- Injective’s latest upgrades have considerably elevated the pace of their blockchain, bettering scalability and efficiency.

- The Ethereum derivatives market has seen excessive liquidation charges of lengthy positions, highlighting elevated market volatility.

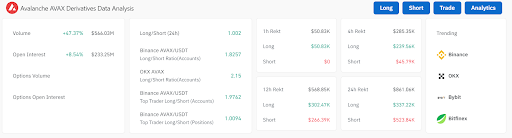

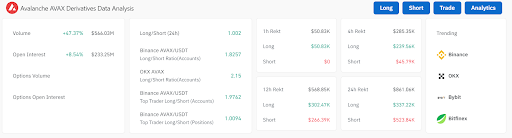

- The Avalanche derivatives market is exhibiting bullish sentiment with rising buying and selling volumes and robust desire for lengthy positions.

Injective (INJ) is main the best way with a formidable blockchain improve, whereas Ethereum (ETH) is experiencing a slight worth drop. Kadena (KDA) and Brett (BRETT) are additionally dropping in worth, whereas Avalanche (AVAX) is bucking the pattern with constructive positive aspects. Let's analyze the newest cryptocurrency market actions together with the corresponding buying and selling volumes.

Injective's latest upgrades have considerably improved the scalability of the blockchain and decreased block occasions to 0.65 seconds, making it one of many quickest Layer 1 blockchains available on the market. Presently, INJ is buying and selling at $18.46, down simply 0.38% up to now 24 hours.

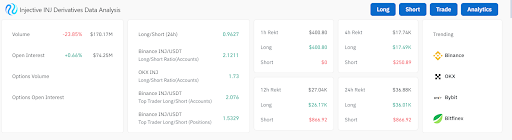

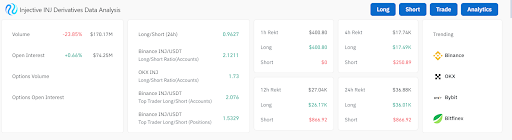

Buying and selling quantity within the final 24 hours reached $58,569,854, with a market cap of $1,802,172,729. There are at the moment 97,622,780 INJ cash in circulation. Open balances for derivatives elevated by 1.40% to $75.06 million, with extra merchants taking lengthy INJ positions than quick positions on platforms reminiscent of Binance and OKX.

Ethereum (ETH) worth is at $2,542.73, down 3.87% within the final 24 hours. Regardless of this drop, ETH stays a serious participant with a buying and selling quantity of $11.9 billion and a market cap of $305.9 billion. The circulating provide is 120.3 million ETH cash.

The ETH derivatives market continues to be dominated by lengthy positions, as evidenced by the excessive lengthy/quick ratio. Nonetheless, liquidations of lengthy positions have elevated considerably, indicating elevated market volatility. Binance, OKX, Bybit, and Bitfinex stay the highest platforms for buying and selling ETH derivatives.

Kadena has seen a decline in worth, at the moment at $0.497440, down 5.52% over the past 24 hours. It has a buying and selling quantity of $4.6 million and a market cap of $142.2 million. Kadena has a circulating provide of 285.9 million KDA cash and a most provide of 1 billion KDA cash.

The KDA derivatives market is seeing a decline in exercise. The lengthy/quick ratio displays blended sentiment with extra quick positions than lengthy positions on Binance. Moreover, each lengthy and quick positions are dealing with related liquidation ranges, with quick positions being barely extra pressured.

Avalanche (AVAX) is buying and selling at $22.99, with a constructive change of three.86%, with a 24-hour buying and selling quantity of $304.7 million and a market cap of $9.3 billion. AVAX has a circulating provide of 404.8 million AVAX cash and a most provide of 720 million AVAX cash.

The AVAX derivatives market is booming with a rise in buying and selling volumes and open curiosity. Bullish sentiment is widespread as evidenced by the rise in lengthy positions. Liquidations of lengthy positions are excessive, suggesting elevated danger. The primary platforms for AVAX derivatives are Binance, OKX, and Bybit.

Brett (BRETT) is buying and selling at $0.087416 with a 24-hour buying and selling quantity of $39.7 million. It’s down 0.17% over the previous day with a market cap of $866.3 million. The circulating provide is 9.9 billion BRETT cash and the utmost provide is 10 billion BRETT cash.

The BRETT derivatives market is experiencing a decline in buying and selling exercise. Lengthy positions dominate the market, with extra lengthy positions than quick positions. Moreover, quick positions are dealing with increased liquidation stress. Binance, OKX, and Bybit are the primary platforms for BRETT derivatives.

Disclaimer: The data offered on this article is for informational and academic functions solely. This text doesn’t represent any type of monetary recommendation or counsel. Coin Version just isn’t liable for any losses incurred on account of using the content material, merchandise, or companies talked about. Readers are suggested to train warning earlier than taking any motion associated to our firm.