Senate crypto invoice classifies community tokens as BTC-like merchandise

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any form. Coin Version shouldn’t be accountable for any losses incurred on account of using the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.